Critical Week For Central Bank Decisions And Earnings From About One Third Of S&P 500 Companies

To gain an edge, this is what you need to know today.

Critical Week

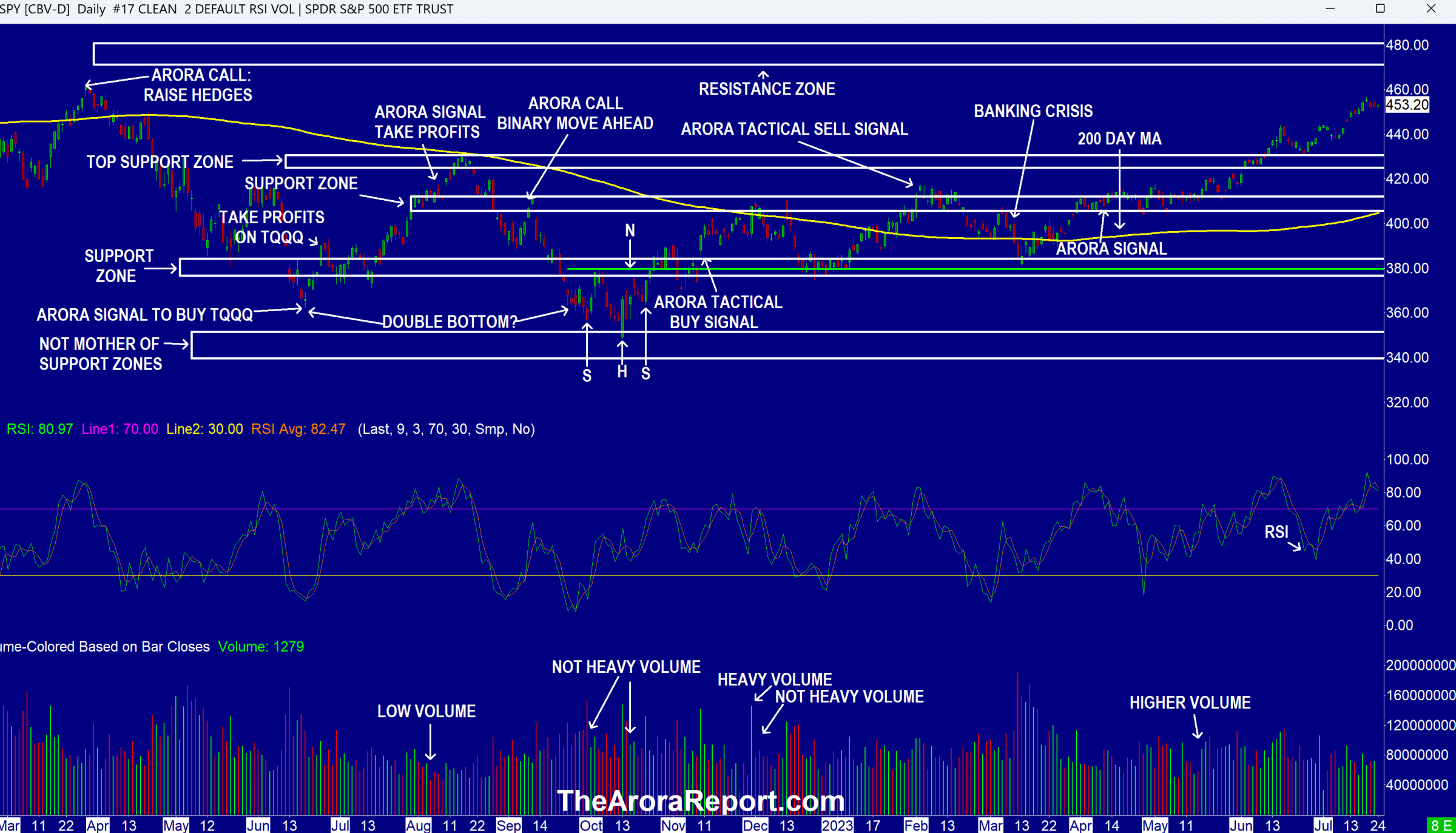

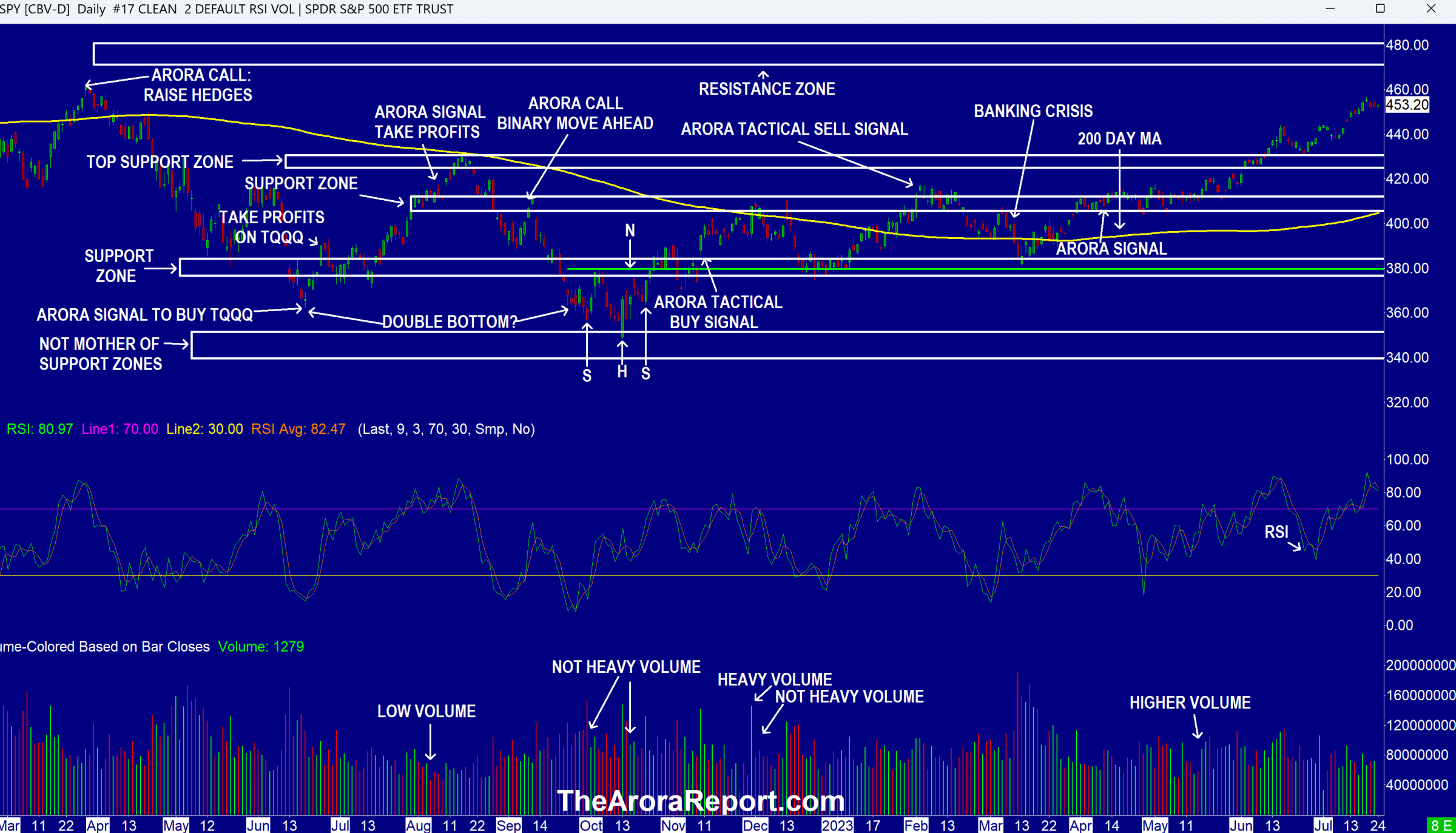

Please click here for a chart of SPDR S&P 500 ETF Trust (NYSE:SPY) which represents the benchmark stock market index S&P 500 (SPX).

Note the following:

- The chart shows that ahead of the critical week, the stock market is levitating midway between the support zone and the resistance zone.

- The chart shows the stock market is stretched to the upside relative to the 200 day moving average shown in yellow.

- RSI on the chart shows that the stock market is overbought.

- This is a critical week for central banks.

- FOMC will start its meeting tomorrow and announce its decision at 2pm ET on Wednesday followed by Powell’s press conference. The consensus is for a 25 bps rate hike.

- Bears believe that there may still be one or two more rate hikes ahead. Bears believe the stock market will turn down after the Fed meeting.

- Bulls believe that this will be the last rate hike and then the Fed will start cutting rates in September. Bulls are gunning to run up the stock market to the resistance zone shown on the chart.

-

- In The Arora Report analysis, unless the economic data changes, the probability of a rate cut in September is low.

- The European Central Bank (ECB) is expected to raise rates by 25 basis points.

- So far, Bank of Japan (BoJ) has been an outlier, keeping its easy money policy.

- At The Arora Report, we will be keeping a close eye for any signs of a pivot at BoJ towards tighter policy as inflation is rising past the 2% target.

- The consensus is that a tightening may occur in October.

- Historically, the momo crowd buys ahead of the Fed meeting and runs up the stock market. The reason is that the momo crowd buys on hope. In contrast, smart money tends to reduce risk ahead of the Fed meeting.

- About one third of S&P 500 companies will be reporting earnings this week.

- Among the tech stocks, critical earnings are from Microsoft Corp (NASDAQ:MSFT), Meta Platforms Inc (NASDAQ:META), and Alphabet Inc Class C (NASDAQ:GOOG). These stocks have run up on AI frenzy. Please click here for a list of 18 artificial intelligence picks from The Arora Report.

- Among non-tech earnings, important earnings that may potentially have an impact on the market are from McDonald's Corp (NYSE:MCD), Chipotle Mexican Grill, Inc (NYSE:CMG), General Motors Co (NYSE:GM), Ford Motor Co (NYSE:F), MONDELEZ INTERNATIONAL INC Common Stock (NASDAQ:MDLZ), and Hershey Co (NYSE:HSY).

- To date, about 20% of S&P 500 companies have reported earnings. These earnings are down about 9% from the prior year. As earnings have fallen, the stock market has gone up on PE expansion.

- Investors should note that among the earnings reported so far, critical earnings were from Tesla Inc (NASDAQ:TSLA), and Netflix Inc (NASDAQ:NFLX). Both stocks went down after the earnings release.

- Going into the critical week, sentiment is very positive, bordering on extreme. When sentiment reaches extremely positive, it is a contrary signal. In plain English, it means time to sell. As a reminder, sentiment is not a precise timing indicator. In general, you want to buy when sentiment is extremely negative, and take profits when sentiment is extremely positive.

- As an actionable item, the sum total of the foregoing is in the protection band, which strikes the optimum balance between various crosscurrents.

Europe

PMI is a leading indicator. Leading indicators carry heavy weight in the proven ZYX Asset Allocation Model. The model is adaptive in that it changes itself with market conditions. The adaptiveness is, in part, responsible for the accurate calls of The Arora Report. Most models on Wall Street are static. They work for a while and then stop working when market conditions change. Please click here to see how adaptiveness is achieved.

A number less than 50 indicates economic contraction. Here are the details of the latest data from Europe:

- Euro area manufacturing PMI came at 42.7 vs. 43.5 consensus.

- Euro area services PMI came at 51.1 vs. 51.6 consensus.

Momo Crowd And Smart Money In Stocks

The momo crowd is buying stocks in the early trade. Smart money is inactive in the early trade.

Gold

The momo crowd is inactive in the early trade. Smart money is inactive in the early trade.

For longer-term, please see gold and silver ratings.

Oil

The momo crowd is buying oil in the early trade. Smart money is inactive in the early trade.

For longer-term, please see oil ratings.

Bitcoin

There is disappointment that whales did not run up bitcoin (CRYPTO: BTC) over the weekend.

Markets

Our very, very short-term early stock market indicator is neutral but expect the market to open higher. This indicator, with a great track record, is popular among long term investors to stay in tune with the market and among short term traders to independently undertake quick trades.

Protection Band And What To Do Now

It is important for investors to look ahead and not in the rearview mirror.

Consider continuing to hold good, very long term, existing positions. Based on individual risk preference, consider holding 🔒 in cash or Treasury bills or allocated to short-term tactical trades; and short to medium-term hedges of 🔒, and short term hedges of 🔒. This is a good way to protect yourself and participate in the upside at the same time. To see the locked content, please click here to start a free trial.

You can determine your protection bands by adding cash to hedges. The high band of the protection is appropriate for those who are older or conservative. The low band of the protection is appropriate for those who are younger or aggressive. If you do not hedge, the total cash level should be more than stated above but significantly less than cash plus hedges.

It is worth reminding that you cannot take advantage of new upcoming opportunities if you are not holding enough cash. When adjusting hedge levels, consider adjusting partial stop quantities for stock positions (non ETF); consider using wider stops on remaining quantities and also allowing more room for high beta stocks. High beta stocks are the ones that move more than the market.

Traditional 60/40 Portfolio

Probability based risk reward adjusted for inflation does not favor long duration strategic bond allocation at this time.

Those who want to stick to traditional 60% allocation to stocks and 40% to bonds may consider focusing on only high quality bonds and bonds of five year duration or less. Those willing to bring sophistication to their investing may consider using bond ETFs as tactical positions and not strategic positions at this time.

The Arora Report is known for its accurate calls. The Arora Report correctly called the 2008 financial crash, the start of a mega bull market in 2009, the COVID crash, the post-COVID bull market, and the 2022 bear market. Please click here to sign up for a free forever Generate Wealth Newsletter.