JPMorgan Says Household Excess Savings Gone By October

Warren Buffett has donated another $4.64 billion of Berkshire Hathaway stock to five charities. This boosts his total giving since 2006 to more than $51 billion.

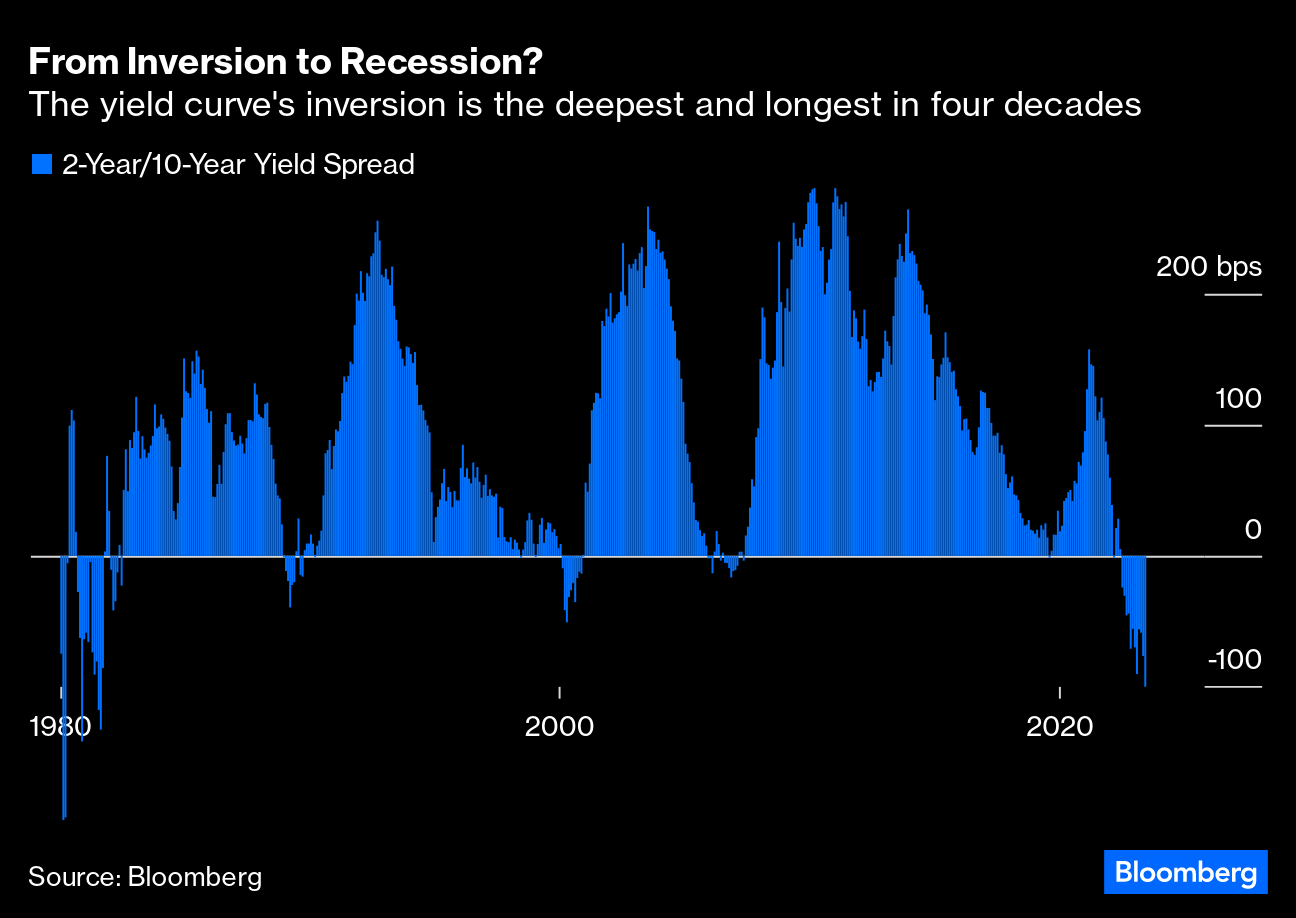

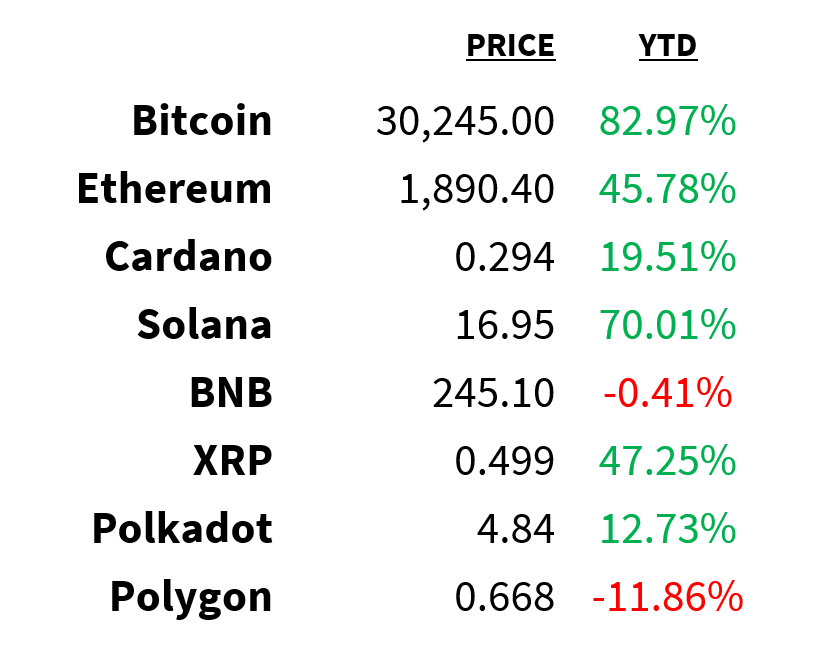

Market

Prices as of 4 pm EST, 6/22/23

Macro

New filings for unemployment benefits are hovering at the highest level since October 2021.

-

Initial jobless claims totaled 264,000 last week.

-

The figure was unchanged from the previous print but above market expectations of 260,000.

-

This points to a cooling labor market.

-

Continuing claims, on the other hand, dropped to 1.76 million from 1.77 million and suggest a tight market where laid-off workers are quickly finding new jobs.

Sales of existing US homes were flat in May, rising 0.2% from the previous month.

-

On an annual basis, sales posted their 21st consecutive decline, falling by over 20%.

-

The drop comes despite mortgage rates falling (slightly) for the 3rd consecutive week to 6.67%.

-

Median prices, meanwhile, experienced their largest annual drop since December 2011, falling by 3.1% in May to $396,100.

Even after May’s big drop, the median household would need to spend more than 40% of their income to afford today’s median-priced home.

-

Three years ago, that figure was just 28%.

-

Since the beginning of last year, the monthly mortgage payment for the average loan size has roughly doubled to nearly $3,000.

-

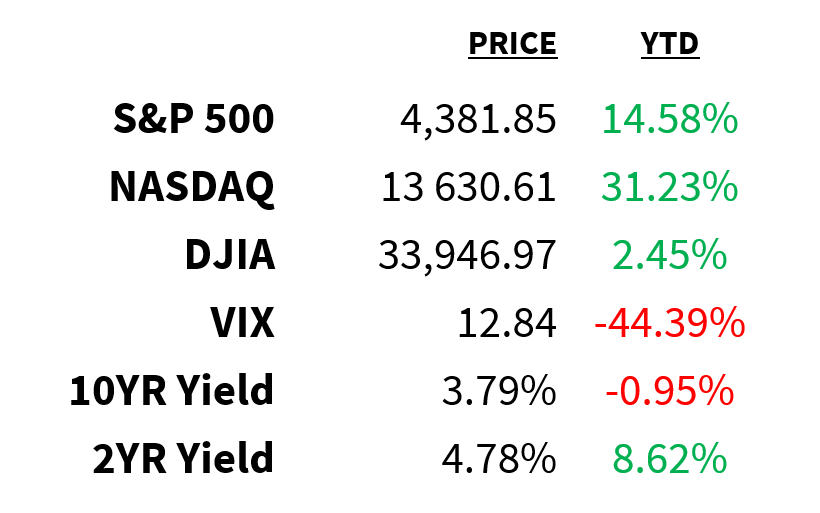

As households run down their excess savings, these payments will take a higher toll on the consumer and the housing market.

-

According to JPMorgan, those savings are likely to be drained before the end of the year:

JPMorgan

Stocks

The quality of new vehicles is getting worse, according to J.D. Power.

-

The firm’s latest Initial Quality Study revealed the number of problems per 100 vehicles increased by 12 to an average of 192.

-

Last year, the number of problems increased by 18.

-

Growing problems include advanced driver-assistance features as well as those related to other technologies like wireless charging pads.

-

EVs accounted for 7 of the top 10 worst autos, with Tesla ranking second-worst in vehicle quality.

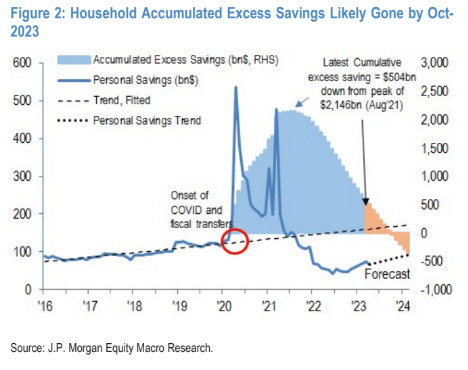

The stock market is saying one thing while the bond market is saying another.

-

The recent rally in equities suggests investors are brushing off the possibility of further rate increases, even as the Fed signals a higher-for-longer environment.

-

Bond investors, meanwhile, are increasingly betting that the Fed’s rate increases will drive the US into a recession with the inversion on the yield curve dropping beyond 100bps for the first time since March.

-

Both can’t be right.

John Authers

Energy

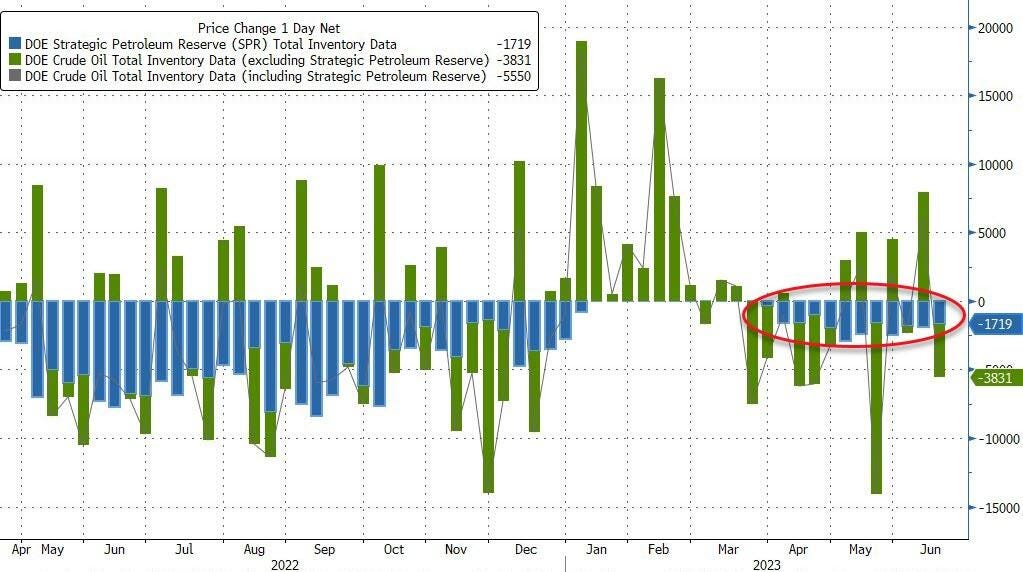

US inventories of crude oil posted a surprise draw last week.

-

The drop in stocks was fueled by strong export demand and lower imports.

-

Together with a 1.7 million drain of the Strategic Petroleum Reserves (the 12th straight draw), overall crude inventories fell by the most in 4 weeks.

-

Oil prices fell, however, with the threat of hawkish central banks outweighing the drop in inventories.

Bloomberg/Zero Hedge

Earnings

Yesterday’s highlights:

Darden Restaurants (NYSE:DRI): $2.58 EPS (vs. 2.54 expected), $2.77 billion in sales (in-line).

-

Net sales rose 6.4% YoY but were dragged down by lower-than-expected same-store sales for Olive Garden.

-

Forecasted for adjusted earnings for FY24 disappointed.

What we’re watching today:

-

Carmax (NYSE:KMX)

Top Headlines

-

Office space: Office building values in the US are expected to fall by 35% and are unlikely to recover to their peak values until at least 2040.

-

AI regulation: Current AI models are at risk of violating draft EU rules to govern the technology.

-

AI investment: Amazon Web Services is investing $100 million in a generative AI center to keep up with Microsoft and Google.

-

AI jobs: Generative AI-based job postings in the US rose by 20% in May.

-

Record loan: Ford’s joint venture with Soth Korean battery maker SK On has secured a record $9.2 billion loan from the Department of Energy.

-

TikTok resignation: The social media platform’s COO of 5 years is stepping down to focus on “entrepreneurial passions”.

-

Global trade shift: For the first time in almost 20 years, the US imported more goods from South Korea than China did.

-

Recession risk: US Treasury Secretary Janet Yellen said yesterday she sees diminishing risk of a US recession.

Crypto

Prices as of 4 pm EST, 6/22/23

-

Super-app: Coinbase CEO Brian Armstrong said he envisions the platform becoming a global “super-app”.

-

Deliberate action: Former CFTC Chair Chris Giancarlo said the agency’s move against Coinbase appears to have been “deliberate”.

-

Clawback: FTX is looking to claw back over $700 million from billionaires, celebrities, and politicians.

-

Relinquished: The SEC is postponing collection of a $30 million fine from BlockFi until investors are repaid.

-

Ethereum milestone: The number of staked ETH has more than doubled this year and now totals over $38 billion.

Deals

-

Retail auction: Overstock.com will buy Bed Bath & Beyond’s IP and digital assets for $21.5 million.

-

Smart home: Despite getting the green light from regulators in the UK, Amazon’s $1.6 billion iRobot deal is headed for an EU probe.

-

Gaming: In a court hearing, Microsoft portrayed Sony as the “complainer-in-chief” against its Activision acquisition.

-

Aviation: Bell helicopter and Cessna jet manufacturer Textron is looking to sell its +$1 billion fuel systems unit.

-

Media auction: Fortress Investment Group emerged as the winner for Vice Media with a $350 million bid.