Mr. Powell Goes To Washington

The S&P earnings yield, corporate bonds and treasury bills are all offering the same yield of 5.3%.

So a medium risk, low risk and no risk asset is offering the exact same yield…

What a time to be alive!

Market

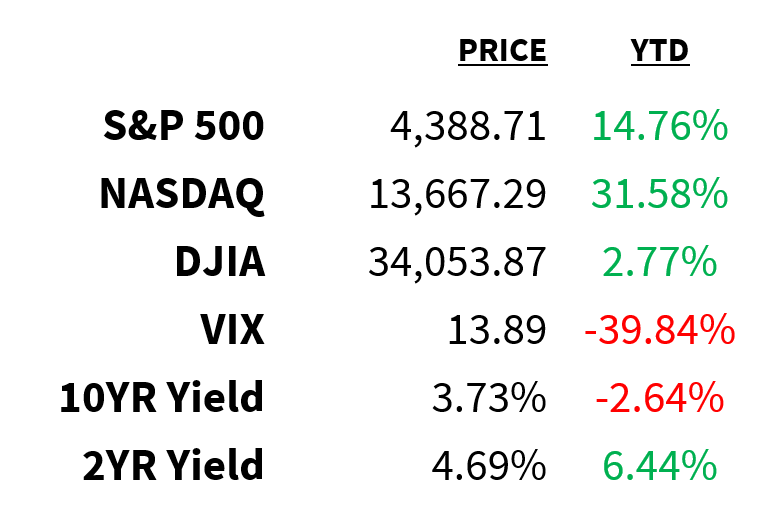

Prices as of 4 pm EST, 6/20/23

Macro

Fed Chair Jerome Powell heads to Capitol Hill this morning for his semi-annual report on monetary policy and the economy.

-

He’ll spend the next 2 days giving his testimony to the House Financial Services Committee.

-

On the one hand, he’ll need to convince Republicans the central bank is steadfast in its mission to bring down inflation via tight monetary policy

-

On the other, he’ll need to assure Democrats the economy is resilient enough to handle said monetary policy.

Student loan repayments are set to resume in October.

-

The announcement from the Department of Education comes after a 3-year pause on payments.

-

Still unknown are the amounts borrowers will owe.

-

That will be answered this month once the Supreme Court decides on the validity of President Biden’s plan to cancel up to $20k in student debt for borrowers.

-

According to Barclays, the restart of payments could lead to a monthly decrease of $15.8 billion in household spending (or $190 billion per year).

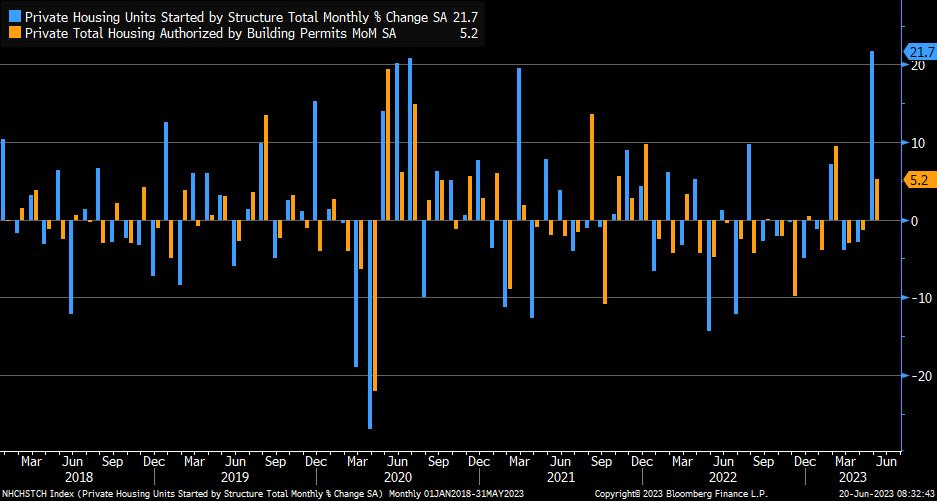

Last week, Powell noted the housing market was showing signs of stabilizing, and new homebuilder data this week confirms that message.

-

Construction of new homes (blue) in the US jumped 21.7% in May—the largest monthly increase since October 2016—and is now at its highest level since April 2022.

-

Applications to build (orange) also jumped to the highest since October 2022, rising 5.2% in May.

-

Meanwhile, homebuilder confidence is at its strongest since July 2022 thanks to strong demand and a lack of existing inventory.

@lizannsonders

Stocks

A handful of Wall Street giants—including Fidelity, Charles Schwab, Citadel, Virtu, and Sequoia—are wading deeper into crypto.

-

After 9 months of building, the group has launched its new cryptocurrency exchange, EDX Markets.

-

Unlike other crypto platforms, EDX will limit its role to that of exchange only.

-

That means it won’t take on custodian or broker duties–a distinction that sets it apart from firms like Binance and Coinbase.

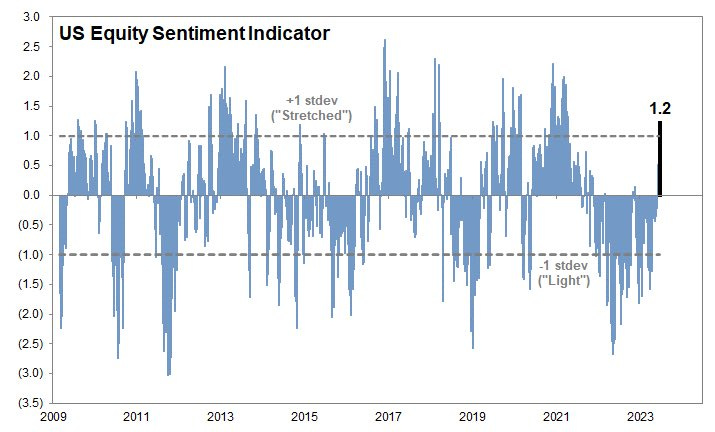

FOMO is alive and well among investors across US equities markets.

-

Last week, call option volume for both the S&P 500 and Russell 2000 hit new record highs.

-

Skew tied to those S&P 500 options is at its lowest (most bullish) levels since at least 2019.

-

Aggregate equity positioning is moving deeper into overweight territory as both discretionary and systematic strategies increase exposure.

But does that FOMO warrant caution?

-

Risk appetite for stocks is at its highest since 2021.

-

Net positioning in the S&P, according to Citi, is at its “most extended ever”.

-

According to Goldman Sachs’ Equity Sentiment Indicator, positioning is at its most stretched since April 2021.

Goldman Sachs

Energy

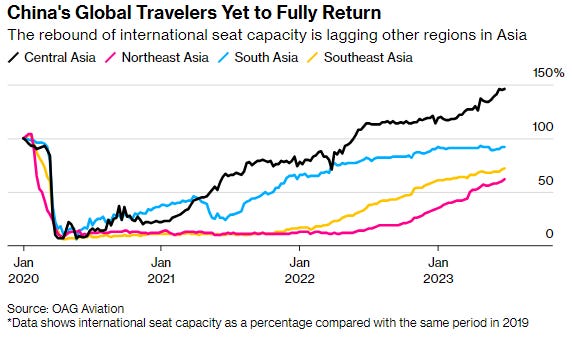

Revenge travel ain’t what it used to be.

-

With more efficient planes, China’s slower-than-expected recovery, and pilot shortages in the EU, jet fuel use is still lagging pre-pandemic levels.

-

In 2023, airlines are expected to use 700k barrels per day less than they did in 2019.

-

In fact, global jet demand is expected to remain weak relative to 2019 until 2024.

Earnings

Yesterday’s highlights:

FedEx (NYSE:FDX): $4.94 EPS (vs. $4.85 expected), $21.9 billion (vs. $22.55B expected).

-

Revenue fell for the 3rd straight quarter and missed expectations for the 5th consecutive quarter

-

Express daily package volumes and average daily freight pounds shipped dropped 10% and 14% YoY, respectively.

-

Guidance for FY24 paints an improving picture but fell short of expectations.

What we’re watching today:

-

KB Home (NYSE:KBH)

-

Patterson Companies (NYSE:PDCO)

-

Winnebago Industries (NYSE:WGO)

-

Enerpac Tool Group (NYSE:EPAC)

-

Avid Bioservices (NASDAQ:CDMO)

Top Headlines

-

UK inflation: The BOE is under pressure as inflation in the UK came in hotter than expected in May with prices rising 8.7% YoY.

-

Corporate borrowing: The slowdown in the market for junk-rated loans is forcing companies to pay higher rates or abandon borrowing altogether.

-

Ad-tech monopolization: News publisher Gannett has sued Google for monopolization of ad-tech markets and deceptive commercial practices.

-

Worker safety: Bernie Sanders is leading a Senate probe into dangerous and illegal work conditions at Amazon warehouses.

-

NACS: Rivian will join Ford and GM in adopting Tesla’s EV charging standard.

-

Bonus suit: Twitter employees have filed a lawsuit against the company alleging that promised 2022 bonuses were never paid out.

-

Hedging failure: Private equity firms that failed to hedge against rising interest rates are facing significant losses and potential defaults.

-

Hunter Biden: Hunter Biden will likely avoid prison time after pleading guilty to misdemeanor tax charges and striking a deal on a felony gun charge.

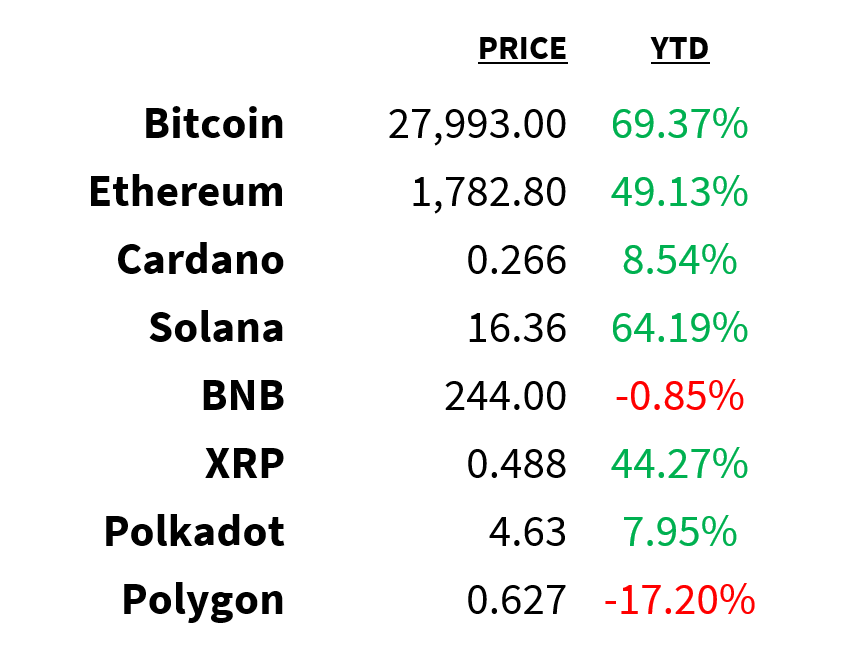

Crypto

Prices as of 4 pm EST, 6/20/23

-

USDT: Tether (CRYPTO: USDT) is launching its USDT stablecoin on the Kava blockchain, furthering its multi-chain presence.

-

Crackdown targets: Berenberg Bank thinks stablecoins and DeFi will be the next targets of the SEC’s crackdown on crypto.

-

Flash pump: Traders on Binance.US saw the price of Bitcoin (CRYPTO: BTC) reach over $138,000 in a “flash pump”.

-

Surveillance sharing: Here’s what sets BlackRock’s proposed spot Bitcoin ETF apart from others like Bitwise’s.

-

New ETF filings: WisdomTree and Invesco have followed BlackRock’s lead and submitted new filings for spot Bitcoin ETFs in the US.

Deals

-

Biopharma: Eli Lilly will acquire Dice Therapeutics for $2.4 billion to expand its portfolio of treatments for autoimmune diseases.

-

Shale M&A: Earthstone Energy plans to acquire Novo Oil & Gas in a $1.5 billion deal.

-

AI mining: AI-powered mining startup KoBold Metals has reached unicorn status after a $200 million funding round.

-

Separate sale: Bed Bath & Beyond is planning a separate auction for its Buy Buy Baby assets.

-

M&A blitz: Middle Eastern state firms are aggressively seeking global acquisitions totaling close to $20 billion.