5 Things To Know In Investing This Week: The We Pivoted Bigly Issue

Years ago, President Trump talked about a change in tax rates that he described as “big league”. It was misinterpreted as “bigly” and a new word entered the lexicon. Last week, the Fed pivoted and cut the fed funds rate. This cut was more than two years after Fed doves and asset gatherers started begging for a return to zero interest rates. The Fed was too late for them and too early for my liking. They went for the 50bp cut, a bigly move. Those who disagree with me about the Fed will find their proof in weaker than expected results from shipper, FedEx (NYSE:FDX). Intel (NASDAQ:INTC) makes the smart move to separate their foundry business and gets a $3B government contract (and a potential buyout). Despite being a free market advocate, I think this was a good move for all involved. We discuss how Bitcoin (CRYPTO: BTC) is a short-term proxy for the NASDAQ and a long-term hedge against inflation. Finally, Learn Wall Street gives the smart advice to do substantial research before investing and we provide two examples of why that’s important.

This week, we’ll address the following topics:

-

The Federal Reserve pivots and cuts the fed funds rate by 50bp. More cuts on the way.

-

Lower rates mean more inflation which means reduced purchasing power for the dollar. Bitcoin rises on expectations for a weaker dollar.

-

Intel restructures and gets a big government contract. After weeks of criticizing Intel, DKI approves.

-

FedEx misses bigly supporting the decision of the Fed to cut.

-

If someone tells you there’s gold underground, how do you know there’s gold?

Alex Petrou and Andrew Brown come through bigly delivering an almost-completed version of this week’s 5 Things by Thursday night. Fantastic work as usual. Next week’s 5 Things will not include the word “bigly”. In order to remain non-partisan, will we include the term “unburdened by what has been”? Probably not, but check in with us just to be certain.

Ready for a new week of big rate cuts and more inflation? Let’s dive in:

The Federal Reserve completed its September meeting and decided to cut the fed funds rate by 50bp (.50%). The market knew the Fed would pivot and cut at this meeting. There was debate regarding the size of the cut. I had expected 25bp (.25%). The doves in the crowd calling for the larger 50bp cut were correct. The Fed will continue its monthly quantitative tightening and will continue to shrink the size of its balance sheet (for now). Given the weaker employment data and the public comments by Chairman Powell, I’m not surprised the Fed cut (no one is surprised at this point). I’m a bit surprised by the larger 50bp cut because the Fed tries to appear non-partisan and non-political in its actions. Today’s larger cut just 6 weeks before the November elections give the appearance that they’re trying to help Democratic candidates. Public cries for a 75bp cut from prominent Democratic politicians did not help this perception.

For those of you who were cheering for rate cuts, please look at this chart.

DKI Takeaway: I’m probably in the minority here, but think this cut is unwise. While many claim that the US economy is already in recession, I’m concerned that inflation is still above the 2% target and retail sales remain strong. There are still almost 8MM jobs available which is more than the number of people seeking jobs. Most importantly, Congress is still engaging in trillions of dollars of annual inflation-causing stimulus spending. (For those of you on team red or team blue, I’m sorry to report that overspending is a bipartisan problem.) Check out the graph for this Thing where we compare the inflation of the 1960s and 1970s with the more recent numbers. You can see where former Fed Chairman, Arthur Burns, eased rates prematurely leading to a resurgence of inflation. It looks like the Powell-led Fed just made the same decision. In the end, my opinion of the wisdom of the actions of the Fed is not relevant. We get the market and conditions we get, not the ones we want. As usual, DKI will invest based on the market we have. Our portfolio is well-prepared for higher inflation over the next few years. It’s also important to note that recent DKI stock picks are high potential-return companies that I believe won’t be economically sensitive and can continue to grow revenue at a high level regardless of future Fed actions.

-

Bitcoin Update:

Since hitting its all-time high in March, Bitcoin has been moving sideways (really up and down), but MicroStrategy (NASDAQ:MSTR) is still buying. Recently, they raised $750 million through a convertible debt offering right after purchasing $1.1 billion of Bitcoin (18,300 BTC). The strategy is clear: stack BTC while the opportunity is still there. With the Fed cutting rates, rising inflation, and the dollar losing purchasing power, Bitcoin’s long-term appeal as a hedge against currency debasement is becoming more important than ever. With more money printing on the horizon, Bitcoin should thrive as traditional currencies continue to lose value.

BlackRock was against Bitcoin before figuring out how to make money from it.

DKI Takeaway: In the short term, Bitcoin is still behaving as a high-beta proxy for tech stocks like the Nasdaq’s Invesco QQQ Trust (NASDAQ:QQQ)—rising sharply when tech rallies and crashing hard when sentiment sours. Following the recent Fed meeting, Bitcoin jumped from $59,000 to $63,500, reflecting this tech-driven volatility. Meanwhile, BlackRock released a whitepaper titled "Bitcoin: A Unique Diversifier", outlining Bitcoin’s growing role as a non-correlated asset and stressing its importance given the looming US debt crisis. With the US debt ballooning and dollar value at risk, Bitcoin is increasingly being seen as a critical asset in a diversified portfolio, unshackled from traditional market forces. DKI has owned and recommended Bitcoin since it was $15k.

-

Intel Fights Back:

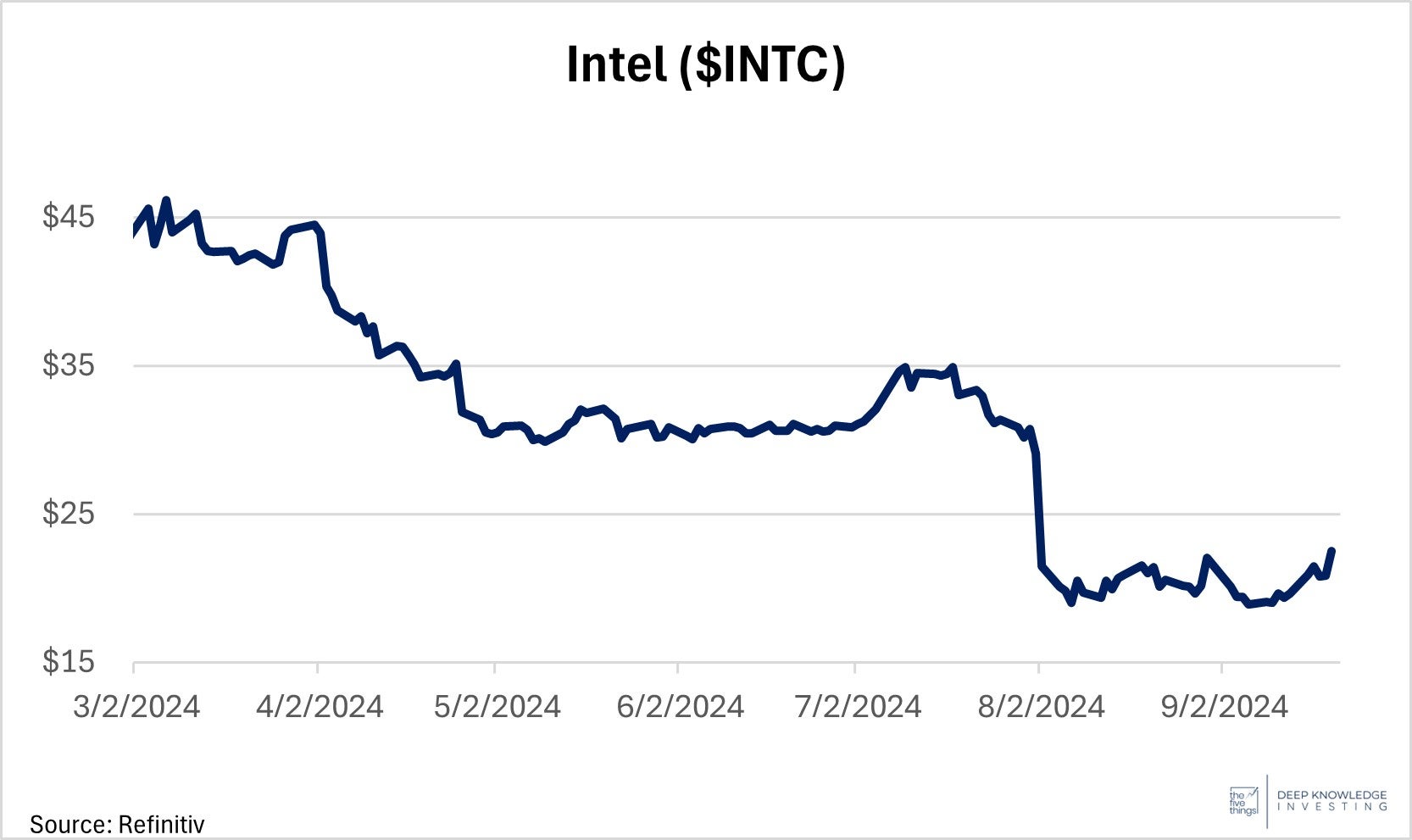

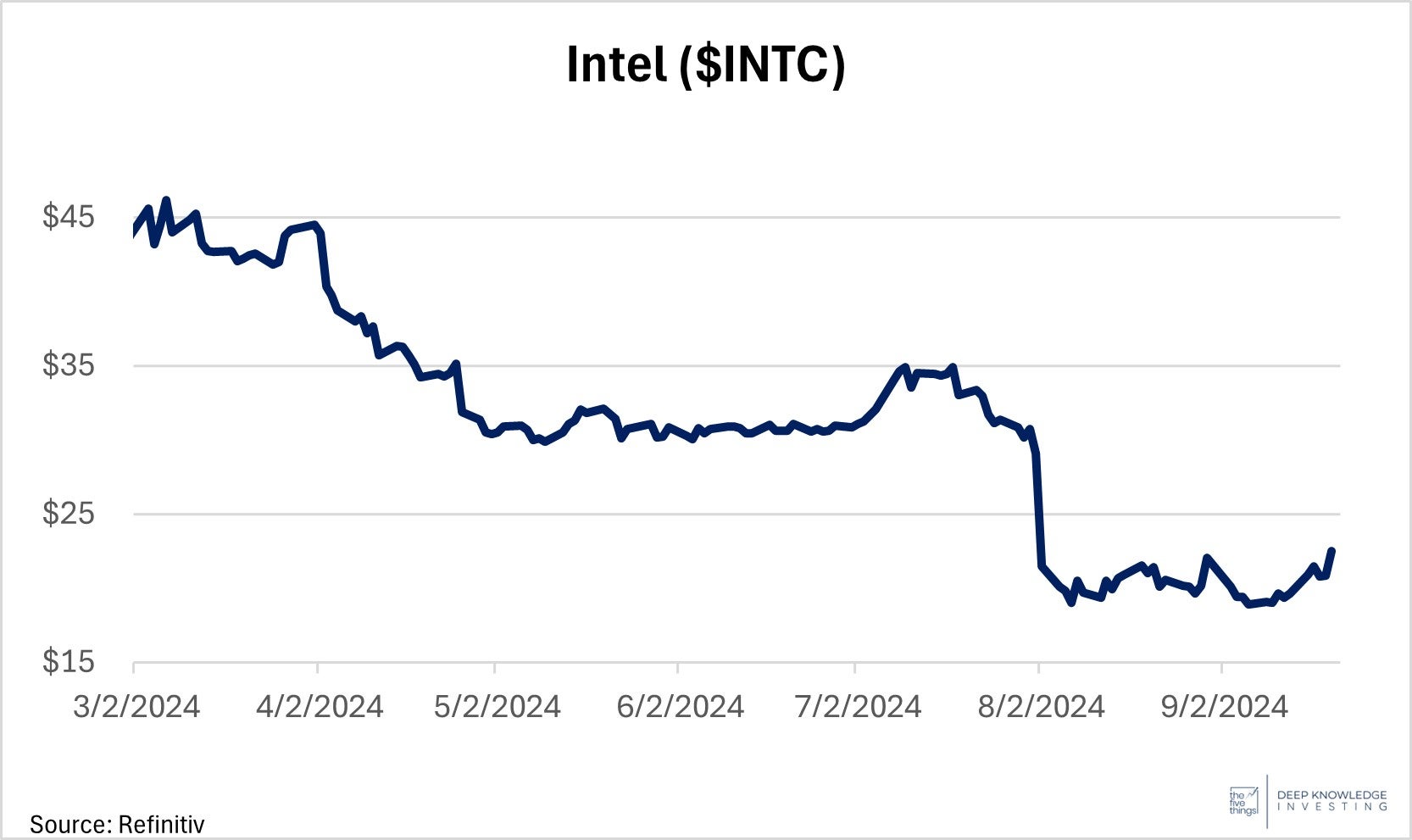

As previously reported by DKI, Intel has faced challenges in recent weeks, struggling with negative headlines related to chip malfunctions. The company is having manufacturing issues and has fallen behind in power efficiency and AI-related GPUs. However, this week brought positive news from CEO Pat Gelsinger. Gelsinger announced that Intel’s Foundry business will be restructured as a subsidiary with its own board, allowing it to raise external capital independently. He also hinted at a potential future spinoff of this division, which serves as a manufacturing partner for tech companies developing new products. In addition, the Foundry unit has entered a partnership with Amazon Web Services (AWS) to produce custom chips. Another significant development is the $3 billion in direct federal funding Intel secured for their Secure Enclave Program.

It's been a rough year for Intel, but the takeover talk helped the stock price.

DKI Takeaway: Intel has struggled for the past few years. Their decline began in 2020 when Apple (NASDAQ:AAPL) decided to move away from Intel's chips in favor of its own M series. However, this week's announcements could signal a turning point. With ongoing layoffs and the separation of their business units, the company is positioning itself for greater efficiency. The $3 billion government order is a significant boost for both the company and national security. In today’s world, chips are essential, and an inability of the U.S. to domestically produce and develop them poses a national security risk. While DKI generally advises against additional government intervention in the economy, this is one of the rare instances where national security considerations outweigh concerns over government spending. As we were finalizing this week’s 5 things, Qualcom (NASDAQ:QCOM) announced they are interested in buying Intel. We’ll probably have more on that next week.

-

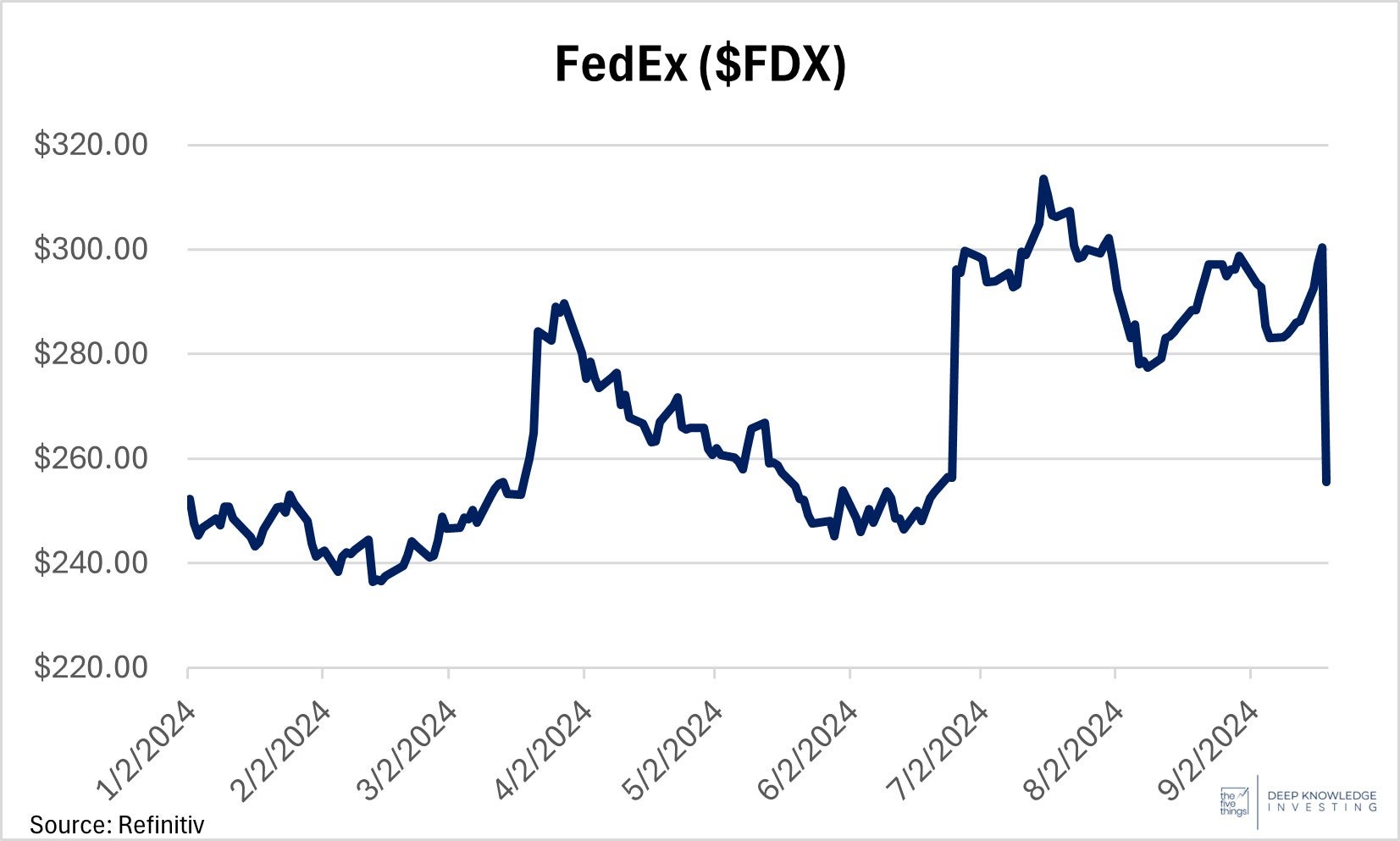

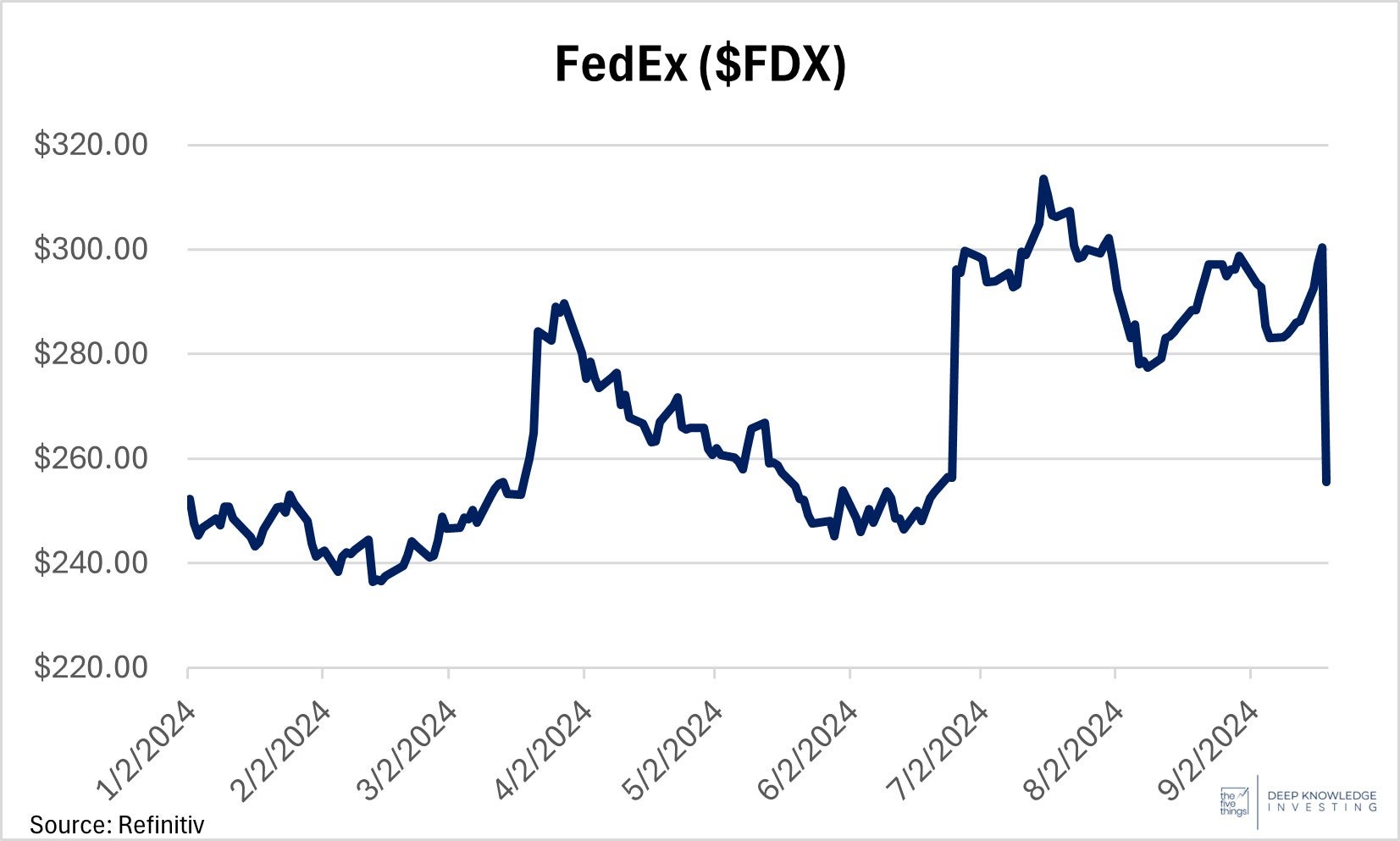

FedEx Earnings Disappoints and Validates the Federal Reserve:

On Thursday, FedEx reported disappointing earnings, with revenue of $21.6 billion falling short of the projected $21.9 billion. The company also posted earnings per share of $3.60, well below the expected $4.77. Management cited a “mix shift” that “reduced demand for priority services,” which constrained yield growth. Additionally, they revised guidance, lowering revenue growth projections from low-to-mid single digits to low single digits and adjusting fiscal 2025 EPS expectations to $20-$21, down from the previous range of $20-$22.

Lack of shipping demand supports the Fed decision to cut.

DKI Takeaway: FedEx’s earnings are closely tied to retail performance, as the company supports major retailers like Walmart, Target, and Home Depot. Recently, FedEx reduced its end-of-year guidance, mirroring similar actions by these retail giants. This signals a slowdown in consumer spending and increasing unemployment, key factors influencing Fed Chair Powell’s decision to adjust policy. The disappointing earnings report led to an 11% drop in FedEx’s stock during after-hours trading, reflecting investor concerns about the broader economic outlook affirming the Fed’s decision to make a larger cut in the fed funds rate. DKI has disagreed with the Fed decision to cut by 50bp. If you disagree with us, weak demand at $FDX is a good place to start.

-

Gold/Investment Research:

As usual, our friends at Learn Wall Street make an important point about doing proper research before investing. It might be fun to buy the latest meme stock on its way “to the moon” as a get rich quick and easy scheme, but the market has a way of punishing those who want to avoid doing hard work. Back in the 1990’s, Canadian mining company, Bre-X Minerals, claimed it had found a huge amount of gold in the Indonesian jungle. Bre-X stock rose from $.20 to $280 (Canadian dollars). Skipping ahead, there was no gold. It turns out core samples were “salted” meaning gold from another location was sprinkled into samples to provide the false impression of a big gold find. There was no gold. Investors lost their money. And the chief geologist (or someone who looked like him) exited a helicopter in flight. It was a terrible outcome for everyone involved.

Image Credit: Learn Wall Street

DKI Takeaway: In 2012, I attended an investment conference where a prominent hedge fund manager extoled the virtues of Viacom. At the time, most big hedge funds had huge positions in Viacom, CBS, and Disney which owned ABC and ESPN. After a week of research, I went back to a friend at a multi-billion-dollar fund which owned Viacom. I asked how he got comfortable with the risk of streaming television, YouTube, Hulu, Netflix, piracy, and DVR-powered commercial avoidance. His answer was “I haven’t thought about it.” Raji and I wrote a white paper called TV is Next where we correctly predicted the downfall of the traditional television model due to now-common streaming. The linear television stocks got crushed in the coming years while Netflix grew its stock price and market cap to $300 billion. The tl;dr version: if a company or a smart investor tells you something, it’s worth the time to do your own research and come to your own conclusion.

Information contained in this report, and in each of its reports, is believed by Deep Knowledge Investing (“DKI”) to be accurate and/or derived from sources which it believes to be reliable; however, such information is presented without warranty of any kind, whether express or implied. DKI makes no representation as to the completeness, timeliness, accuracy or soundness of the information and opinions contained therein or regarding any results that may be obtained from their use. The information and opinions contained in this report and in each of our reports and all other DKI Services shall not obligate DKI to provide updated or similar information in the future, except to the extent it is required by law to do so.

The information we provide in this and in each of our reports, is publicly available. This report and each of our reports are neither an offer nor a solicitation to buy or sell securities. All expressions of opinion in this and in each of our reports are precisely that. Our opinions are subject to change, which DKI may not convey. DKI, affiliates of DKI or its principal or others associated with DKI may have, taken or sold, or may in the future take or sell positions in securities of companies about which we write, without disclosing any such transactions.

None of the information we provide or the opinions we express, including those in this report, or in any of our reports, are advice of any kind, including, without limitation, advice that investment in a company’s securities is prudent or suitable for any investor. In making any investment decision, each investor should consult with and rely on his or its own investigation, due diligence and the recommendations of investment professionals whom the investor has engaged for that purpose.

In no event shall DKI be liable, based on this or any of its reports, or on any information or opinions DKI expresses or provides for any losses or damages of any kind or nature including, without limitation, costs, liabilities, trading losses, expenses (including, without limitation, attorneys’ fees), direct, indirect, punitive, incidental, special or consequential damages.