What Happens If Bitcoin Halving Screws Up? 6 Keys To Understanding Seminal Crypto Moment

What happens if the Bitcoin (CRYPTO: BTC) halving in April screws up?

An X account that goes by Financelot asked and received a mix of scorn, amusement and friendly advice.

"RIP your replies on this one," predicted pseudonymous Glassnode on-chain analyst Checkmate.

Some, such as a Swan engineering lead, poked light fun at Financelot: "The miners have been training every day to pull it off. They got this!"

Some could not tell whether the question was asked ironically or seriously, such as TFTC founder Marty Bent, who wondered about "rehashing the most brain dead 'What if'" questions.

Dylan LeClair, director of Market Intelligence at UTXO Management, sarcastically commented "profound stuff on fintwit as always," making fun of the macro-oriented subculture called "Fintwit," which has a poor reputation among Bitcoin supporters.

Pseudonymous Bitcoin fan April Snow offered a serious answer:

Since the dumb questions are rolling in, now might be a good time to mention: nothing actually happens during the day of the halving! There will be no fireworks. No parade. The price will not go up $100,000 overnight. It’s just a normal day.

Fireworks happen the following year. https://t.co/IaUVh9kJgU

— April Snow � (@FiatisF00lsgold) February 26, 2024

Why It Matters: Whether engagement bait or genuine lack of understanding, Financelot asked a question less knowledgeable Bitcoin investors may not immediately know the answer to.

Jesse Myers, COO of Onramp Bitcoin, took the opportunity to link to a blog post explaining the "6 keys to understanding the Bitcoin halving:"

The Bitcoin halving reduces supply issuance: each halving reduces the rate of new bitcoin being issued.

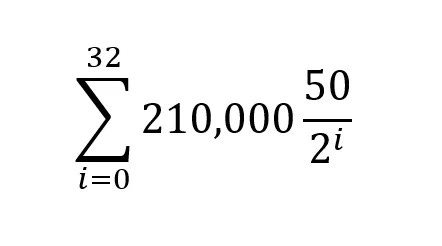

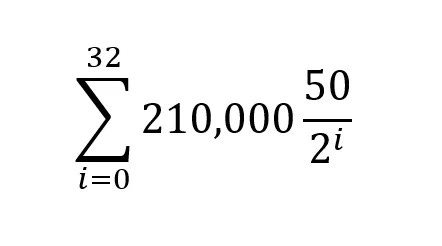

- Immutable code guarantees the halving: the mathematical function below defines the halving happens every 210,000 blocks, approximately four years, and halves the bitcoin reward for mining a new block. The 2024 halving cuts the inflation rate from 1.8% to 0.9%.

- "Perfectly inelastic supply:" Myers argues that Bitcoin, unlike other commodities, is "perfectly inelastic," meaning even if price were to 10X overnight, there would be no way to expand supply.

- The halving impacts the price equilibrium: if 900 bitcoin, currently worth about $45 million, are issued per day, there has to be demand worth at least $45 million to keep the price steady.

- The halving cuts the rate of newly issued bitcoin in half, meaning if demand stays equal, price has to rise. The unusually high demand thanks to spot exchange-traded funds (ETFs) prompted traders to predict an all-time high even before the halving.

- "Increasing scarcity leads to absolute scarcity:" Myers states these qualities is something no other asset displays, creating a "cumulative and compounding" effect. This "inexorable march of increasing scarcity" means Bitcoin's value is headed higher, according to Myers.

- The halving's self-fulfilling psychology: Finally, the halving is a "reliable, recurring market opportunity" that creates the kind of speculative anticipation that has become a self-fulfilling prophecy. Household names like BlackRock CEO Larry Fink extolling the virtue of Bitcoin as a protective asset could be seen as a testament to this effect.

Price Action: At the time of writing, Bitcoin was trading at $51,080, down 1.2% over the past 24 hours, as reported by Benzinga Pro.