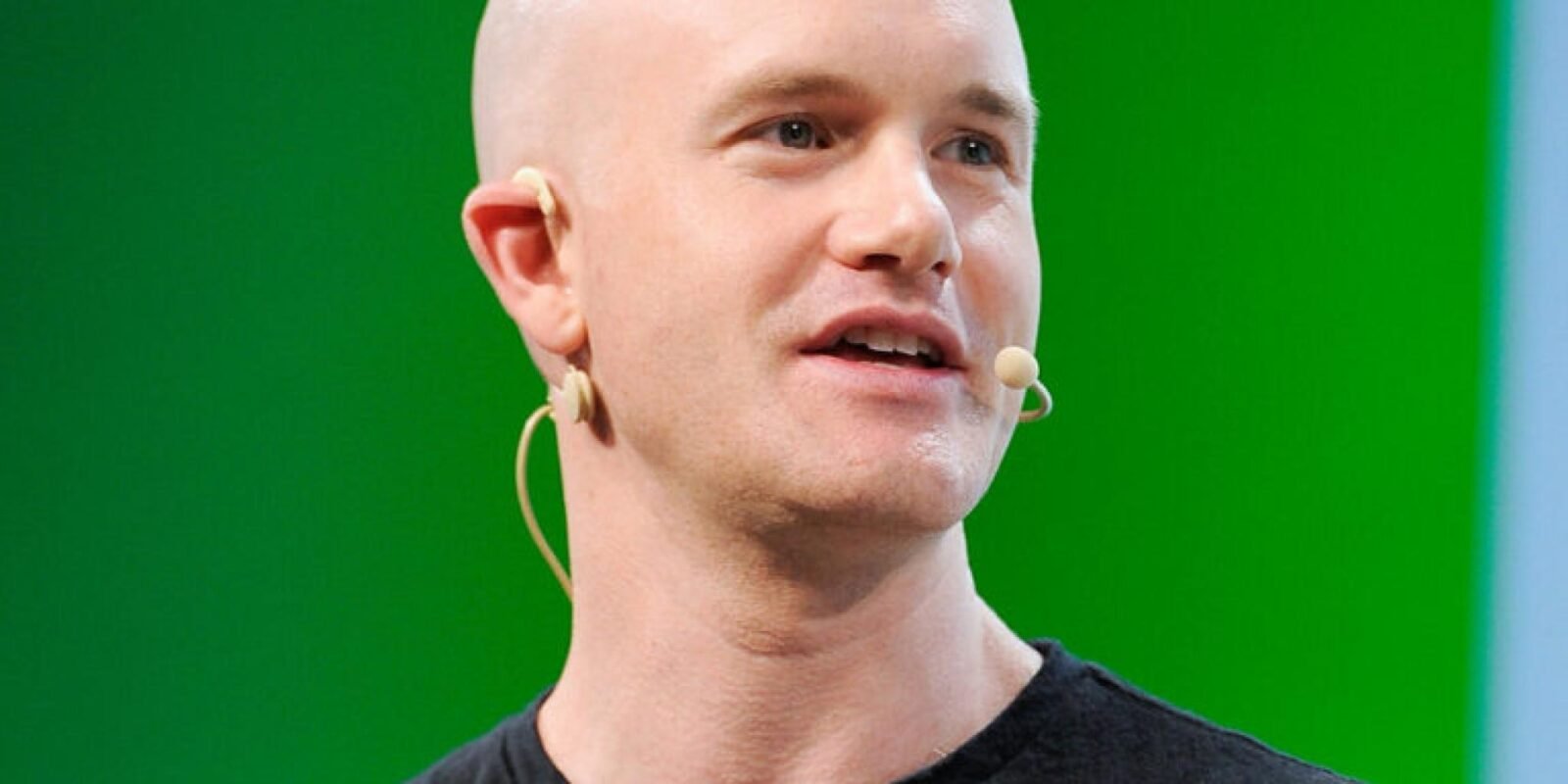

Coinbase CEO Brian Armstrong: Failed Anti-Money Laundering Regulations ‘Sounds Like A Job For DOGE’

Coinbase Inc. (NASDAQ:COIN) CEO Brian Armstrong has called on the newly established Department of Government Efficiency (D.O.G.E.) to tackle what he describes as a glaring failure of global Anti-Money Laundering (AML) regulations.

What Happened: “Anti-Money Laundering (AML) regulations have been a policy failure,” Armstrong wrote on Saturday on X, noting that these regulations cost an estimated $213 billion annually while only stopping about 0.2% of illicit activity according to United Nations data.

“Sounds like a job for @DOGE,” he added, referring to the agency created under the Trump administration to streamline regulatory inefficiencies.

The Coinbase CEO responded to a tweet highlighting how financial institutions are pressured to police money laundering at the expense of legitimate accounts.

Armstrong’s comments echo growing concerns in the financial sector about the unintended consequences of AML policies, which critics argue disproportionately harm legitimate consumers and small businesses.

Also Read: Ethereum ETF With Integrated Staking To Be Approved In The Future: Bernstein

Banks, facing the risk of massive fines for compliance failures, often resort to de-banking practices—closing accounts or denying services to individuals and entities deemed even remotely risky.

Armstrong’s tweet follows a broader debate ignited by John Arnold, co-chair of Arnold Ventures, who highlighted how regulators have effectively shifted the burden of anti-money laundering enforcement to private financial firms.

This shift, Arnold argued, incentivizes banks to avoid risk altogether, often to the detriment of legitimate account holders.

Armstrong’s mention of D.O.G.E. also carries a playful nod to Dogecoin (CRYPTO: DOGE), the cryptocurrency often associated with humor but now gaining serious traction as a cultural and financial symbol.

What’s Next: With Dogecoin’s initials coinciding with the agency’s acronym, many in the crypto community see the potential for the meme coin’s ethos of inclusivity and decentralization to inspire a fresh approach to solving entrenched regulatory inefficiencies.

Read Next:

Photo: Shutterstock