Bitcoin Miners With AI Exposure Stumble While Traditional Players Thrive: What’s Behind July’s Shake-Up?

July was a month of stark contrasts in the Bitcoin (CRYPTO: BTC) mining sector. As miners with AI exposure grappled with losses while traditional mining companies seized the spotlight, showcasing the dynamic nature of the industry.

With evolving market conditions and technological shifts, how miners navigate this landscape is becoming increasingly complex.

Miners With AI Exposure Vs. Traditional Players

In the Bitcoin mining arena, not all players are created equal. According to insights from JPMorgan’s Reginald L. Smith, the divide between miners with AI exposure and their traditional counterparts has never been more pronounced.

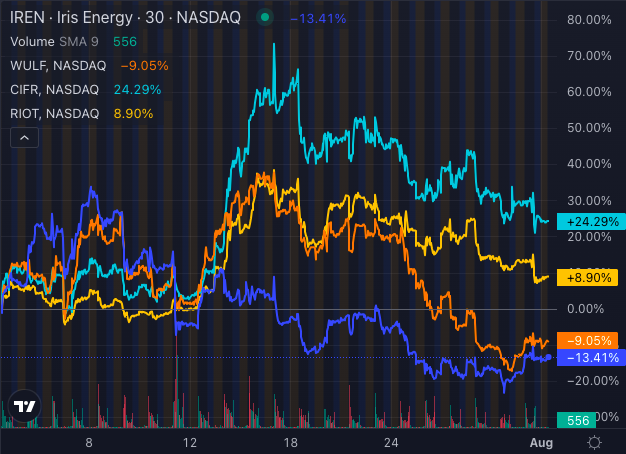

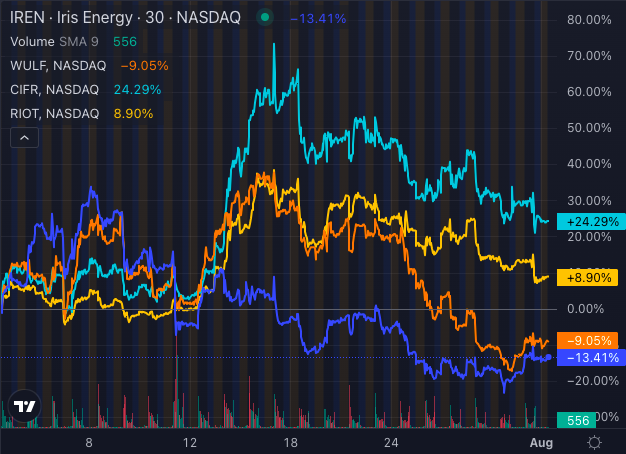

Chart created using Benzinga Pro

While miners with AI exposure like Iris Energy Ltd (NASDAQ:IREN) and TeraWulf Inc (NASDAQ:WULF) saw their gains evaporate, traditional miners such as Cipher Mining Inc (NASDAQ:CIFR) and Riot Platforms Inc (NASDAQ:RIOT) enjoyed investor favor in July, noted Smith.

AI-Linked Miners Face Headwinds

AI miners have been riding a wave of innovation, but July proved challenging. According to Smith, as Bitcoin prices fluctuated and network competition intensified, AI-driven strategies struggled to deliver.

Iris Energy and TeraWulf, both at the forefront of integrating AI technologies into their mining operations, experienced significant setbacks in stock performance. Their dependence on emerging technology appears to have created vulnerabilities in an unpredictable market landscape.

Traditional Bitcoin/Crypto Miners Gain Ground

Conversely, traditional miners like Cipher Mining and Riot Platforms managed to attract investors despite the turbulent market conditions.

Cipher Mining emerged as the top performer with a 26% rise in stock value in July, signaling strong market confidence in its conventional mining approach.

Riot Platforms also saw positive momentum, benefiting from Bitcoin’s price rally in late July.

Read Also: Riot Platforms Reports Worse-Than-Expected Q2 Results: Details

The resilience of these traditional players underscores a fascinating trend: while AI integration offers potential advantages, the market still values established mining methods. This juxtaposition highlights the ongoing debate over the future of mining: innovation versus reliability.

Broader Crypto Mining Market Dynamics

The broader Bitcoin market landscape painted a complex picture in July.

Smith highlighted that the average Bitcoin price was $62,700, down 5% from June, yet it reached as high as $70,000 following the Bitcoin 2024 conference in Nashville.

By month-end, Bitcoin settled at a $66,900 seven-day average, indicating a 10% increase from June’s figures. Additionally, Bitcoin’s annualized volatility rose from 37% in June to 45% in July, contributing to the uncertain environment.

Bitcoin Mining Profitability Concerns

Amid these shifts, mining profitability continued its downward trajectory. The average earnings for miners plummeted to $45.8k per EH/s, hitting record lows, noted Smith.

This represents a significant decline from the $342,000 peak in November 2021, posing a challenge for miners across the board. Traditional miners have thus far weathered these economic pressures more effectively than their AI-focused peers.

The Bitcoin mining sector’s future remains uncertain as AI technologies continue to develop and market dynamics evolve. While AI miners face hurdles, traditional players are capitalizing on their established methods, reminding investors of the industry’s inherent volatility.

As we move forward, the question remains: will AI-driven innovation overcome its growing pains, or will traditional mining methods continue to hold sway?

Read Next:

Image created using artificial intelligence via Midjourney.