Powell: ‘More Hikes Are Coming’, Market: ‘No They’re Not’

FED hiking rates will cause more losses on bank balance sheets. Unrealized losses are $620 billion, up from $8 billion a year ago. Yellen said the FDIC will NOT guarantee ALL deposits.

Meanwhile, equity and bond holders of regional banks can get wiped out overnight if there’s a bank run.

We had 5 banks fail in 10 days.

This doesn’t end well.

Market

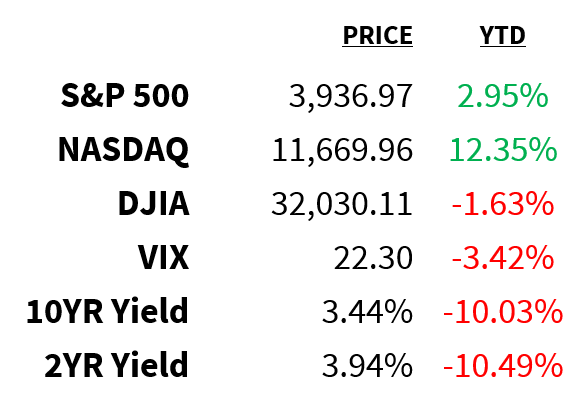

Prices as of 4 pm EST, 3/22/23

Macro

-

Fed officials voted unanimously to increase interest rates by 25bps for the ninth consecutive hike, pushing the federal funds rate to its highest since September 2007. On top of Fed Day volatility, traders also had to deal with contradictory messages from Powell and Yellen regarding the safety of bank deposits.

-

By the bond market’s interpretation, both a recession and rate cuts are certain this year. A deep inversion of Powell’s preferred recession indicator signals a weaker economy ahead as well as an increased likelihood the Fed will cut rates.

-

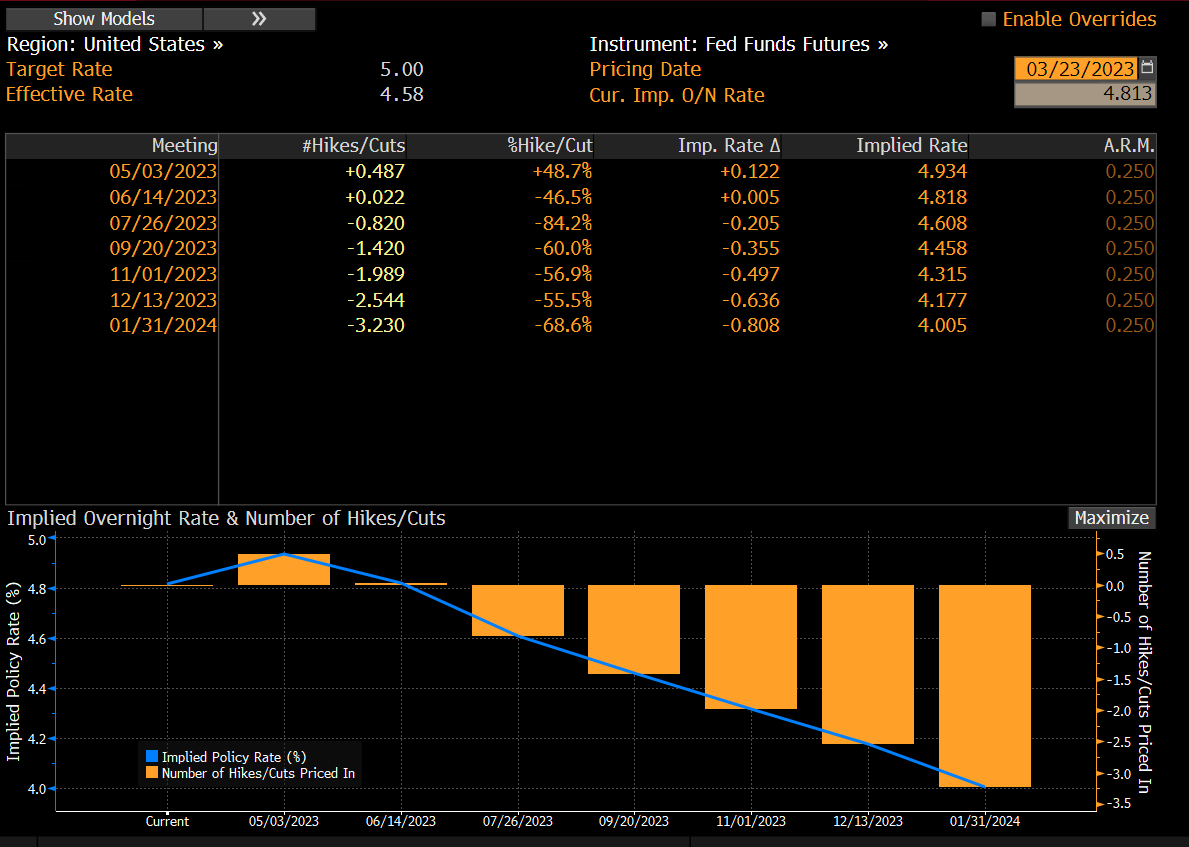

Meanwhile, despite Powell suggesting further tightening, traders now see a roughly 50% chance officials won’t raise rates again. By the end of the year, they anticipate the federal funds rate will drop below 4.2% after hitting a peak of just under 5% in May:

Stocks

-

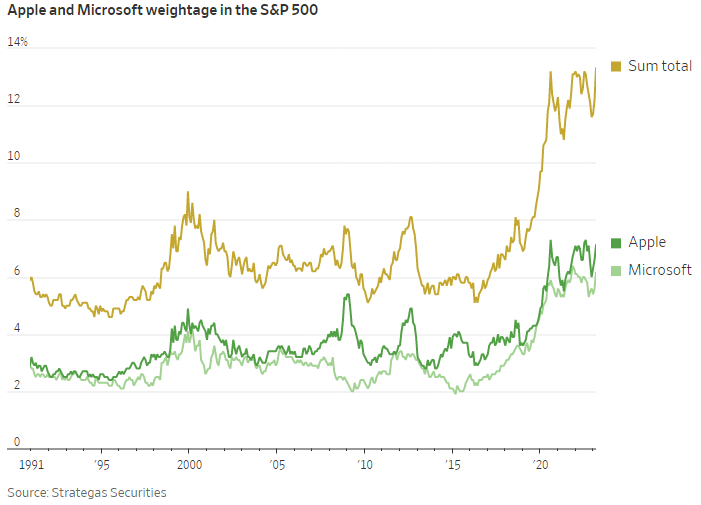

Is FAANG dead? While Alphabet, Amazon, Meta, and Netflix have lost their luster, investors have sought shelter in Apple (NASDAQ:AAPL) and Microsoft (NASDAQ:MSFT). The combined weighting of the two companies in the S&P 500 has risen to an all-time high of 13.3%:

-

Speaking of big tech, shares of Nvidia (NASDAQ:NVDA) are on a roll. The chipmaker has ridden the AI wave to a 15.3% gain over the last 8 sessions. It’s the longest string of positive gains since 2020 and the best 8-day streak since 2007.

-

Boeing (NYSE:BA) beat out rival Airbus with an agreement to sell 21 of its 737 Max aircraft to Japan Airlines. At a hefty price tag of $51.3 million per jet, the order is worth over $1 billion.

-

Moderna (NASDAQ:MRNA) is facing blowback from lawmakers after announcing plans to sell its Covid vaccine at around $130 per dose. The price tag is significantly higher than the $15 and $26 the US government paid per dose last year.

Energy

-

Crude oil prices rose yesterday after the EIA reported a weekly build in inventories of 1.1 million barrels last week, including a major draw in fuel inventories. Current levels of crude oil stocks in the US sit roughly 8% above the 5-year average for this time of year.

-

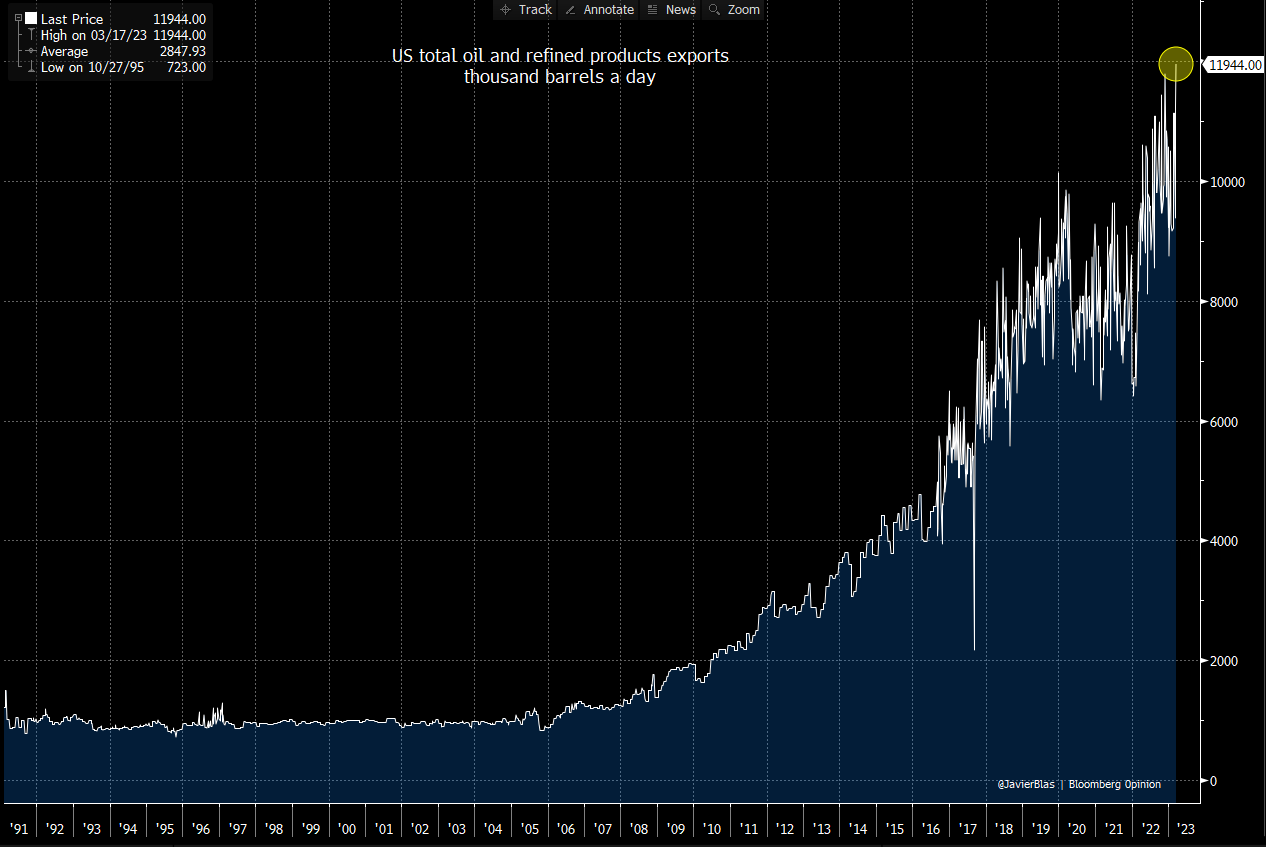

Meanwhile, US total petroleum exports of crude oil and refined products surged to 12 million barrels per day last week. That was good for a new all-time high:

Earnings

-

Accenture (NYSE:ACN)

-

General Mills (NYSE:GIS)

-

Darden Restaurants (NYSE:DRI)

-

Factset Research (NYSE:FDS)

News

-

Twitter: Despite carrying more than $13 billion in debt, Elon Musk sees Twitter becoming cash-flow positive in the coming months.

-

Deposits: Bill Ackman is predicting deposit outflows from banks will accelerate after comments from Janet Yellen yesterday failed to project confidence in the system.

-

Irony: Indeed—a job-search platform—will reduce its employee headcount by 15% (or 2,200 jobs).

-

CRE: US banks are increasingly concerned about the risks posed by the $5.6 trillion commercial real estate loan market.

-

Airlines: In December, just over 69% of domestic flights in the US departed on time which is below the typical 75-80% range.

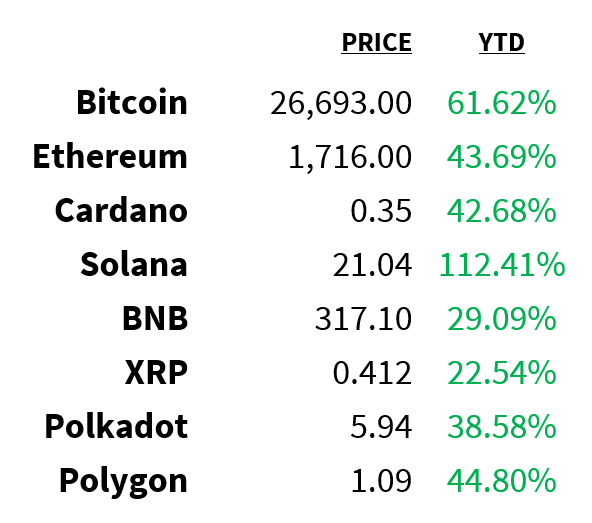

Crypto

Prices as of 4 pm EST, 3/22/23

-

Wells notice: Coinbase (NASDAQ:COIN) stock dropped 16% after it revealed it received a Wells notice from the SEC warning it may have broken securities laws.

-

Celebs: The SEC has charged celebrities including Jake Paul, Lindsey Lohan, and Soulja Boy with fraud and securities violations for their role in endorsing Tronix and BitTorrent crypto assets.

-

Tokenization: An Atlanta home netted over $214k in less than 3 minutes after being tokenized via Ethereum-based NFT.

-

Settlements: Custody account holders at bankrupt lender Celsius will receive more than 72% of their holdings “free and clear” over two settlement payments.

-

ETH/BTC: Ethereum (CRYPTO: ETH) is on pace for its worst month relative to Bitcoin (CRYPTO: BTC) since September 2022.

Check out GritCRYPTO for more.

Deals

-

Storage: Extra Space Storage is exploring an offer for Life Storage which had previously rejected an $11 billion bid from Public Storage in February.

-

M&A: Learning Technologies Group is looking to fend off buyout firms with a planned M&A spree of its own.

-

Space race: In desperate need of cash, Virgin Orbit is nearing a deal for a $200 million investment from a Texas-based VC.

-

Restructuring: Carvana plans to offer as much as $1 billion of bond principal at below-par prices in exchange for new bonds secured by assets including vehicles.

-

Super app: Indian conglomerate Tata Group is exploring a $2 billion capital injection for its super app, Tata Neu.