The Top Crypto Trends For 2024: A Genuine Shift Towards Utility-Focused Development?

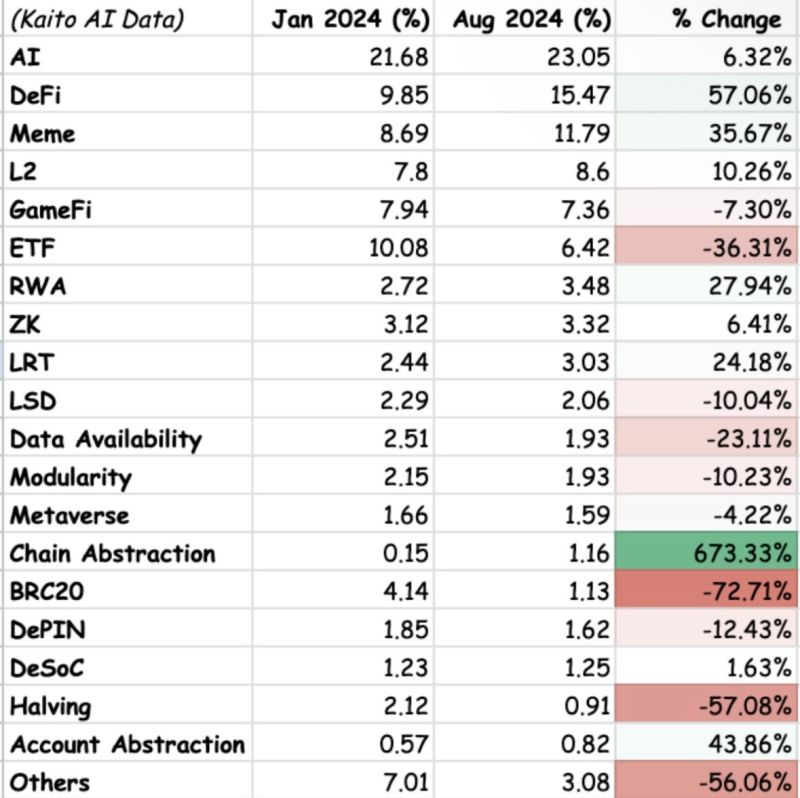

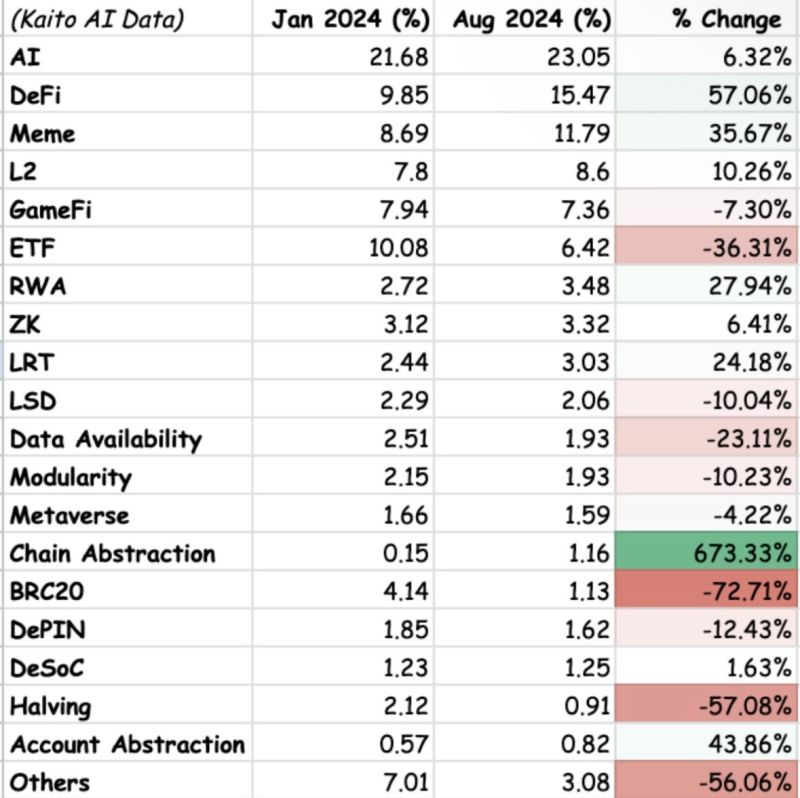

Pseudonymous cryptocurrency trader Arndxt shared his observations on the shifting narratives within the cryptocurrency space this year, highlighting the strength of the AI sector and the resurgence of Decentralized Finance (DeFi).

What Happened: Arndxt also discussed the brief comeback of meme coins, the debate around Layer-2 solutions, the Bitcoin halving and ETFs.

He noted Aave (CRYPTO: AAVE) and Compound (CRYPTO: COMP) slowly gaining momentum, while newer entrants like Ethena Labs (CRYPTO: ENA) hold strong.

Meme coins are seeing a short-term spike due to Tron founder Justin Sun, but the trader sees speculative energy flowing back into established ecosystems like Solana (CRYPTO: SOL) and Base.

The top Solana meme coins are Dogwifhat (CRYPTO: WIF), Bonk (CRYPTO: BONK), Popcat (CRYPTO: POPCAT) and others. Base meme coins are Maga (CRYPTO: TRUMP), Brett (CRYPTO: BRETT), and Mog Coin (CRYPTO: MOG).

Data via Arndxt

Arndxt also highlighted the growth in chain abstraction and account abstraction and expressed his anticipation for the gaming and Real-World Asset (RWA) sectors.

Why It Matters: Arndxt’s analysis provides valuable insight into the current state of the crypto market. His observations on AI’s continued dominance despite diminishing returns, the resurgence of DeFi due to institutional involvement, and the potential of L2s as a proxy for Ethereum (CRYPTO: ETH) investments, offer a comprehensive overview of the market’s dynamics.

The brief resurgence of meme coins, the underperformance of BRC20 tokens, the Bitcoin halving and the growth in chain and account abstraction, highlight the volatility and rapid evolution of the crypto space.

Arndxt’s anticipation for the gaming and RWA sectors, along with his mention of specific projects to watch, provides valuable guidance for those navigating the complex and ever-changing crypto landscape.

What’s Next: The influence of Bitcoin as an institutional asset class is expected to be thoroughly explored at Benzinga’s upcoming Future of Digital Assets event on Nov. 19.

Read Next:

Image: Shutterstock