All Eyes On Fed Decision, Powell Presser

It’s FED day. Will they raise interest rates or pause? Here’s what Wall Street thinks:

25 BPS HIKE �

-

CITI

-

CREDIT SUISSE

-

TD

-

VISA

NO RATE HIKE 🙅♀️

-

BARCLAYS

-

BMO

-

BLOOMBERG

-

GOLDMAN SACHS

-

JP MORGAN

-

MORGAN STANLEY

-

RBC

-

WELLS FARGO

MEDIAN NO RATE HIKE

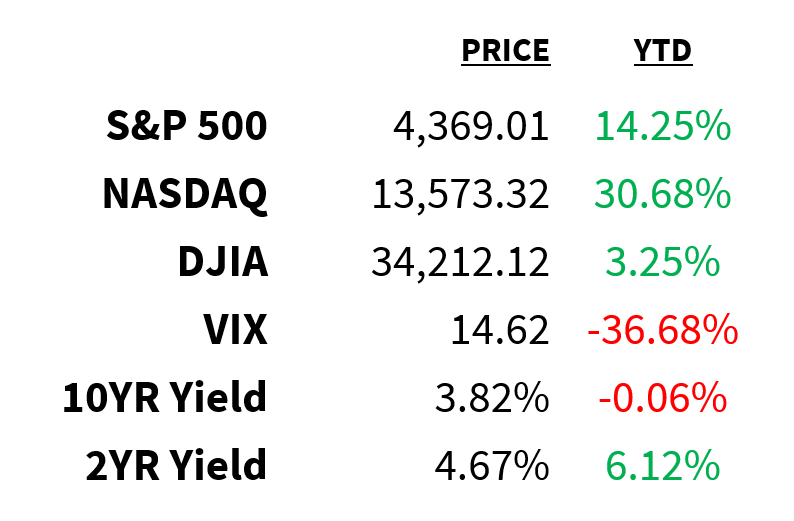

Market

Prices as of 4 pm EST, 6/13/23

Macro

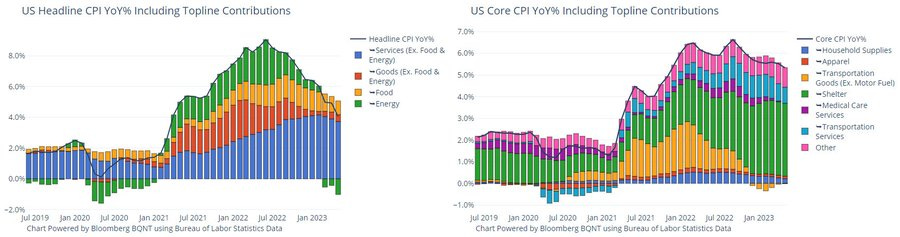

Annual headline and core inflation in May fell to their lowest levels since March 2021 and November 2021, respectively.

-

The former rose by 0.1% MoM (vs. 0.2% expected) to 4% YoY (vs. 4.1% expected).

-

The latter increased by 0.4% MoM (in-line) to 5.3% YoY (in-line).

-

Supercore prices—which are closely watched by the Fed and measure core services excluding rent—rose 0.24% in May (slightly above the pre-pandemic average of 0.23%).

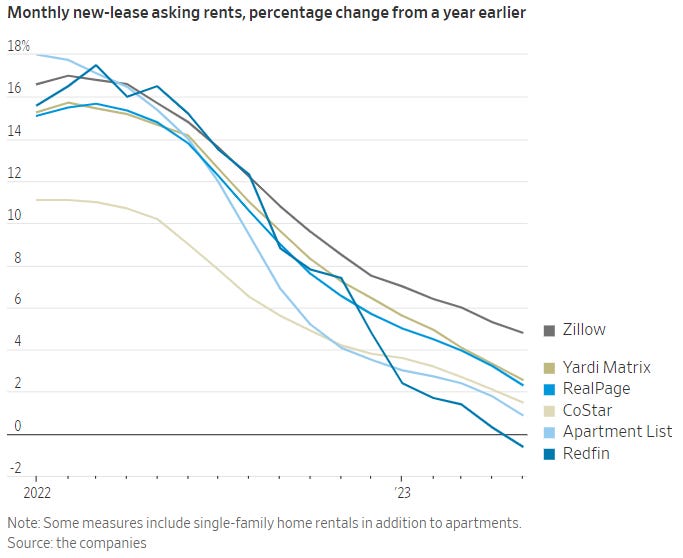

Shelter is still the biggest driver for inflation and remains stubbornly high.

-

That’s good news, however, because the index tends to be a lagging indicator and is expected to ease in the coming months.

-

Based on real-time gauges, shelter prices are already coming down:

-

According to Zillow’s All-House Rent Index, rental inflation has fallen below 5% for the first time since 2021.

-

By Redfin’s measure, nationwide rents declined 1% from a year earlier in May for the largest drop and first annual decline since March 2020.

-

WSJ

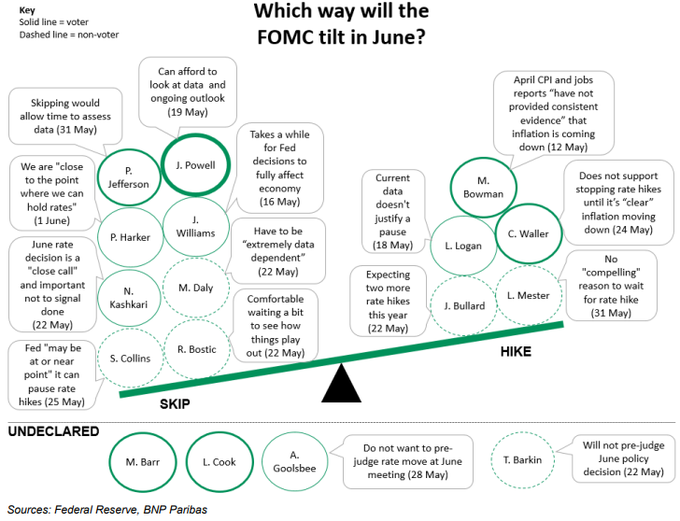

All of this suggests the Fed will announce a pause to rate hikes this afternoon.

-

In fact, traders are now pricing in a ~95% chance rates remain untouched this month.

-

Looking out further, futures markets predict there will be no net cuts for the rest of 2023.

-

As for FOMC members, here’s how they lean:

BNP Paribas

Stocks

UBS has downgraded Apple (NASDAQ:AAPL) to neutral from buy.

-

Analysts cited softness in developed markets which suggests growth will remain under pressure.

-

They point to slowing demand for iPhones and Macs in the second half as well as sluggish growth in its services business.

-

They did, however, raise their price target to $190 from $180.

-

Even so, the downgrade leaves Apple with the lowest number of buy ratings from analysts (67%) since late 2020.

Meta Platforms (NASDAQ:META) has released a pair of AI-powered tools in recent days.

-

MusicGen is a controllable music generator trained on 20k hours of music that turns text descriptions into 12 seconds of audio.

-

I-JEPA is a “human-like” AI model designed to analyze and complete unfinished images more accurately than existing models by using background knowledge about the world to fill in missing pieces.

-

Like the rest of its AI research, the tools are open-sourced with an aim towards improvement and innovation.

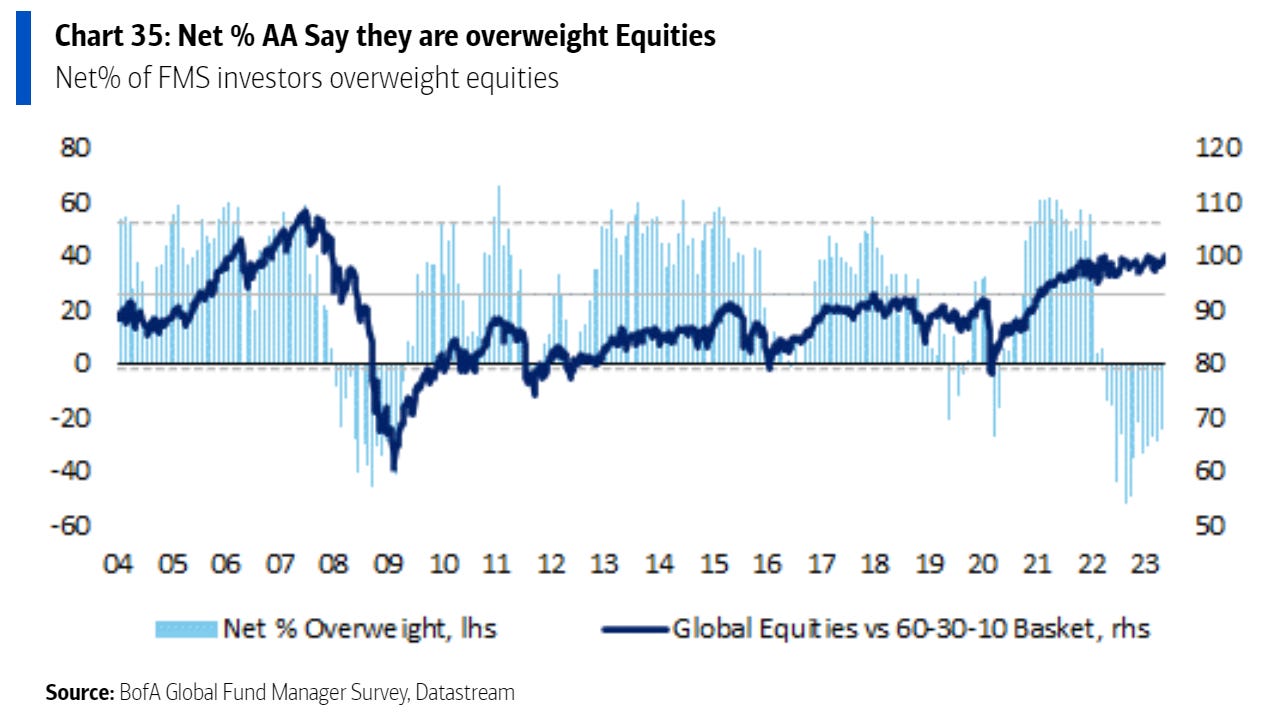

BofA published its monthly Global Fund Managers Survey yesterday—here are some highlights:

-

Long Big Tech is by far the most crowded trade.

-

59% believe the Fed isn’t done hiking interest rates.

-

63% expect a worsening economy ahead.

-

Allocations to commodities reached a 3-year low.

-

Cash levels are at the lowest since January 2022.

-

Investors are net 32% underweight equities.

Energy

Oil prices got a boost after a cut to short-term interest rates by China’s central bank.

-

The surprise cut was also accompanied by the possibility of broad stimulus measures.

-

The moves are aimed at strengthening the country’s faltering post-pandemic recovery.

-

China is the world’s largest crude oil importer.

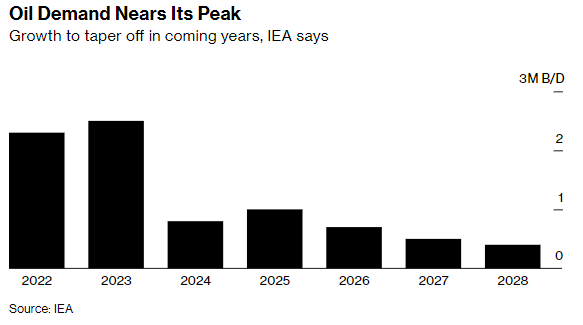

Meanwhile, a new report from the International Energy Agency (IEA) predicts global oil demand in 2024 will grow at half the rate of previous years, dropping to 860,000 barrels per day.

-

By 2028, the agency expects demand growth will fade to just 400,000 barrels per day.

-

Fueling (pun intended) the pullback in future demand are increasing production capacity, the shift towards clean energy, and a decrease in Chinese consumption.

IEA/Bloomberg

Earnings

What we’re watching today:

-

Lennar (NYSE:LEN)

Top Headlines

-

Pipeline plot: The CIA warned Ukraine not to attack the Nord Stream pipeline last summer.

-

RTO: Office occupancy rates in New York topped 50% last week for the first time since the start of the pandemic.

-

Live-stream: Netflix is preparing to enter live-stream sports with a celebrity golf tournament this fall.

-

AI chip: AMD announced the upcoming release of its most-advanced GPU for AI which will challenge Nvidia’s dominance.

-

AI trust: Salesforce is introducing the “Einstein GPT Trust Layer” to protect proprietary data and address concerns about data control and ownership.

-

Global inequality: As measured by the Gini coefficient, global inequality has reached its lowest level in 150 years.

-

Beer me: With sales down 24% YoY in the week ending June 3, Bud Light is no longer the US’ top-selling beer.

-

UK GDP: The UK economy returned to growth in April thanks to rebounds in the retail and creative industries sectors.

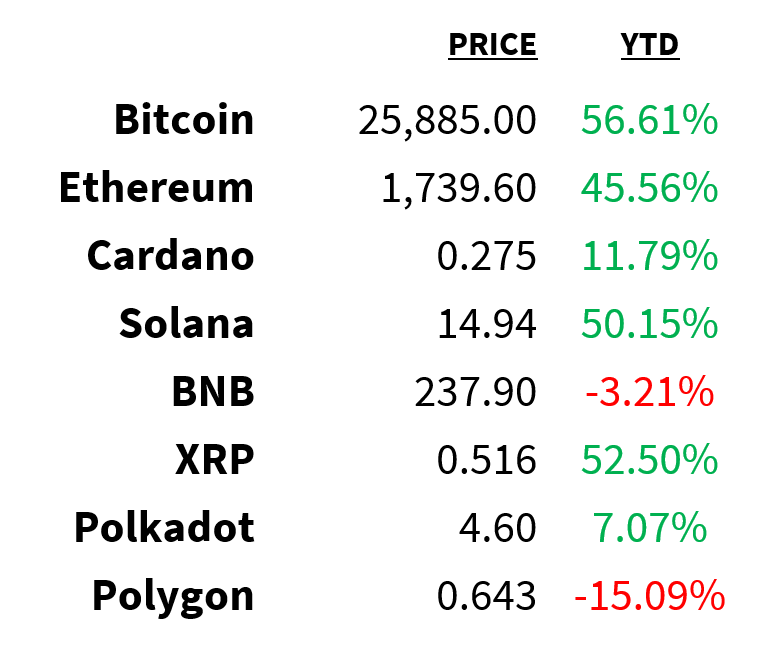

Crypto

Prices as of 4 pm EST, 6/13/23

-

CZ pushes back: Changpeng “CZ” Zhao says Binance has not been selling Bitcoin (CRYPTO: BTC), despite the rumors.

-

Compromise: Binance.US and the SEC are working on a deal to prevent a complete asset freeze.

-

Undecided: The SEC has not made a decision on whether it will respond to Coinbase’s (NASDAQ:COIN) petition for clarity.

-

Definitions: House Republicans are opposing the SEC’s proposed rule to change the definition of “exchange”.

-

Outflows: Digital asset investment products have seen 8 straight weeks of outflows totaling $417 million.

Deals

-

Temporary block: A federal judge in California has temporarily blocked Microsoft’s $69 billion acquisition of Activision Blizzard.

-

Sports betting: Entain will buy Poland-based sports betting operator STS Holdings for $946 million.

-

Wait, what?: Zyus Life Sciences, a cannabis company, will go public via a reverse merger with Phoenix Canada Oil, an oil producer.

-

AI unicorn: A Nvidia-backed AI startup, Synthesia, has reached unicorn status after raising $90 million in a Series A.

-

Auto SPAC: Auto software firm LeddarTech is going public via SPAC with Prospector Capital.