Weekly Points – 5 Things To Know In Investing This Week

The Silly People Saying Silly Things Issue

Treasury Secretary, Janet Yellen speaking in public typically leads to her accidentally saying things out loud that confirm the fears of her critics. At the same time, the Bitcoin bears who celebrated a small decrease in the dollar price of Bitcoin last month have gone into hibernation causing quiet in my Twitter/X feed. I believe the market gets the lack of uranium production in Cameco’s earnings wrong. DKI releases a full report on a favorite stock pick. And after years of increases, used car prices have started to decline.

This week, we’ll address the following topics:

-

Janet Yellen says the quiet part out loud and accidentally ruins the narrative. She is the Marie Antoinette of inflation.

-

Bitcoin back up after the post-ETF selloff. For some reason, my X timeline got a lot quieter.

-

DKI releases report on Shockwave Medical (NASDAQ:SWAV). Premium subscribers started to get in at $191. Stock at $235 at the time of this writing. Still worth buying?

-

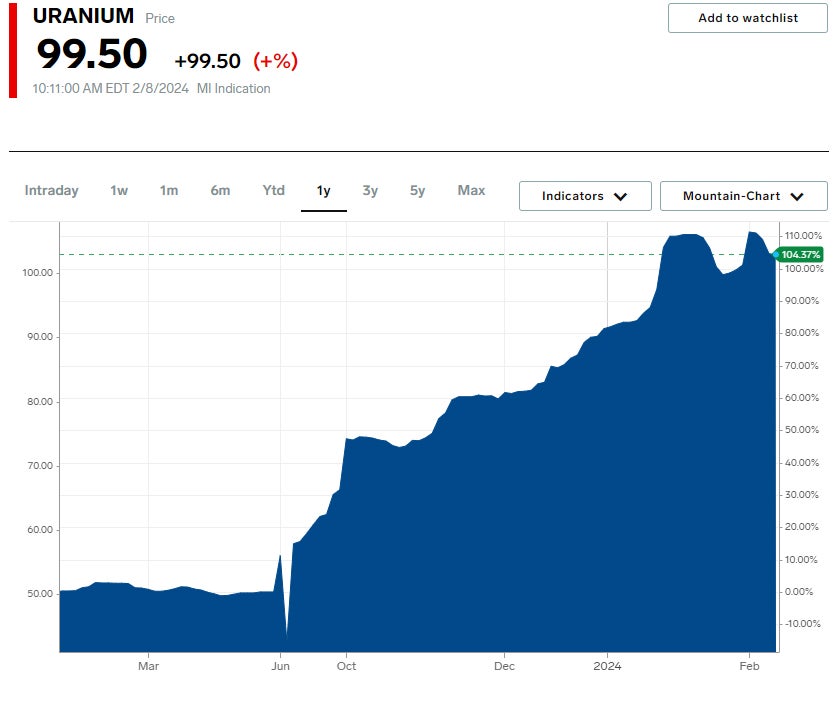

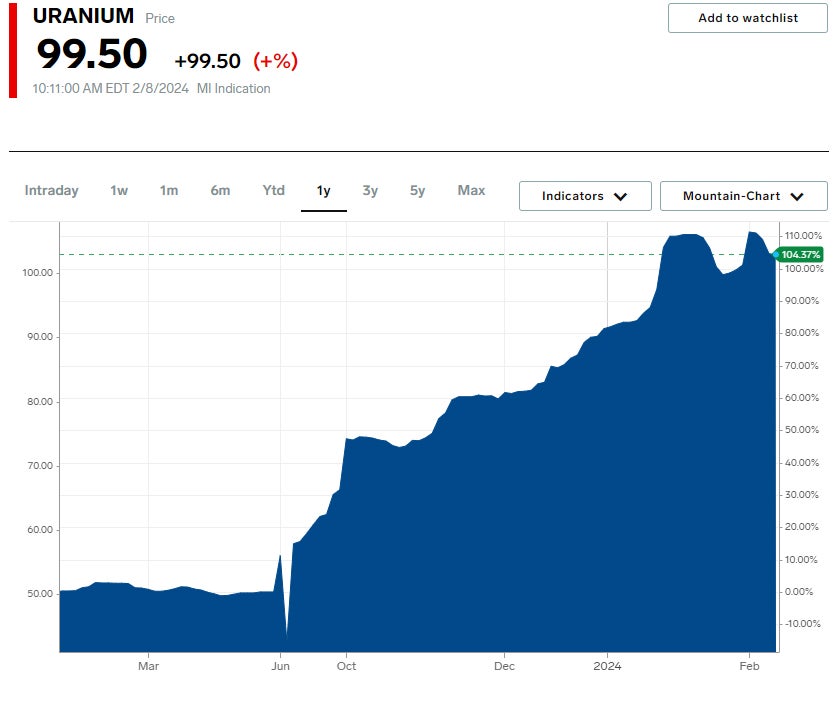

Big uranium producer falls short on production and says they’ll be buying in the spot market. This sent uranium prices down. We think the market got it wrong.

-

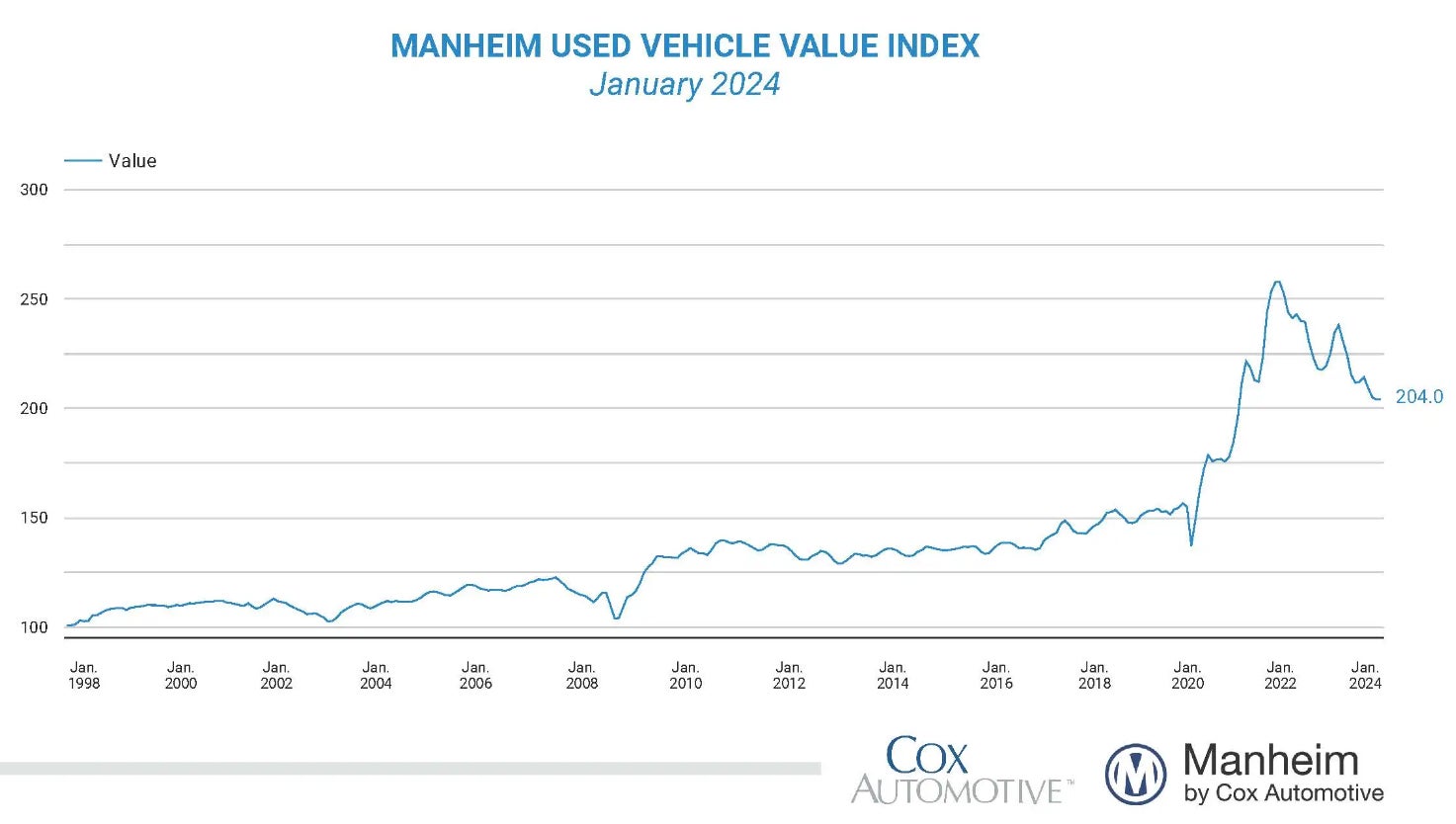

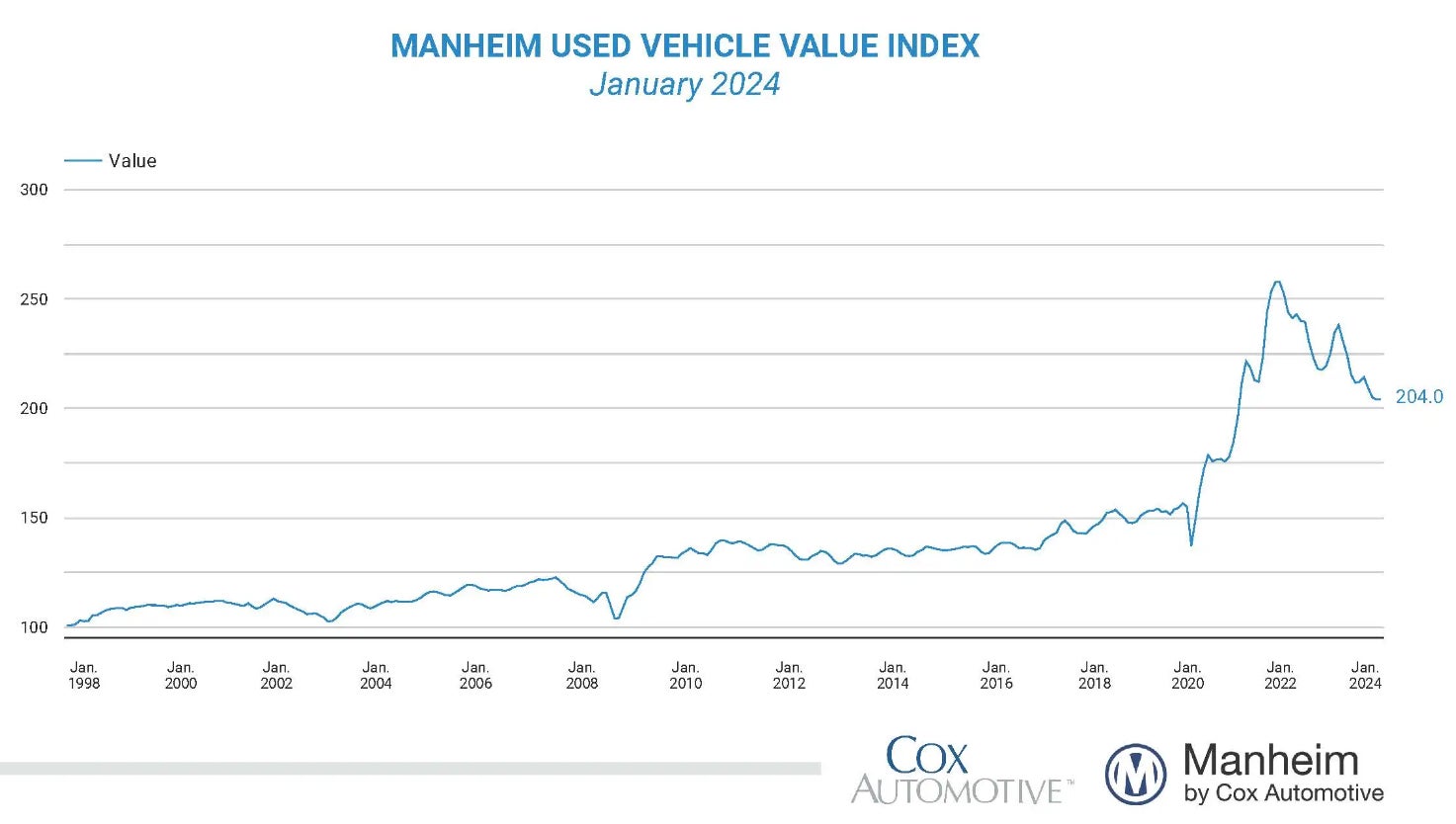

After a huge pandemic-related increase in the price of used cars, much of the price premium is now gone. Will this affect the CPI?

Ready for a new week of silly sayings? Let’s dive in:

-

Janet Yellen Accidentally Destroys the Narrative on Inflation:

This week, Treasury Secretary, Janet Yellen, said “We don’t have to get the prices down because wages are going up.” I can’t decide if the most remarkable thing about this is that Yellen is either insensitive and economically illiterate, or that she said this in public. Despite wage gains in the last few years, inflation has reduced the purchasing power of most families. Most of the country isn’t better off with higher wages and higher prices. In addition, Yellen’s comments ignore the devastation caused by inflation on elderly people who live on fixed incomes. Stable prices are crucial for economic growth, and Yellen is famous for saying her biggest regret as Chair of the Federal Reserve was low inflation.

Janet is confused about how normal people live. She’s also been hilariously described by our friends at Unicus Research as the “Marie Antoinette of our inflation”.

DKI Takeaway: DKI has long insisted that the primary cause of the inflation of the past few years has been massive overspending by the government leading to a huge increase in the money supply. The White House, the Federal Reserve, and the Treasury (headed by Yellen) have all blamed supply chain problems. With the Covid lockdowns over and supply chains back to normal, it’s obvious that prices aren’t coming back down to pre-Covid levels. At this point, the government is hoping to reduce the pace of further increases. Yellen acknowledging that they’re not trying to get prices down is further confirmation that inflation is neither transitory nor caused by temporary factors.

-

Bitcoin Recovers Post ETF Approval Dip – Timeline Gets Quiet:

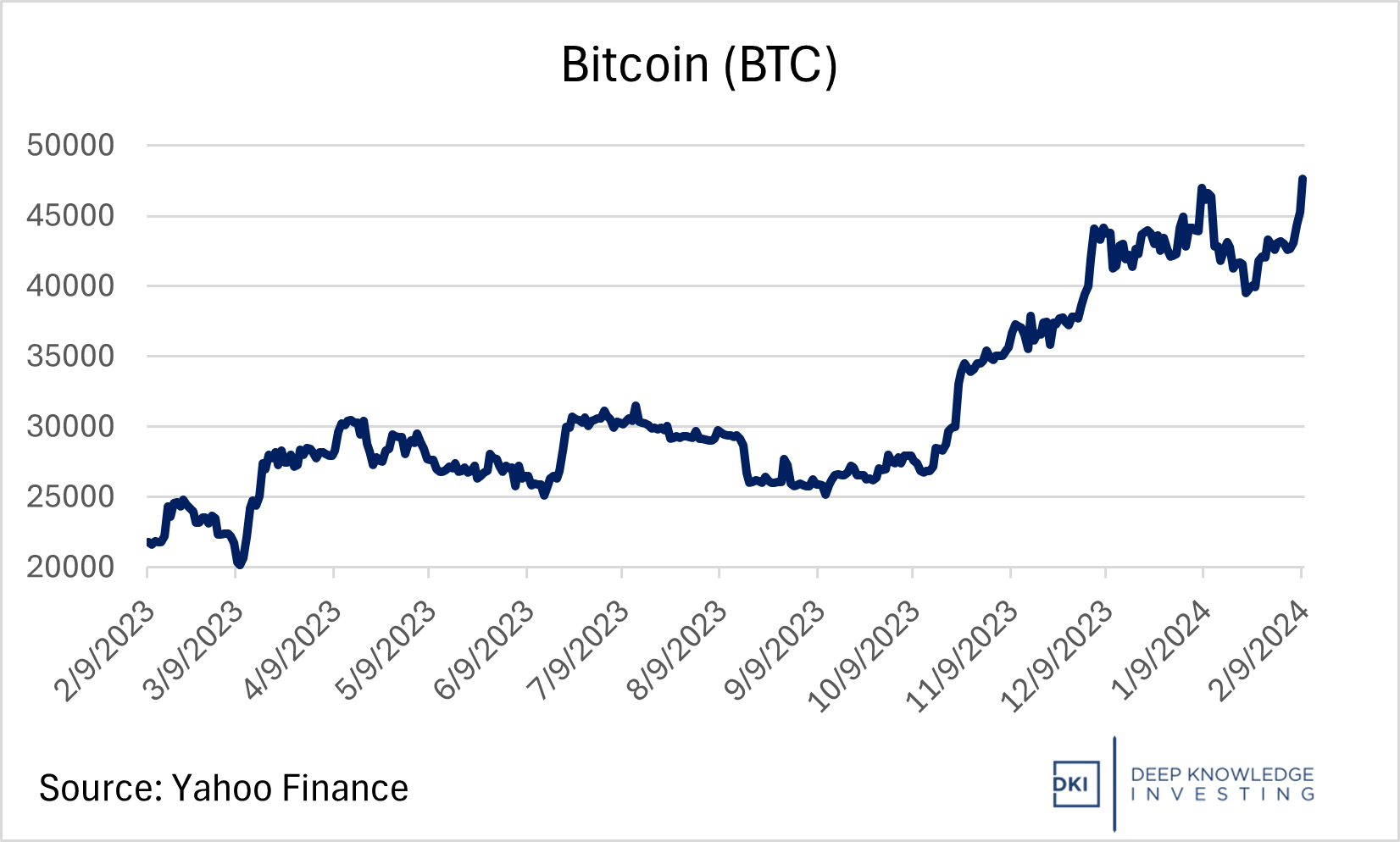

From early 2023 to just before the SEC approved 11 Bitcoin ETFs, Bitcoin (CRYPTO: BTC) ran up from about $20,000 to about $45,000. Bitcoin bulls (like me) thought post-approval buying would push up the dollar price of an increasingly scarce asset. Bitcoin bears thought the pre-approval price appreciation would be reversed after the regulatory event. Post-approval, Bitcoin fell a modest amount by Bitcoin standards, and the bears were crowing about how this worthless asset was going to find its proper price of zero. DKI didn’t sell.

A small dip caused some to declare victory. Where’s the mea culpa now?

DKI Takeaway: I think it’s unwise to have a short-term opinion on Bitcoin. If you own it, it’s probably because you have concerns about the debasement of the fiat dollar, and want to have some hard assets outside the system. I have noticed my timeline on Twitter/X to have very little anti-Bitcoin comments over the past week or two. If you’re going to claim you’re right because of a short-term drop in price, then wouldn’t a recovery of that entire drop and a Bitcoin price above the pre-SEC approval price make you wrong? I don’t think a 10% – 20% move in Bitcoin’s price makes anyone right or wrong on the asset, but for those who had a short-term opinion, it would be nice to see their humility reach the levels of their hubris.

-

DKI Releases Report on Shockwave Medical ($SWAV):

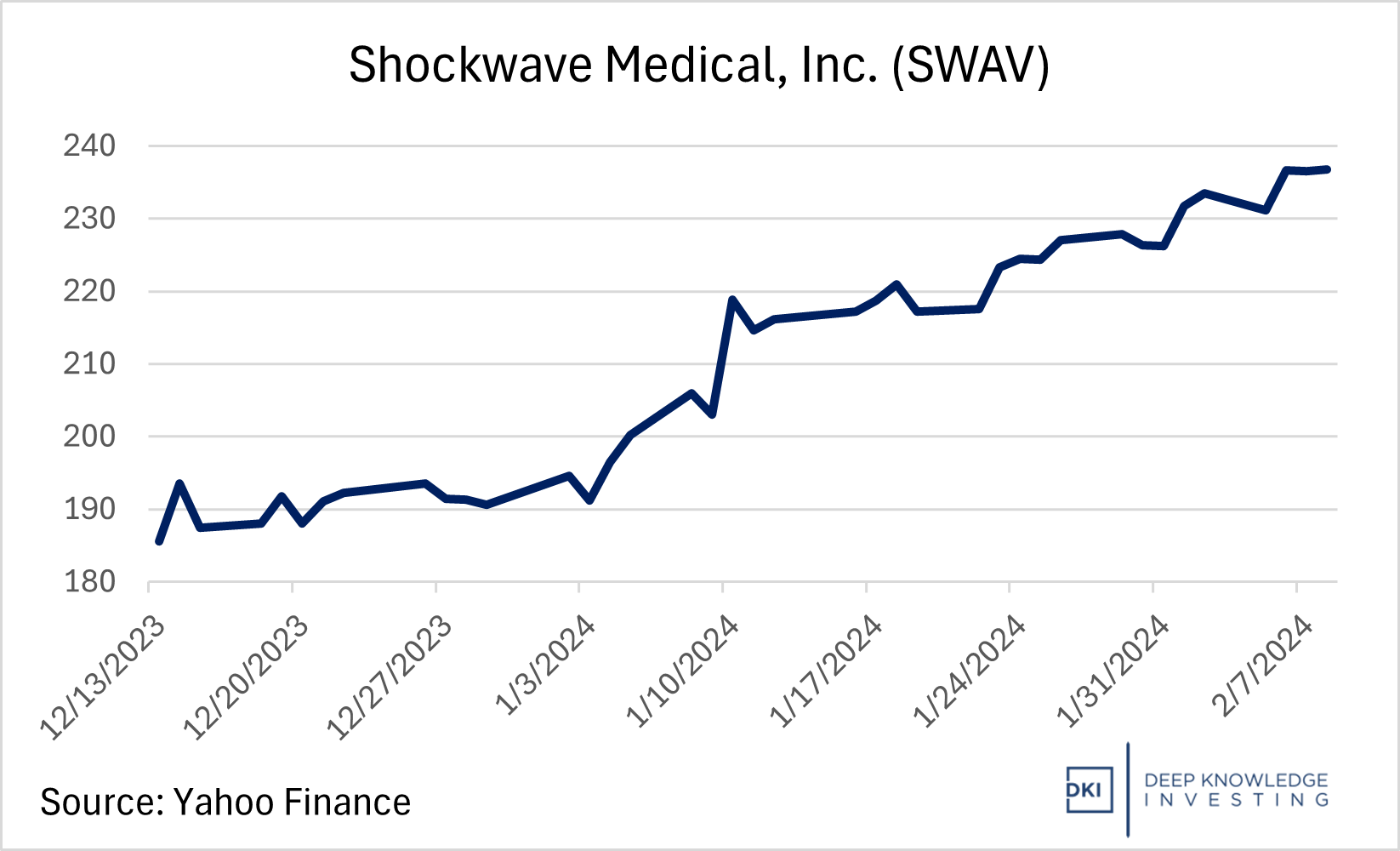

- DKI subscribers started buying Shockwave Medical ($SWAV) in December at $191. At the time of this writing, the stock is now at $235. The company makes a device that enables placement of a cardiac stent in the 10% – 25% of cases where excessive calcification makes deployment or expansion impossible. Shockwave’s technology is safer than the previous standard of care for these difficult cases, and the equipment is easy enough to use that more interventional cardiologists are able to handle advanced procedures.

A nice run so far, but we think there’s more to go.

DKI Takeaway: With the stock up nicely, we still think there’s more upside. $SWAV was in takeover talks last year, and looking at multiples paid in prior medical device acquisitions, the stock could be acquired for more than $300. If you’d like to know more, DKI just made its full research report available to the public. You won’t be able to get in at the premium subscriber price, but I haven’t sold a single share if that tells you what I think. Report available here: https://investor.deepknowledgeinvesting.com/swav. If you want to know if or when we decide to sell, you’re welcome to subscribe.

-

Cameco is Light on Production – Has to Buy Spot Uranium:

- Cameco (NYSE:CCJ) is one of the world’s largest uranium producers. This week, the company announced earnings and missed lowered estimates for production. $CCJ had to buy uranium in the spot market, and some/all of those purchases are money-losing for the company which locked in long-term supply contracts when uranium prices were much lower. Of greater significance, Cameco announced they expect to have to buy more spot uranium in 2024 to meet demand.

We think uranium prices continue to rise. Chart from Markets Insider.

DKI Takeaway: Despite $CCJ missing its production estimates and projecting spot market purchases in 2024, the price of uranium fell after the earnings report. DKI’s positive thesis on uranium is related to large increases in the number of nuclear plants under construction combined with permitting existing plants to be in operation longer. Demand for uranium is going to rise before the supply does and since fuel is only 5% of the cost of operating a nuclear plant, higher prices won’t slow down nuclear adoption. We think Thursday’s price drop is temporary and that we’ll see higher future prices. If you want to know what we own to take advantage of the opportunity, reach out to us.

-

Used Car Pricing Dropping – Will it Affect the CPI?:

While DKI has been skeptical of the supply chain excuse for inflation caused by over a decade of near-zero interest rates, Congressional overspending, and monetization by the Treasury Department, one place where supply chains did cause massive pricing issues is in the used car market. A lack of computer chips put thousands of mostly-finished cars in giant car lots waiting for parts to be completed. As a result, used car prices rose by more than 60%.

Much of the huge increase has been unwound.

DKI Takeaway: With demand for new cars falling and supply chains normalized, used car prices have given up much of their price gains. Prices are still elevated from a few years ago, but down from last year. This price move will help get the consumer price index (CPI) lower, but used cars and trucks are only 2.5% of the index. Still, with a total reduction of 9% from a year ago, that’s about .2% off the CPI. Given how tight the numbers have been recently, that’s a meaningful decrease.

Information contained in this report, and in each of its reports, is believed by Deep Knowledge Investing (“DKI”) to be accurate and/or derived from sources which it believes to be reliable; however, such information is presented without warranty of any kind, whether express or implied. DKI makes no representation as to the completeness, timeliness, accuracy or soundness of the information and opinions contained therein or regarding any results that may be obtained from their use. The information and opinions contained in this report and in each of our reports and all other DKI Services shall not obligate DKI to provide updated or similar information in the future, except to the extent it is required by law to do so.

The information we provide in this and in each of our reports, is publicly available. This report and each of our reports are neither an offer nor a solicitation to buy or sell securities. All expressions of opinion in this and in each of our reports are precisely that. Our opinions are subject to change, which DKI may not convey. DKI, affiliates of DKI or its principal or others associated with DKI may have, taken or sold, or may in the future take or sell positions in securities of companies about which we write, without disclosing any such transactions.

None of the information we provide or the opinions we express, including those in this report, or in any of our reports, are advice of any kind, including, without limitation, advice that investment in a company’s securities is prudent or suitable for any investor. In making any investment decision, each investor should consult with and rely on his or its own investigation, due diligence and the recommendations of investment professionals whom the investor has engaged for that purpose.

In no event shall DKI be liable, based on this or any of its reports, or on any information or opinions DKI expresses or provides for any losses or damages of any kind or nature including, without limitation, costs, liabilities, trading losses, expenses (including, without limitation, attorneys’ fees), direct, indirect, punitive, incidental, special or consequential damages.