Crypto Stocks Plunge as Bitcoin Dips Below $50K, Triggers $270B Market Value Decline

Crypto stocks including Coinbase Global, Inc (NASDAQ:COIN), Marathon Digital Holdings, Inc (NASDAQ:MARA), Riot Platforms, Inc (NASDAQ:RIOT), CleanSpark, Inc (NASDAQ:CLSK), MicroStrategy Inc (NASDAQ:MSTR) tumbled Monday amid a global market sell-off spurred by recession fears.

The price of Bitcoin (CRYPTO: BTC) sank more than 13% on Monday to $50,963.57, CNBC writes. At one point, it fell to $49,111.10, its lowest level and the first time under $50,000 since February.

Bitcoin has lost nearly 18% since Saturday. A week ago, on July 20, it climbed as high as $69,982.

Ethereum (CRYPTO: ETH) losses were even steeper. The crypto asset dropped 17% to $2,271.21, bringing its three-day loss to 24% and erasing its 2024 gain. Mining stocks suffered double-digit losses, too.

The moves follow a broader market sell-off that began last week. A weaker-than-anticipated July jobs report renewed investor fears of a recession, and the tech-heavy Nasdaq Composite entered a correction.

In addition to economic and geopolitical concerns, crypto investors have been contending with sell pressure from Mt. Gox distributions and decreasing odds of a second Donald Trump presidency in the U.S.

Bitcoin fell by 11% in the past 24 hours, and ether plunged by 21%, causing the total value of cryptocurrencies to drop by approximately $270 billion, according to CNBC.

Investors can gain exposure to crypto stocks through iShares Bitcoin Trust (NASDAQ:IBIT) and ProShares Bitcoin Strategy ETF (NYSE:BITO).

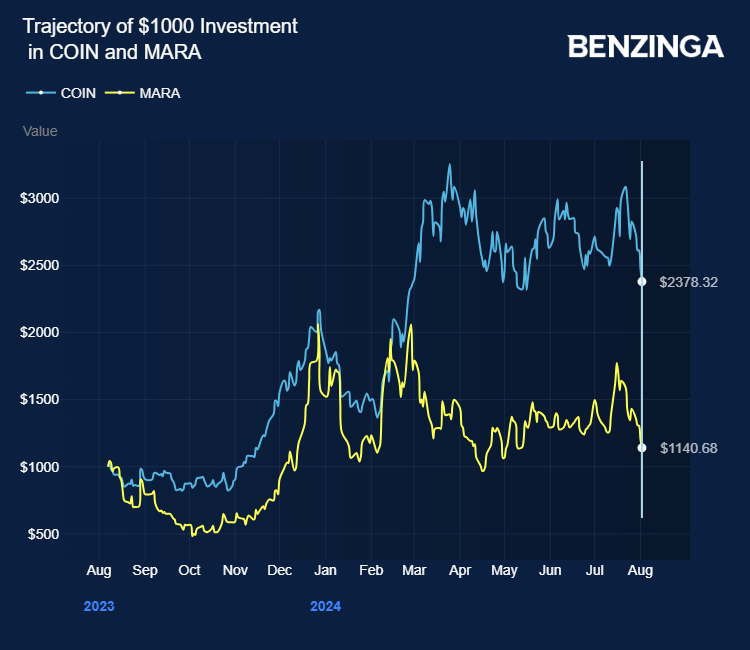

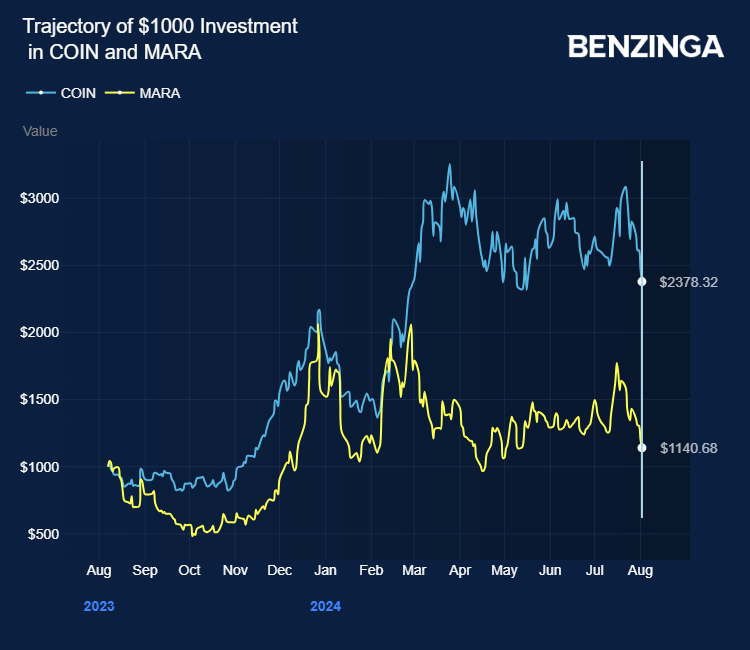

Price Action: COIN stock is down by 14% to $175.37 at the last check on Monday

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Photo by Igor Faun on Shutterstock