From $100K to $250K? Analyzing Bitcoin’s Bull Market Signals

Who would have thought we’d see Bitcoin shoot through the roof this quickly, soaring past $100K? As we move forward into 2025, the main question on our minds is, what lies ahead? Is this a bubble about to burst, or are we on track for $150K–$200K soon? Are there any rational tools to predict its trajectory, or are we left to just play guessing games? From what I’ve observed, the fog starts to lift when you look at on-chain and technical indicators, while also factoring in the macro perspective. I’ve aimed to do just that in this piece below.

Extreme Greed, Rising Active Addresses, and Record Hash Rate

The Fear and Greed Index is at 84, indicating Extreme Greed, which often signals potential tops in the short term. However,sustained levels of greed during bull markets (like now) often align with parabolic price increases before final peaks. In other words, this precedes short-term pullbacks because of market exuberance.

The number of active addresses is increasing and as of December 4, 2024, was 893,426, suggesting heightened interest and usage of the Bitcoin network.

Bitcoin’s hash rate is rising, at around 792 EH/s currently, reflecting miner confidence and network security, which are long-term bullish signals. Bitcoin’s price tends to follow the hash rate; the more confident miners are about price appreciation, the less likely they are to sell.

Weekly Golden Cross Signals Bull Market with $150K-$250K Potential

The weekly Golden Cross, where the 50-week moving average (MA) crosses above the 200-week MA, is a highly significant signal for long-term investors because it often marks the start of major bull markets and the conclusion of prolonged bearish phases.The previous instance of this signal occurred when Bitcoin recovered from the 2018 bear market and eventually surged to its all-time high of $69,000 in 2021.

Mirroring its behavior in previous bull cycles, this signal repeated in early 2024, preceding Bitcoin’s parabolic rise, reaching $101K as of now. Previous bull cycles following weekly Golden Crosses have led to gains of 300%-600%. If this occurs, Bitcoin could potentially reach $150,000 to $250,000 before the next major cycle correction. Meanwhile, the next Golden Cross is unlikely to occur until 2026 or 2027, assuming Bitcoin undergoes a complete cycle of price appreciation, correction, and consolidation.

Source: TradingView

RSI Signals Overbought Conditions, Hinting at Pullback or Consolidation

On the weekly time frame, the Relative Strength Index (RSI) is now at 77.77, consistent with overbought conditions. However, this does not imply a trend reversal right away but does indicate the possibility of either a short-term pullback or a period of sideways price action. In the past, many bull cycles saw similar RSI readings, followed by temporary pullbacks, which were then followed by renewed rallies to higher highs. This pattern suggests potential cooling-off phases ahead.

In the 2021 bull cycle, the RSI reached similar levels multiple times before peaking above 90, after which Bitcoin experienced a significant correction. Assuming Bitcoin stays in the most recent consolidation range around $100,000 and the RSI retraces back to a healthier range of 60-65, the next leg upward could occur. A healthy correction of 10% to 20% or a sideways period would allow the markets to reset before experiencing sustained growth.

Source: TradingView

Fibonacci Levels and Bollinger Bands Signal Key Support and Potential Cooling

Fibonacci retracement levels are used in technical analysis to identify potential support and resistance zones during price corrections or rallies. They help indicate where a price might retrace before continuing its trend. Based on the chart below:

Key Levels:

- $78,000 (0.786): Strong support zone.

- $70,000 (0.618): Major retracement level for a healthy pullback.

- $100,000: Key support, reflecting a critical psychological and technical level.

Bitcoin’s price is currently hovering around the upper Bollinger Band, signaling strong bullish momentum. However, this position also indicates potential overextension, as prices often retrace or consolidate when deviating significantly from the midline (20-week moving average). The Bollinger Bands are widening, reflecting increased volatility, which is typical during strong uptrends or before significant price moves. A pullback to $100,000 or Fibonacci levels at $78,000 or $70,000 would align with a cooling-off period within the Bollinger Band framework, preparing the market for further gains.

Source: TradingView

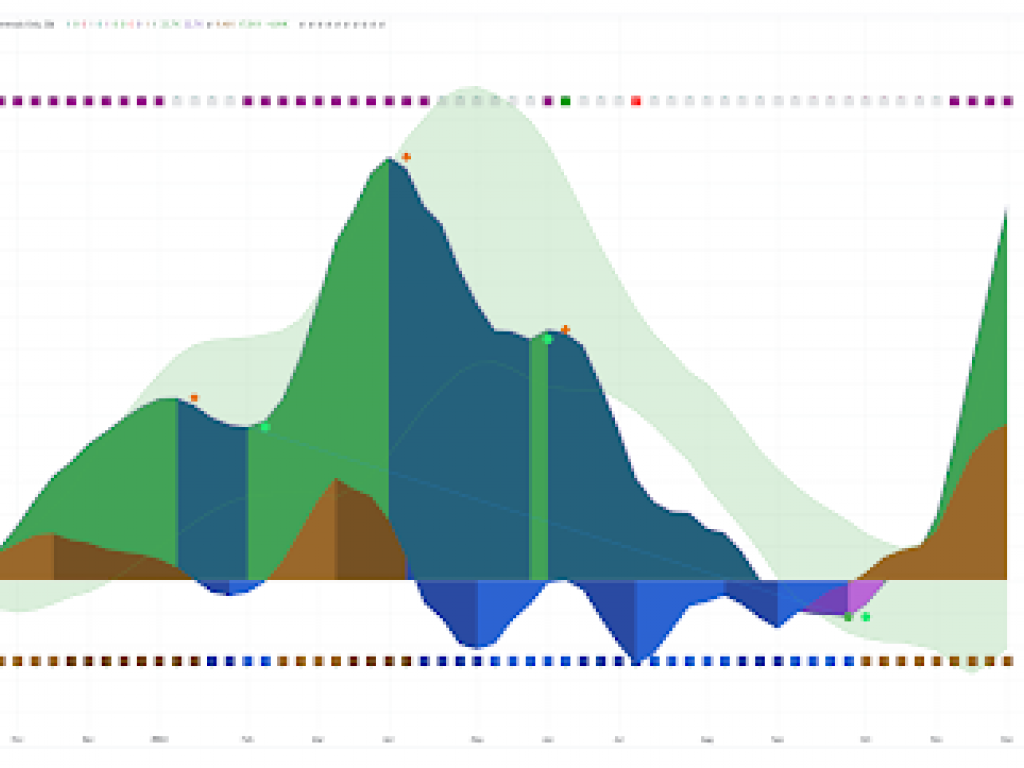

Visualizing Bitcoin’s Market Behavior Through Key Indicators

To further visually represent Bitcoin’s market behavior, let’s look at this colored chart below. The chart includes a color-coded bar at the top that reflects RSI conditions (e.g., overbought, oversold, bullish/bearish divergences). The currently visible purple and green color blocks suggest periods of oversold or bullish divergence, reflecting bullish momentum and aligning with RSI overbought levels.

The second bar shows market structure trends (e.g., ranging, bullish, or bearish). From the chart, we see green blocks that suggest the market is in a bullish phase, confirming breakout behavior.

Next, the main oscillator displays the Awesome Oscillator (AO) with divergences and pivot points, where the green peaks above zero and brown regions below confirm positive momentum and bullish pivots.

The secondary oscillator (AC) below the AO displays similar momentum indications, with positive bars (green above zero) suggesting accelerating upward momentum and a strong bullish bias.

Source: TradingView

Potential Crypto Space Developments in 2025

Post-halving supply shock, increasing retail and institutional participation, institutional accumulation (companies like MicroStrategy and other corporate treasuries adopting Bitcoin as a strategic reserve asset) could push demand to new highs.

The proportion of institutional investors will likely grow, stabilizing price movements but also making Bitcoin more correlated with traditional markets.

Bitcoin’s dominance (currently around 55%) could rise further as investors favor its “digital gold” narrative over altcoins, especially if regulatory scrutiny tightens around smaller tokens.

Bitcoin wallet growth will continue as adoption in emerging markets increases, with Bitcoin used as a hedge against local currency devaluation.

Major corporations could start settling cross-border transactions in Bitcoin, while in regions with high inflation or de-dollarization trends central banks may increase interest in Bitcoin as a reserve asset.

Countries like the U.S., the EU, and the UAE are likely to finalize crypto-friendly regulations, while other jurisdictions may crack down harder on decentralized finance (DeFi) and self-custody to maintain control over financial systems.

Closing Thoughts

With a loud explosion of excitement, Bitcoin shattered the $100,000 barrier, an achievement deemed nothing short of astonishing. Technical indicators, including the weekly Golden Cross and RSI, point toward the possibility of further growth, with projections suggesting a potential climb to $150K–$250K in this bull cycle. But, a healthy period of consolidation or correction would likely provide a stronger foundation for future price action. In practical terms, by 2025, Bitcoin will have likely achieved what was once deemed nearly impossible—establishing itself as a major player in the global financial system.