GDP Revised Lower, Labor Market Still Tight

Good Morning Everyone!

Wells Fargo (NYSE:WFC) just laid off hundreds of mortgage bankers, including some top producers who brought the bank more than $100 million in loans last year.

Is Wells Fargo making a huge mistake?

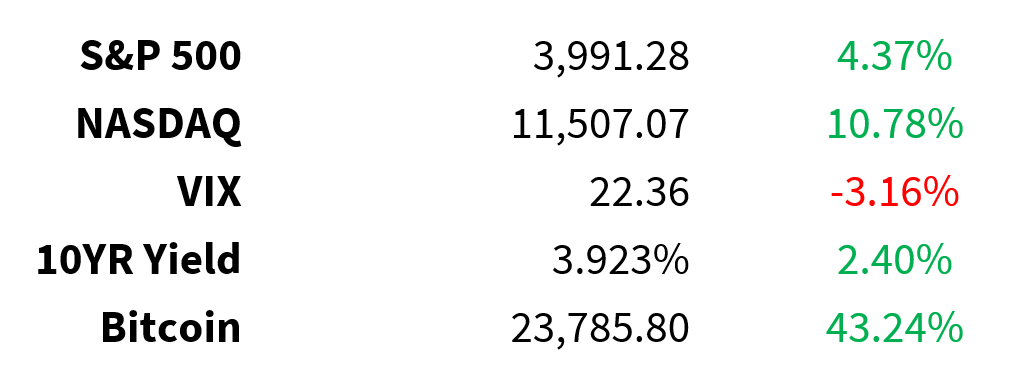

Prices as of 4 pm EST, 2/22/23; % YTD

MARKET UPDATE

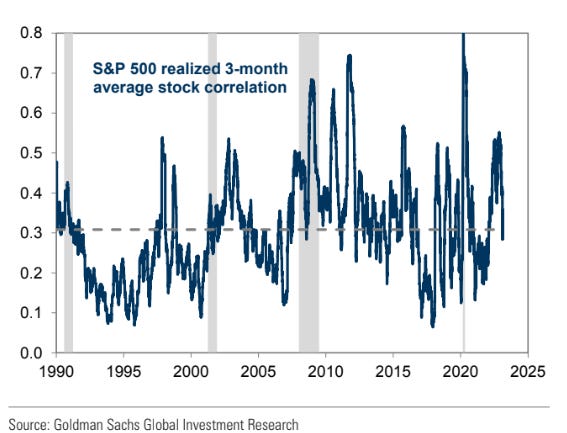

Stock correlations

-

Fading

-

Becoming slightly less macro-driven

-

Good news for stock pickers

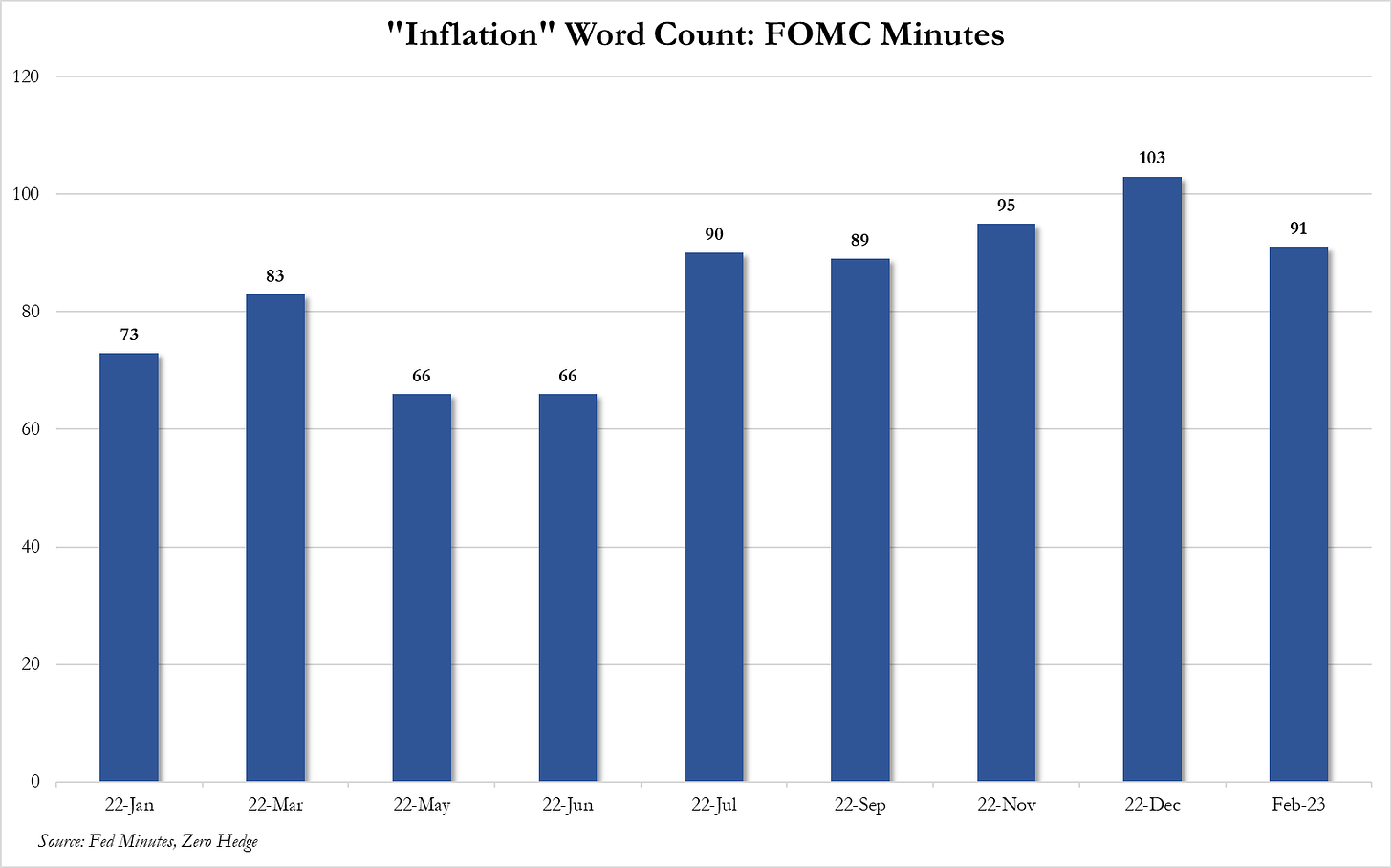

FOMC minutes

-

"Almost all" officials favor 25bps next meeting (Mar 22)

-

"A few" want 50bps

-

Forget about pivot – not willing to give up progress on inflation

-

Market expect peak funds rate ~5.36%

-

Number of mentions of "inflation":

This morning’s data:

-

Labor market

-

Still tight

-

192k initial jobless claims vs. 200k expected (prev. 195k)

-

Continuing claims also lower than expected

-

-

Q4 GDP

-

Revised lower

-

Second estimate 2.7% vs. 2.9% expected

-

-

Core PCE

-

+4.3% vs. 3.9% expected (prev. 4.7%)

-

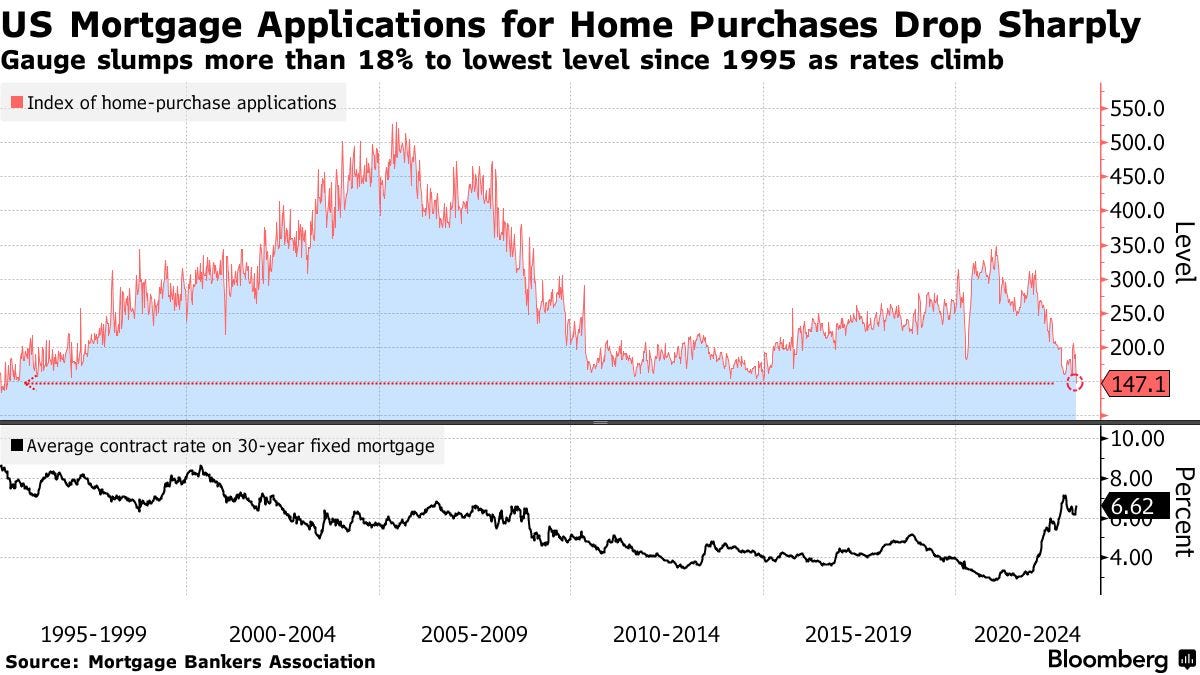

US housing

-

Weak mortgage demand data follows weak sales

-

Purchase index -18% last week (biggest drop since 2015)

-

At lowest level since 1995

-

-

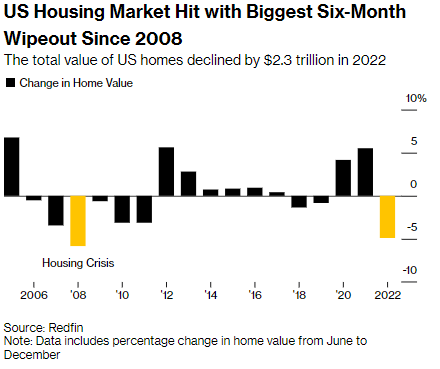

2022: US housing market lost $2.3 trillion in value

-

4.9% drop – biggest since 2008

-

Home prices in Dec 22 still 6.5% higher than Dec 21

-

O&G prices

-

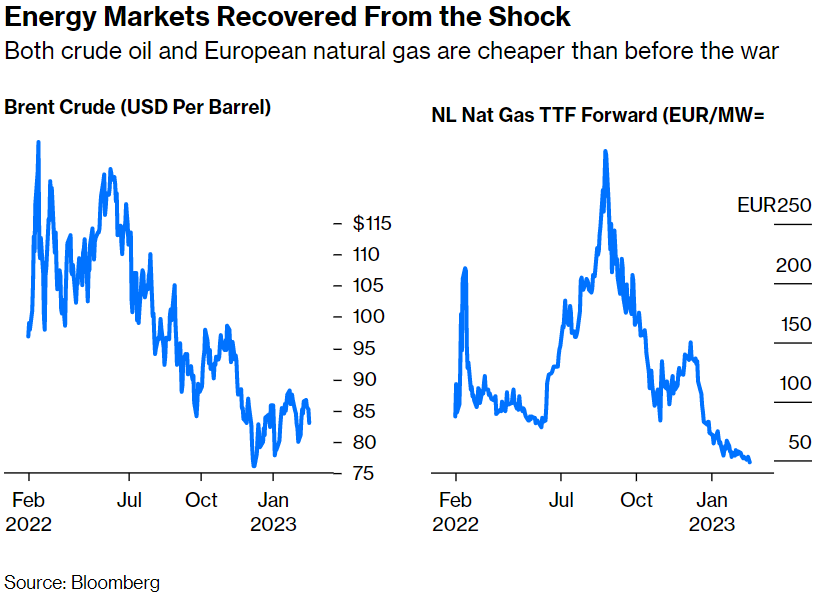

US nat gas has dropped 80% since August

-

Prices at pandemic-era lows

-

-

EU gas prices now lower than before Russia invasion

-

Same with Brent crude:

Nvidia (NASDAQ:NVDA)

-

Beat top and bottom lines

-

Both declined YoY

-

Q1 sales forecast topped estimates ($6.5B vs. $6.3B)

-

Continues to benefit heavily from AI rush

Alibaba (NYSE:BABA)

-

Topped EPS and smashed sales estimates

-

Gross merchandise volume (GMV) decline mid-single-digit YoY

-

Cost controls have paid off: net income +69% YoY

-

Expects strong demand on China reopening

Earnings

-

Alibaba

-

CBRE Group (NYSE:CBRE)

-

Moderna (NASDAQ:MRNA)

-

Cheniere (AMEX:LNG)

-

Lloyds (NYSE:LYG)

-

Vipshop (NYSE:VIPS)

-

PG&E (NYSE:PCG)

-

Genuine Parts (NYSE:GPC)

-

DISH (NASDAQ:DISH)

-

American Electric Power (NASDAQ:AEP)

-

Quanta Services (NYSE:PWR)

-

NetEase (NASDAQ:NTES)

-

Newmont (NYSE:NEM)

-

Wayfair (NYSE:W)

-

Bath & Body Works (NYSE:BBWI)

-

Domino's (NYSE:DPZ)

-

Papa John's (NASDAQ:PZZA)

-

Rent-a-Center (NASDAQ:RCII)

-

Atlas Air (NASDAQ:AAWW)

-

Steve Madden (NASDAQ:SHOO)

-

Yeti (NYSE:YETI)

CRYPTO UPDATE

Silvergate Bank (NYSE:YETI)

-

Wall Street's most shorted stock

-

73.5% of available shares being sold short

-

Trails Carvana (NYSE:CVNA), Applied UV (NASDAQ:AUVI), Bed Bath & Beyond (NASDAQ:BBBY)

-

Down +90% from 2021 peak

Bitcoin (CRYPTO: BTC) whales decline

-

Number of whales (wallets holding >1k BTC) at lowest since August 2019

-

2,027 whales

-

Each whale holds ~$25 million

-

-

Wallets holding +1 BTC still rising (close to 1 million)

-

Number of mega whales (+10k BTC) steady