The Rally Is Broadening

June CPI inflation came in below expectations at 3.0% versus estimates of 3.1% and down from 4.0% in May. The core index came in below 5% which is great news. I think the FED still raises rates in July but it could be the last hike this year!

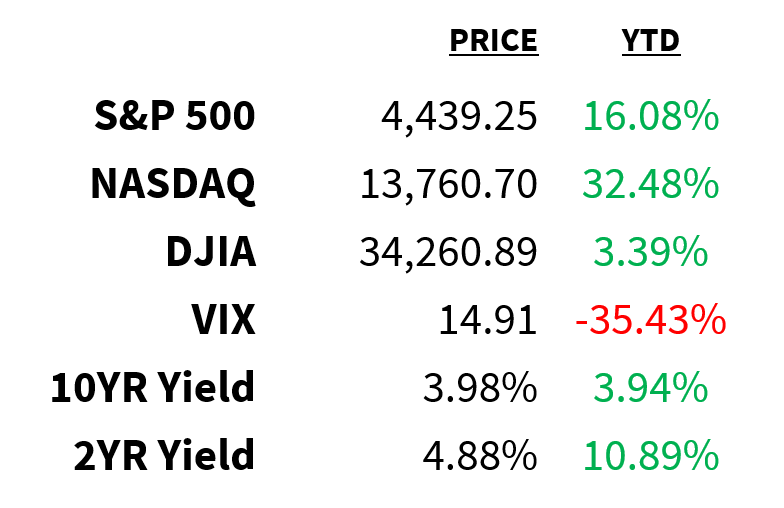

Market

Prices as of 4 pm EST, 7/11/23

Macro

New data from the NFIB points to improving conditions for small businesses.

-

The Small Business Optimism Index rose by the most since August 2022 to a 7-month high in June.

-

The lowest share of businesses reported higher selling prices since March 2021.

-

Nearly a third, however, plan to raise prices over the next 3 months.

-

The outlook on business conditions also improved sharply and more firms expect higher earnings in the next 3 months.

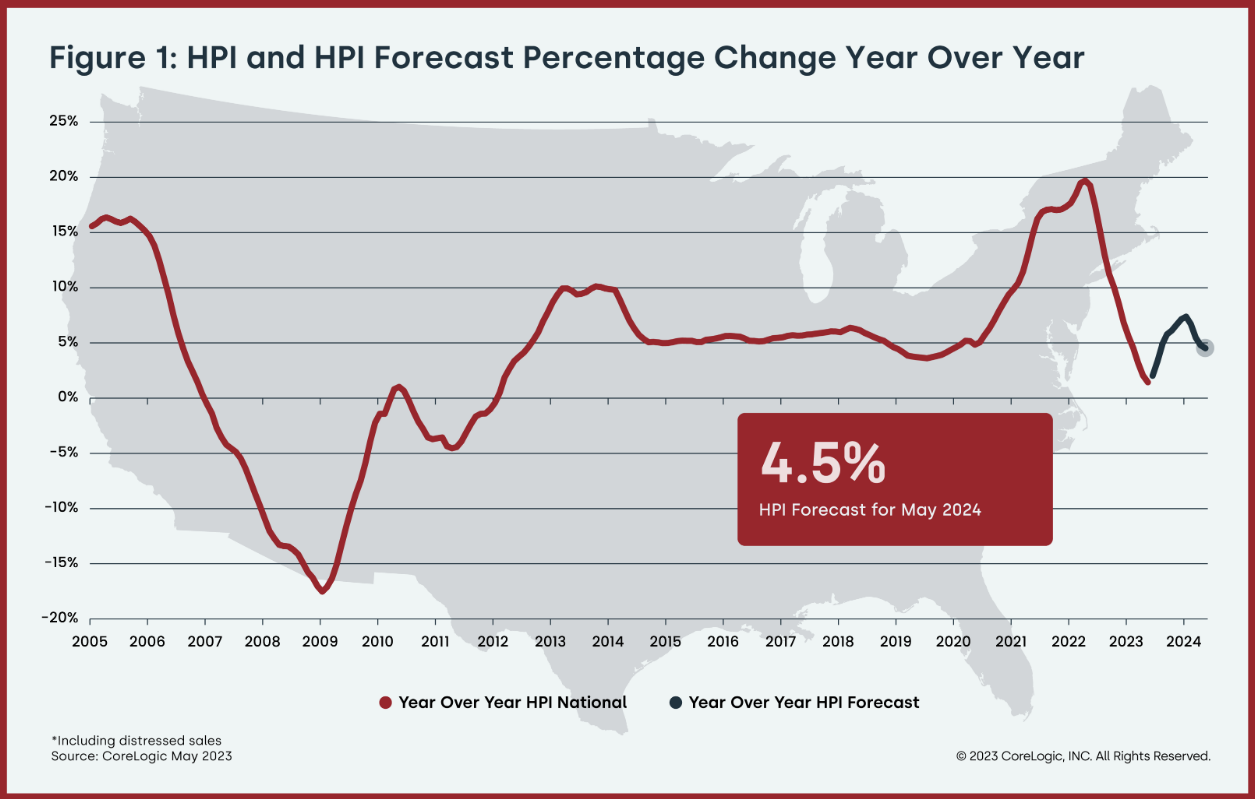

Home prices are bottoming out, according to CoreLogic.

-

Despite single-family home price growth hitting its lowest annual level since 2012 in May, the firm predicts an acceleration over the next year.

-

Its Home Price Index Forecast sees home prices rising 4.5% through May 2024.

-

Separately, by Black Knight’s measure, US home prices rose to a record high in May after rising 0.7%.

CoreLogic

Stocks

A US judge denied the FTC’s attempt to block Microsoft’s (NYSE:MSFT) $75 billion Activision Blizzard (NASDAQ:ATVI) acquisition.

-

The judge ruled Microsoft had little incentive to pull Call of Duty—the game at the heart of regulatory hurdles—off any platform.

-

According to TD Cowen, the deal now has a roughly 80% chance of going through (up from 40% pre-ruling).

-

It’s a big loss for the FTC, but don’t expect it to deter Linda Kahn and Co. from pursuing other cases against Big Tech.

The Nasdaq 100 is set for a “special rebalance”.

-

With 6 companies currently accounting for over 50% of the index, the move will look to redistribute their weightings.

-

While selling pressure is expected, history (similar events in 1998 and 2011) suggests the bull market is not under threat.

-

New weightings will be announced on July 14 and take effect 10 days later on July 24.

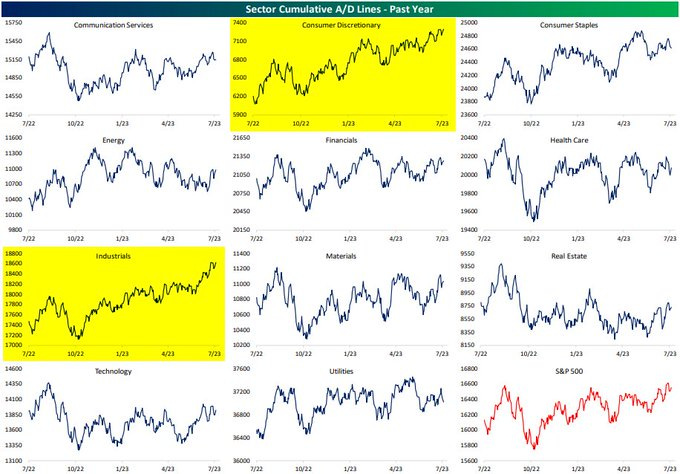

The rally in stocks looks to be broadening out.

-

The equal-weight S&P 500 (NYSE:RSP) has outperformed its market cap-weight counterpart over the past month (1% vs -0.4%).

-

Cumulative advance/decline line readings (chart) are strongest for Discretionary and Industrials (two of the most cyclical sectors).

-

And small caps have seen back-to-back weeks of inflows just as the Russell 2000 (NYSE:IWM) notches a golden cross (its second of the year).

Bespoke

Energy

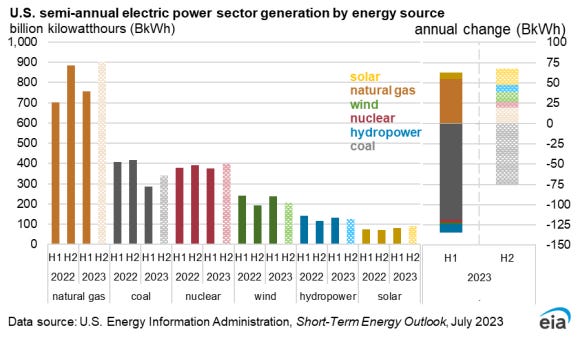

The Energy Information Administration EIA expects power consumption in the US to fall in 2023, according to its latest Short-Term Energy Outlook report.

-

It projects power demand will decrease 1.5% from last year’s record 4,048 billion kilowatt-hours.

-

It estimates a rise in the shares of natural gas and renewable energy sources in power generation.

-

It also predicts coal’s share will fall steadily through 2024.

EIA STEO

Top Headlines

-

Auto negotiations: Ford (NASDAQ:FORD), GM (NYSE:GM), and Stellantis (NYSE:STLA) are facing off with a union representing more than 400k of their workers.

-

Bank fine: BofA has been fined $150 million for engaging in deceptive practices that harmed customers.

-

Another one: Merryl Lynch will pay $12 million for failing to file ~1,500 suspicious activity reports over a +10-year period.

-

USD dominance: The S&P Global’s chief economist says the US dollar’s dominance as the global currency is diminishing.

-

Global risk: The Bank of England is warning that hedge funds’ leveraged trades in US Treasury futures pose a risk to financial stability.

-

AI vs. jobs: According to the OECD, 27% of jobs are at high risk of automation due to AI.

-

Bubble Characters: Google has quietly abandoned plans for an AI-powered chatbot targeted at Gen-Z users.

-

Less bling: Prices for secondhand Rolexes are at their lowest since 2021.

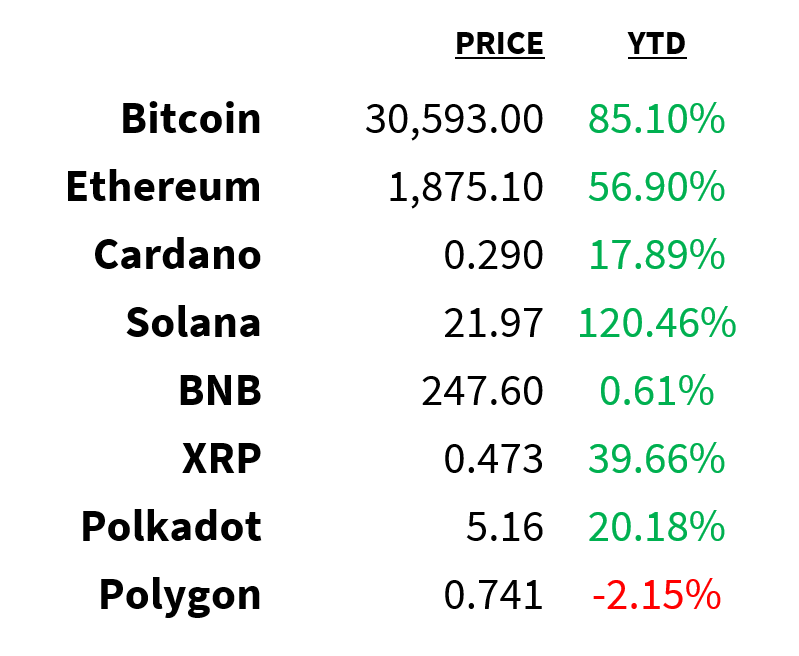

Crypto

Prices as of 4 pm EST, 7/11/23

-

Tax guidance: The US Senate Finance Committee has asked the crypto industry for input on tax rules.

-

MiCA law: The EU has issued its first set of detailed proposals on how crypto companies should be authorized.

-

Skittish hedgies: The percentage of hedge funds investing in crypto assets has fallen to 29% this year from 37% in 2022.

-

ARK x COIN: Cathie Wood’s ARKK sold 135,152 shares of Coinbase yesterday as the stock rallied by almost 10%.

-

BTC futures: Bitcoin futures liquidations are at their lowest since April, suggesting declining interest among futures traders.

Deals

-

Chip anchor: Nvidia (NASDAQ:NVDA) is in talks to become an anchor investor in Arm’s IPO.

-

AI partnership: Microsoft and KPMG announced a $2 billion partnership to co-develop cloud and gen-AI tools.

-

AI raise: AI-powered market research firm Alphasense is raising $150 million at a $2.5 billion valuation.

-

Nuclear SPAC: A Sam Altman-backed nuclear-fission startup, Oklo, plans to go public via SPAC merger.

-

Dead deal: Go Global Retail’s deal to acquire Buy Buy Baby from Bed Bath & Beyond fell apart in the final stages.