Wall Street Retreats As Treasuries Suffer Worst Week In Over A Year, Broadcom Soars, Bitcoin Rebounds: What’s Driving Markets Friday?

The U.S. stock market experienced subdued price action on Friday as investors adopted a cautious stance following disappointing inflation data earlier in the week and in anticipation of the Federal Reserve’s Dec. 18 meeting.

The tech-heavy Nasdaq 100 was the only major index to post gains, rising 0.4%. Yet, after briefly climbing to 21,900 points shortly after the market opened, tech stocks lost momentum and retreated by about 0.8%.

Other indices declined, with only a handful of sectors, such as utilities and healthcare, eking out marginal gains — highlighting a broader shift away from risk assets.

The market’s unease appears tied to diminished expectations for interest rate cuts in 2025, compounded by the possibility of hawkish commentary from Federal Reserve Chair Jerome Powell, particularly in light of the latest November’s inflation reports.

Treasury yields rose for the fifth day in a row, with the benchmark 10-year note climbing to 4.40%, its highest level in three weeks.

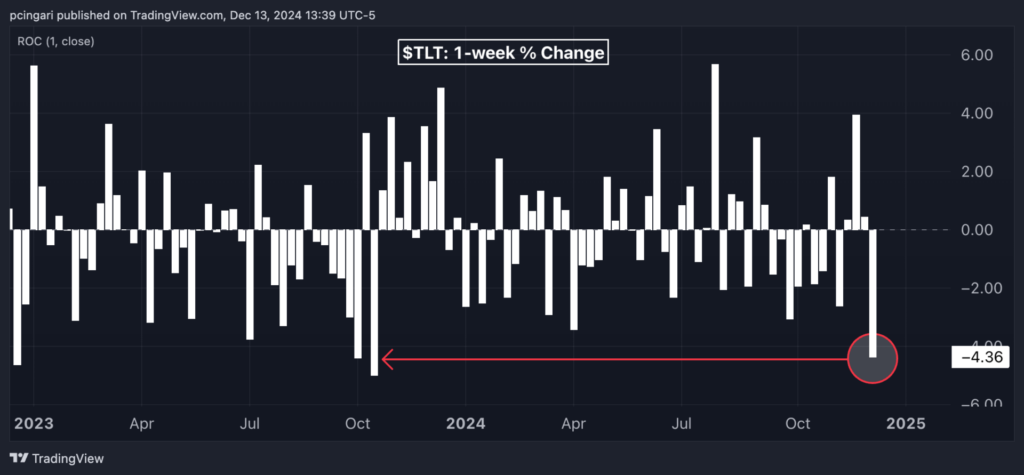

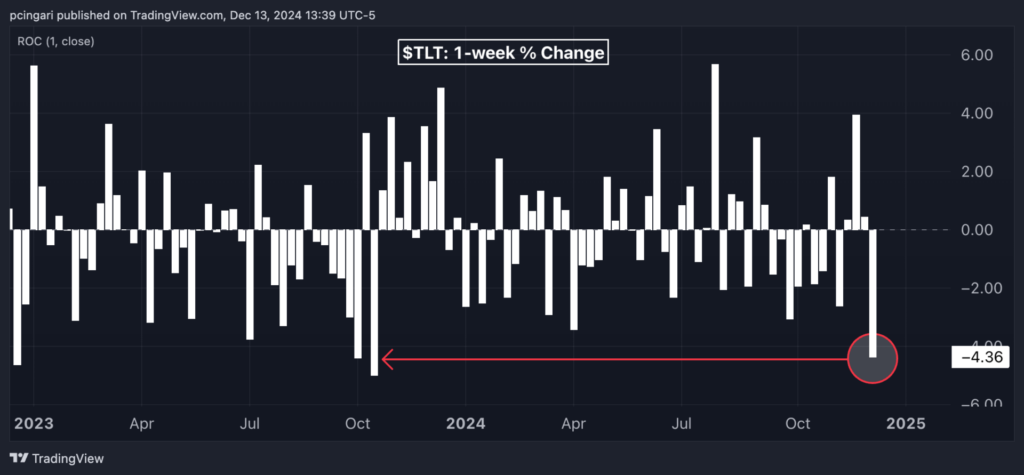

The iShares 20+ Year Treasury Bond ETF (NASDAQ:TLT) dropped 0.9%, hitting a three-week low and marking its fifth consecutive daily decline. For the week, the TLT ETF has lost over 4%, on track for its worst performance since mid-October 2023.

Meanwhile, the U.S. dollar index (DXY) held steady, with the greenback strengthening against the yen for a fifth straight session. Gold prices slipped for the second consecutive day.

In the commodity markets, oil prices rose 1.7%, with West Texas Intermediate (WTI) crude reaching $71 per barrel.

Bitcoin (CRYPTO: BTC) gained 1.8%, climbing to $101,800 and nearly erasing all of Thursday’s losses.

Chart of The Day: Long-Dated Treasury Bonds Poised For For Worst Week Since October 2023

Friday’s Performance In Major U.S. Indices, ETFs

| Major Indices | Price | 1-day % chg |

| Nasdaq 100 | 21,704.65 | 0.4% |

| S&P 500 | 6,044.56 | -0.1 % |

| Dow Jones | 43,840.34 | -0.2% |

| Russell 2000 | 2,341.11 | -0.8% |

According to Benzinga Pro data:

- The SPDR S&P 500 ETF Trust (NYSE:SPY) flattened at $604.33.

- The SPDR Dow Jones Industrial Average (NYSE:DIA) eased 0.1% to $439.83.

- The tech-heavy Invesco QQQ Trust Series (NASDAQ:QQQ) inched 0.5% to $529.76.

- The iShares Russell 2000 ETF (NYSE:IWM) fell 0.8% to $238.38.

Friday’s Stock Performers

- Broadcom Inc. (NASDAQ:AVGO) rallied 22% to record highs in reaction to a strong quarterly earnings report and upbeat guidance on AI growth in the upcoming years. The company’s market capitalization reached the $1 trillion milestone, making it the eighth-largest publicly traded stock.

- Other stocks reacting to company earnings reports included RH (NYSE:RH), up 13.7% and Costco Wholesale Corp. (NASDAQ:COST), up 0.7%,

- Under Armour Inc. (NYSE:UAA) fell 4% as the company forecasted fiscal 2025 adjusted earnings per share of $0.24-$0.27, below analyst forecasts of $0.27.

Read Now:

The image was created using artificial intelligence MidJourney.