Is Bitcoin A Safe Hedge Against Inflation?

Image Source: Pexels

The volatile journey of Bitcoin (BTC) began in 2009, and its price fluctuations have been both dramatic and influential in the financial landscape. Yet, its long-term trajectory has been in an uptrend. It pioneered the cryptocurrency boom, although it took some time before the public took notice.

Nonetheless, cryptocurrencies, particularly BTC, have been the most exciting financial instruments over the past decade. It has created millionaires, given its steep rise since it started circulating in the market. Many traders have done fine by holding BTC, as their view remained bullish.

In 2021, the value of a single Bitcoin broke $60,000. And the total market value of the crypto market reached an astounding $2.5 trillion. Before the year ended, BTC set an all-time high of $68,789.

Despite this, it has still been dogged by periods where its price has fallen precipitously. The 2017-2018 boom and crash is a perfect example. The most recent plunge occurred in March 2022 amid concerns about interest rate hikes and lower financial market liquidity.

Given these dynamics, anyone may infer that market sentiments have driven BTC. It’s no surprise speculators have rushed into and left the trading space to take advantage of the anticipated price increase or depreciation.

It has yet to fulfill its promise to create a decentralized financial system, which has captured the world's attention. Its price does not seem to have traction as buyers and sellers push its value upward or downward, depending on the news and speculation.

But amid all these, BTC has remained the leading cryptocurrency. It remains a giant with its $2.02 trillion market capitalization. And now, prices of cryptocurrencies, especially BTC, have rebounded after over a year of lethargy.

It may be an excellent opportunity to trade as it keeps appreciating despite recession woes. Hence, it is important to know whether or not investors may use Bitcoin as a solid hedge against inflation.

Arguments Against Bitcoin as an Inflation Hedge

Bitcoin has been circulating in the market for more than a decade. Today, many investors treat it as an investment to hedge inflation. Yet, many people remain skeptical about its legality, security, and, most significantly, volatility. These are some arguments for why Bitcoin is not a good hedge against inflation.

Strong inverse correlation with inflation in the medium run

Over the years, cryptocurrencies, especially Bitcoin, have always been associated with risks driven by their volatility. Technical analysis techniques, such as Simple Moving Average (SMA) and Average True Range (ATR), are also applicable to track and predict price direction and volatility.

However, market sentiments remain its primary driving force affecting the buy and sell volume. Hence, traders have been more cautious since tracking its price can take more time and effort than stocks.

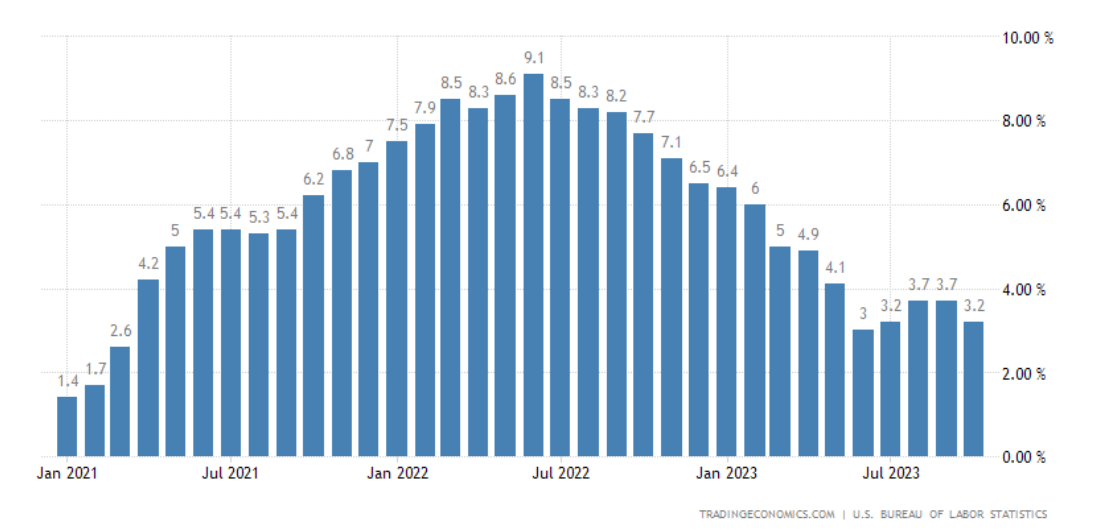

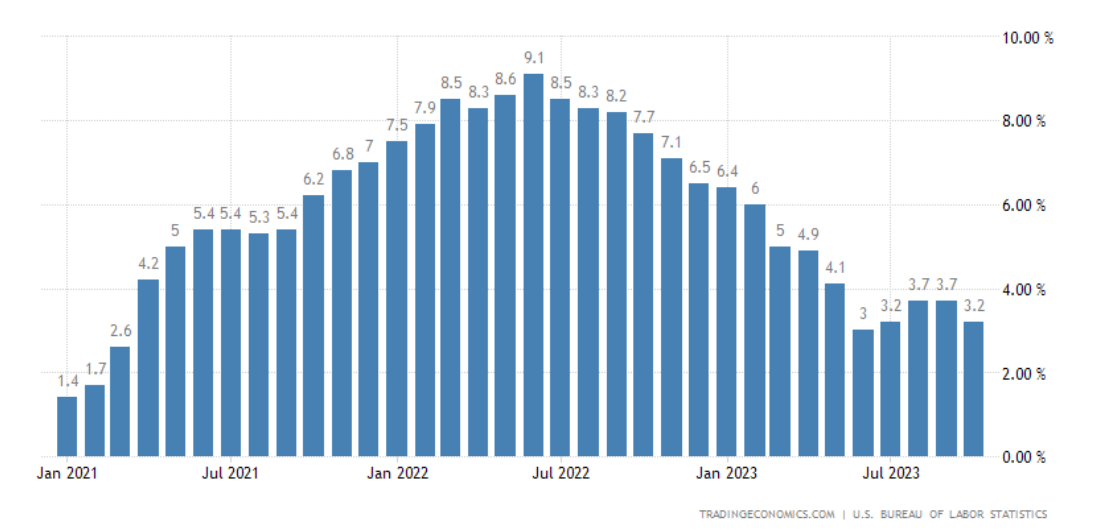

Even more noticeable is its high negative correlation with inflation for more than a year. In 2021, the price of a single Bitcoin peaked and set a new all-time high. But as inflation rose in 1Q22, BTC started to drop.

In 2Q22, inflation accelerated and reached 9.1%. In turn, its price took a nosedive to $17,000 in June. This made the slight rebound from $35,000 in January to $46,000 in March a bear trap. It was also when the US inflation peaked.

For the following months, BTC stayed in a similar range. It showed a slight rebound, though, which could be attributed to the gradual decrease in inflation.

In the first half of 2023, inflation decelerated to 3%. Meanwhile, BTC increased faster from $20,000 to $30,000. BTC indicated another slowdown from July to mid-October as inflation rose to 3.2-3.7%. Indeed, their strong relationship was evident for more than a year.

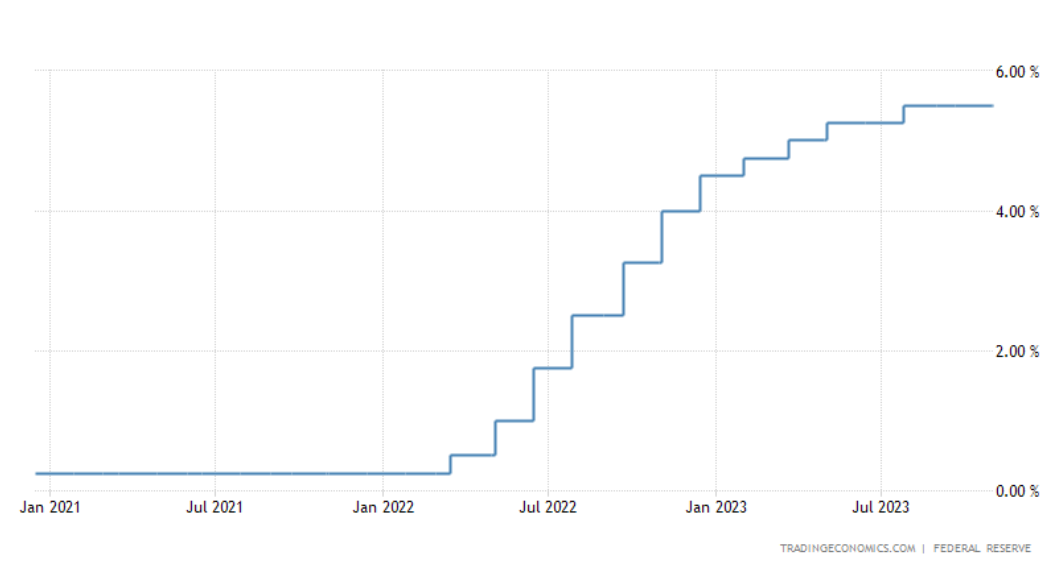

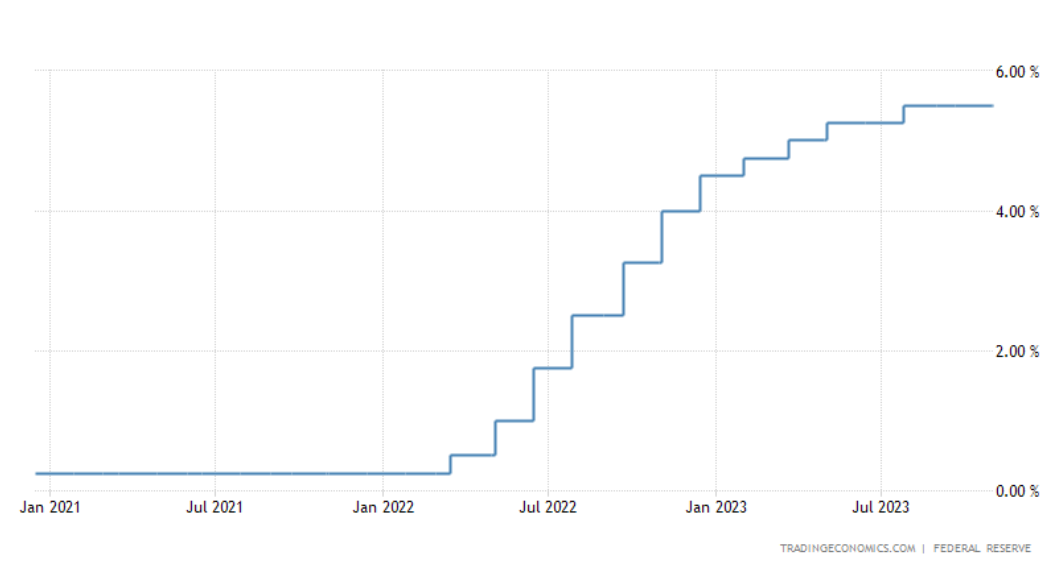

It is common knowledge that the impact of inflation is within the short run, but Bitcoin showed a different response. We also tie BTC to interest rates. Yet, it appeared more reactive to inflation than interest rates. It’s understandable, though, since the Fed pegs interest rate changes on inflation. In the images below, we can see how Bitcoin varied with inflation and interest rate hikes.

Image Source: MarketWatch

Image Source: Trading Economics

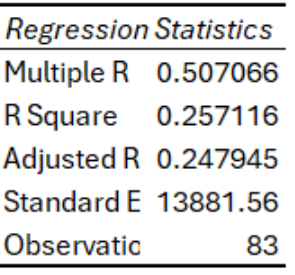

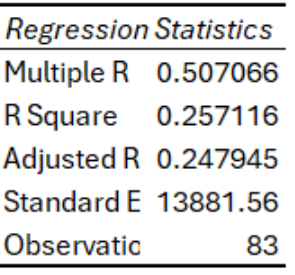

To better measure it, here’s an actual statistical analysis with 52 observations with inflation as “X” and BTC as “Y. This covered 2018-2023 data. We could have only covered 2021-2023, which would have resulted in unwanted biases.

For better precision, we must cover at least 50 time series. The results confirmed our observation in the graph, given the negative correlation of 74%. Meanwhile, the p-value of 0.008 is less than the maximum of 0.05, so our hypothesis is significant.

To further lessen the bias, we increased the number of observations to 83 and covered the 2017 data. While it decreased to 51%, the negative correlation remains moderately strong. Hence, inflation has a moderately strong impact on BTC.

Image from author

Bitcoin took a beating when the Fed implemented interest rate hikes

Bitcoin and interest rates have a strong correlation with inflation. Yet, interest rates further affected BTC prices. It was most visible amid the series of interest rate hikes. You may be wondering why BTC decreased further from July to December despite the gradual decrease in inflation. This may be the answer you need.

The Fed implemented interest rate hikes to combat inflation. It proved effective as it lowered inflation in the succeeding months. However, discouraging lending and investment also reduced liquidity in the financial market.

Also, interest rate hikes were massive in the second half of 2022. As such, the price of Bitcoin fell further. But as inflation decelerated, the Fed decided to ease rate hikes. In turn, BTC increased again.

Additionally, interest rates were flat at near-zero levels in 2020-2021 to counter the pandemic recession. Interest rates appeared to be the primary growth driver of BTC as the price skyrocketed in those years.

Image Source: Trading Economics

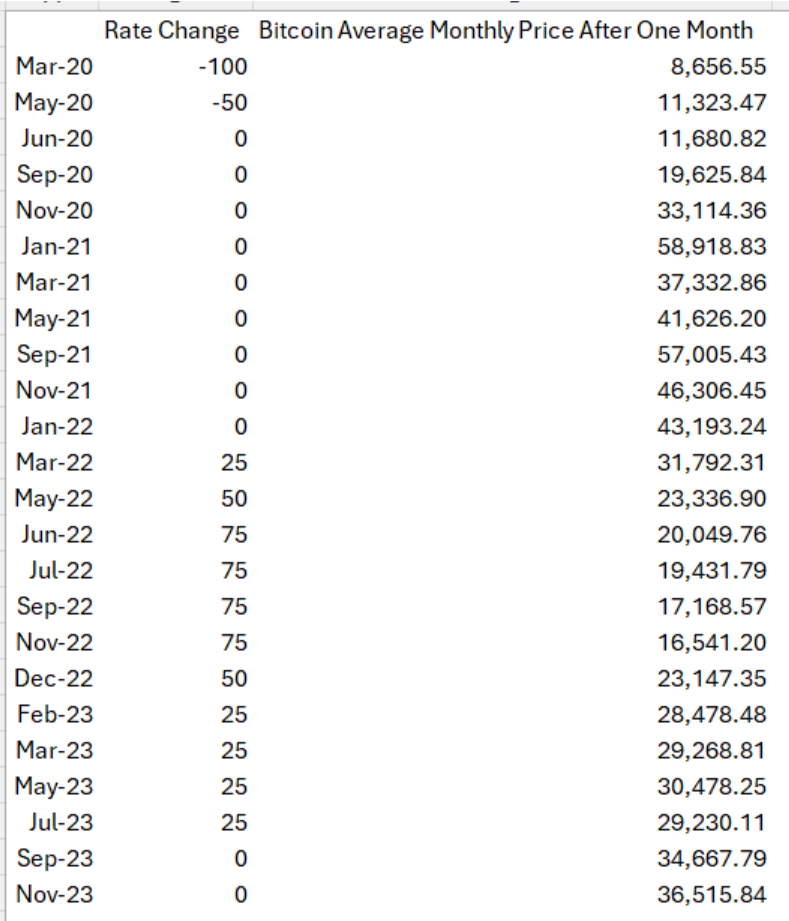

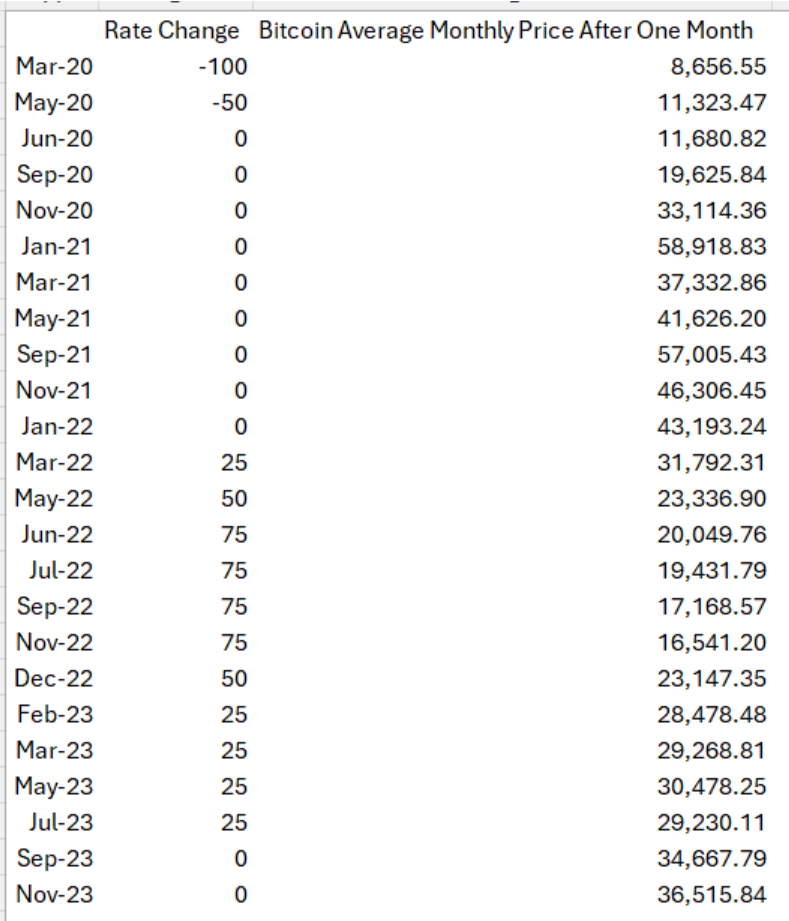

We did not make a statistical analysis using BTC and interest rates since the latter is already very strongly correlated with inflation. Doing so will just cause multicollinearity or redundancy. Nonetheless, we can track the exact change in Bitcoin during the Fed’s meeting. We will focus on the past three years due to extreme volatility.

After its price crashed amid the pandemic, BTC rebounded as the Fed intervened to stabilize the economy. For instance, it bought massive debt securities for quantitative easing, setting a cantillon effect in motion.

Its move increased the money supply and encouraged borrowing while keeping interest rates near zero. Its trend was similar to the stock market.

And as the Fed kept rates unchanged for over a year, BTC enjoyed sustained price appreciation. But it reached its limit in November due to various factors, including inflation.

In January, BTC prices plummeted as the geopolitical tension in Kazakhstan threatened Bitcoin mining. The plunge sped up in the following months as the Fed hiked rates by 100 basis points for four consecutive meetings.

But when the interest rate increment started to ease in December, BTC also rebounded. Its relationship with interest rate hikes remains evident as it increases while the latter decelerates.

Image from author

Still new and doesn’t act like a commodity or a currency

Bitcoin is still considered a new type of asset. Also, it has yet to function as a commodity like precious metals or a currency.

While El Salvador made it a legal tender, most countries have yet to consider using it as one. Some countries also accept Bitcoin and Ethereum payments at government agencies and private institutions.

For instance, individuals use Bitcoins to pay off student debt. However, it is essential to note that certain risks are associated with it, so it would still be prudent to consider the traditional route to refinance student loans.

Still, its use is limited as many large enterprises remain adamant about using it as a mode of payment. Hence, Bitcoin only acts as an investment or asset type.

BTC also appears tricky, knowing that it’s expected to act like a currency. Yet, BTC and other cryptocurrencies are taxed like properties. It doesn’t seem to have a pure definition.

Additionally, BTC has only been around for over a decade. Note that it was released during the Great Recession. The world took a few years to recover. And since 2020, the global economy has been on steep crests and troughs. Once its volatility smooths out, we can better observe how it moves with macroeconomic indicators.

Points To Support Using Bitcoin To Hedge Inflation

There may be tons of criticisms surrounding the crypto market. But one thing is evident- it continues to expand and reach more individuals. With BTC’s popularity, true believers view it as an effective inflation hedge. These are why Bitcoin can be a wise choice to become an inflation hedge.

Bitcoin appreciation in the long run

Bitcoin entered the market when the global economy was at the bottom. Yet, the Great Recession did not stop it from achieving its goal of decentralizing the financial system. It has multiplied over the past decade, and its value soared.

Bitcoin may be tied to inflationary headwinds in the medium run. Even so, its long-run value shows high appreciation in value. It may be very volatile, but rewards in the long run have also been very high. We can compare it to the S&P 500 (SPX) and NASDAQ (IXIC).

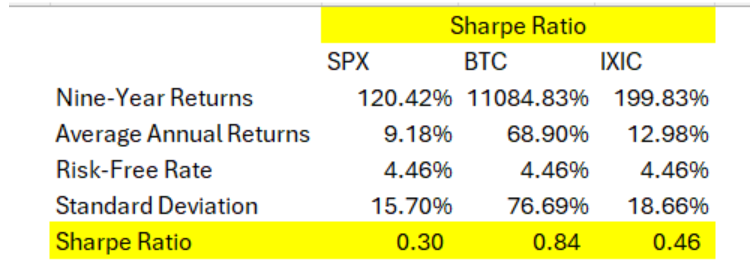

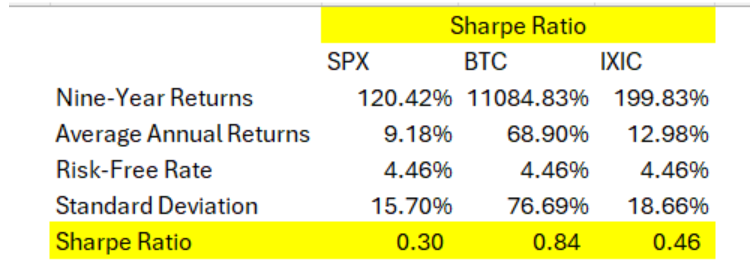

The table below shows the nine-year price returns at 11,084%, about 100x the returns of SPX and IXIC. Its average annual returns were also high at 68.90%. This figure shows that the value of BTC has increased despite the bubble bursts it has experienced.

Meanwhile, it had the highest volatility, as shown by the Standard Deviation. It exhibited approximately four times the volatility seen in the S&P 500 and NASDAQ composite. But if we weigh the risks and rewards using the Sharpe Ratio, BTC appears to be the optimal asset.

Image from author

Inflation hedge as a flawed idea

Moreover, the data shows that the value of these investments, mainly Bitcoin, rose over time. It has even surpassed the price increase by more than a thousand times. This rise is why many individuals became millionaires by holding BTC in IRA accounts.

Also, the traditional definition of inflation hedge has been flawed, especially for Bitcoin. Again, market sentiment remains the key driver of BTC despite its strong correlation with inflation.

The unpredictability of market sentiment, speculative mania, and unethical practices may lead to massive price swings for no apparent reason. Take the 2017-2018 bubble burst as an example. Combining the three factors led to skyrocketing prices before the steep crash.

Even gold, widely regarded as the best inflation hedge, has a spotty history when talking about inflation. Inflation reached 6.5% in the early 1980s, which led to a 10% annual loss for gold owners. A recent example was in 2022, when the price of gold only increased by 2.5% when inflation was nearly four times.

Limited Supply

Over 20 million Bitcoins are circulating in the market. However, the actual supply remains limited as more traders enter the market. Since its number remains fixed, new Bitcoins cannot enter the market.

Limited Bitcoin supply in the market can lead to higher prices. Because market forces still drive it, its price may rise in the long run.

Also, the money supply will decrease if more people use Bitcoins for businesses accepting crypto payments. This may also temper inflation as the increased demand for Bitcoin may lessen the demand for dollars. The lower amount of dollars in circulation may lower inflation and, in turn, reduce the possibility of another interest rate hike. As such, holding Bitcoin can beat the Cantillon effect.

Given the potential inflationary drivers, we also note that the Fed keeps its hawkish stance on policy tightening. These may include the holiday spending splurge this quarter, the low OPEC oil supply pushing oil prices upward, and the ongoing wars, which may further tighten oil supply.

Key Takeaway

Criticisms and controversies have always surrounded Bitcoin, but nothing can stop it from expanding. Over the years, its value has dramatically increased, attracting more investors and enterprises.

It has yet to fulfill its promise to become a currency or an inflation hedge like precious metals, which continues to spark debates. But its potential is not disregarded as the digital revolution provides opportunities for the cryptocurrency market.

This post was authored by an external contributor and does not represent Benzinga's opinions and has not been edited for content. The information contained above is provided for informational and educational purposes only, and nothing contained herein should be construed as investment advice. Benzinga does not make any recommendation to buy or sell any security or any representation about the financial condition of any company.