Jack Dorsey’s Block Shares Rally As Piper Sandler Initiates Coverage With ‘Overweight’ Rating: Here’s What Other Analysts Are Saying

Shares of Block Inc. (NYSE:SQ), led by Jack Dorsey, closed up 4.62% on Tuesday, gaining over 16% in the past five days as Piper Sandler‘s Managing Director and Senior Research Analyst Arvind Ramnani initiated coverage with an “overweight” rating and set a price target of $83 per share.

Block shares on Tuesday outperformed their benchmark indices, as the NYSE Composite closed 0.81% lower and the Russell 2000 dropped 1.77% on the same day.

What Happened: Ramnani’s investor note highlights Block’s skill in launching new ventures, including its cryptocurrency business, and penetrating large fintech markets, TipRanks reported. The analyst estimates a $130 billion total addressable market for Block’s Square payments business and a $75 billion market for its Cash App payment app.

Why It Matters: The coverage was initiated after Block reported its third-quarter financials last week after Thursday’s market close. The results were mixed with an EPS beat but a miss on revenues, however, Dorsey’s commentary was positive.

Jack Dorsey stated that Block’s Bitcoin-centric strategy was driven by the desire to establish a native currency for the Internet, which would accelerate their business. Apart from the “Cash App” digital wallet service, the co-founder expressed confidence in Bitcoin’s ability to boost its mining chip offerings.

“If we have a native currency for the Internet, it means we can move money much faster, and we can offer Cash App products and Square products in every single market instead of the market-by-market push that we have to do today,” Dorsey emphasized.

Price Action: The shares of Block Inc (NYSE:SQ) were down 1.57% in trade during pre-market hours on Wednesday as per Benzinga Pro data. The relative strength index at 55.59 shows that the stock is neither overbought or oversold.

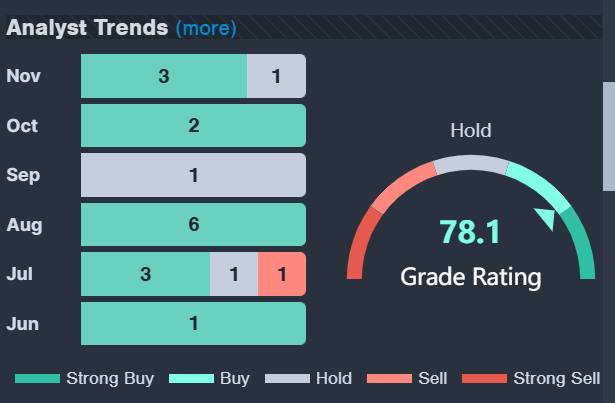

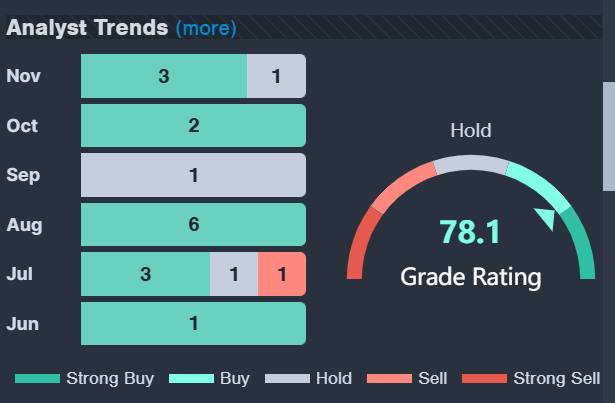

The consensus estimates of all the analysts tracking the stock, as per Benzinga Pro, is a “buy”. Following are a few analysts’ views covered by Benzinga.com.

- Needham analyst Mayank Tandon maintained a Buy rating while raising the price target from $80 to $90.

- JPMorgan analyst Tien-tsin Huang reiterated an Overweight rating and price target of $90.

- Stephens analyst Charles Nabhan reaffirmed an Overweight rating and price target of $90.

- Oppenheimer analyst Rayna Kumar maintained a Perform rating on the stock.

Photo by Frederic Legrand – COMEO on Shutterstock