What The Nasdaq-100 Will Look Like After July 24

Economists expect this morning’s retail sales data to show the strongest growth since January. If a recession is coming, somebody forgot to tell the consumer!

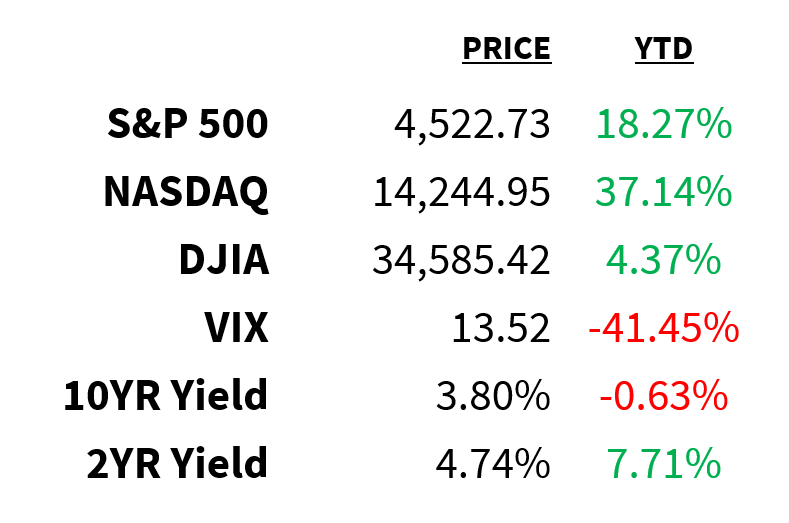

Market

Prices as of 4 pm EST, 7/17/23

Macro

China represents the world’s largest market for chipmakers.

-

In 2022, it was responsible for $180 billion of $555.9 in global semiconductor purchases.

-

The White House has recently taken action to impose restrictions on the sale of chips and related US tech to China.

-

Industry players at home, naturally, have warned against such action.

-

Yesterday, industry executives met with Biden administration officials to urge them to avoid further restrictions.

Manufacturing activity unexpectedly expanded for the second straight month in July.

-

Expected to fall into contraction, The Empire State Manufacturing Survey’s general business conditions index dropped less than expected to 1.1.

-

Underlying components were mixed as new orders and employment increased but shipments declined.

-

Outlook for the next 6 months also deteriorated.

-

In a positive for inflation, prices paid and received fell to their lowest since August 2020 and July 2020, respectively.

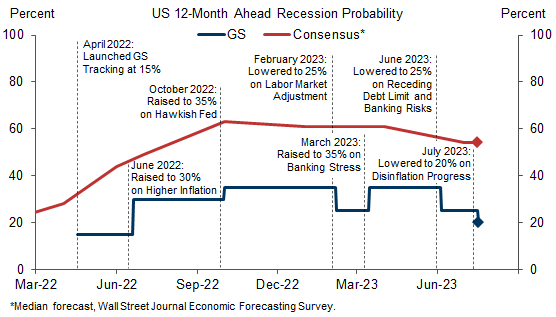

Yesterday we noted how economists were (again) pushing out recession expectations.

-

Goldman Sachs has similarly cut its odds of a US recession within the next 12 months to 20% from 25%.

-

The bank’s main reasons for optimism–like those of said economists–are continued progress on inflation and strong fundamentals despite significantly higher borrowing costs.

-

Treasury Secretary Janet Yellen agrees: she told reporters yesterday she does not expect a US recession.

Goldman Sachs

Stocks

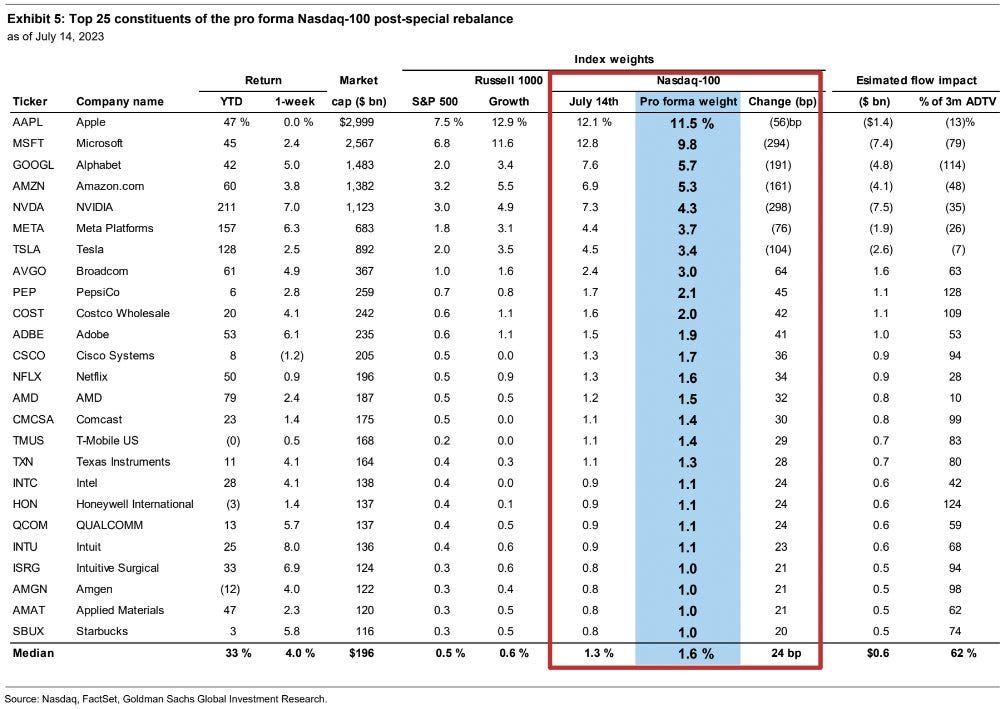

Here’s something you already know: the Nasdaq-100 has become too concentrated.

-

Currently, the top 7 stocks account for 56% of the index.

-

After July 24, their collective weight will be brought down to 44%.

-

Stocks seeing the biggest declines in weight: NVDA (NASDAQ:NVDA) (3%), MSFT (NASDAQ:MSFT) (3%), AAPL (NASDAQ:AAPL) (0.6%).

-

It will be just the second such “special rebalance” in 25 years (the previous one in 2011 had no clear impact on the affected stocks).

-

Here’s what the index will look like after the rebalancing:

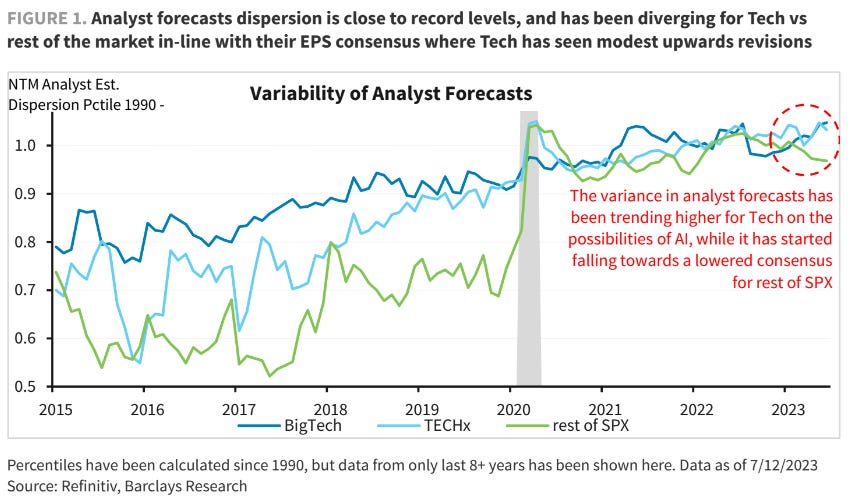

EPS estimates are seeing more positive revisions than negative ones as we head into earnings season.

-

In fact, consensus EPS has seen fewer pre-season cuts than usual.

-

At the same time, earnings uncertainty—a measure of analyst forecast dispersion—has been falling for the S&P 500 as a whole.

-

Uncertainty surrounding Tech earnings, however, has been rising:

Energy

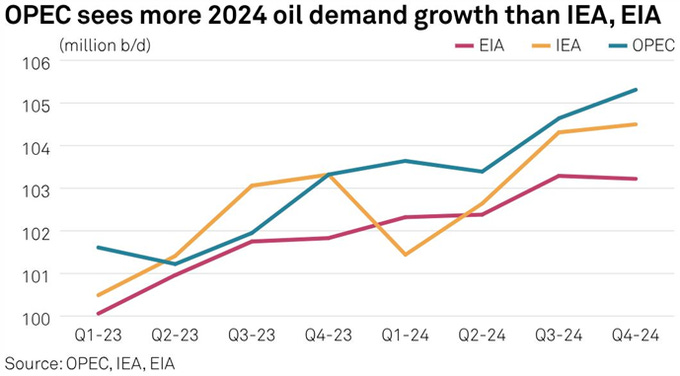

OPEC, the International Energy Agency (IEA), and the US Energy Information Administration (EIA) all see oil demand rising in Q3 (chart).

-

They also forecast tightening supply in the second half of the year.

-

In fact, according to Standard Chartered, the global market is already in a deficit.

-

Don’t tell that to oil investors – traders have remained sellers amid warnings of a tight market.

@mikezaccardi

Earnings

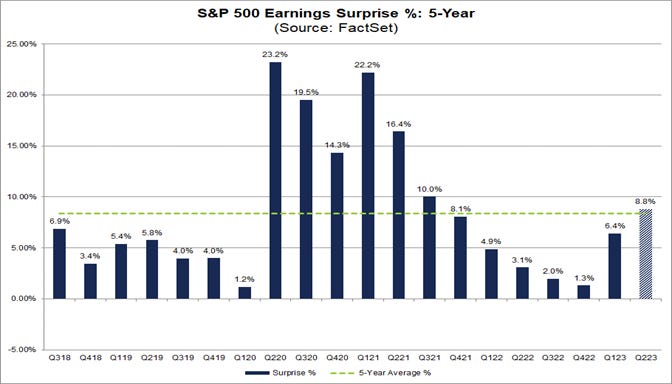

With 30 companies representing 11% of S&P 500 earnings having reported, here’s a (very) early look at Q2 trends:

-

Companies are reporting a -7.1% YoY decline in earnings.

-

The beat rate is above average at 77% but below last quarter’s 90%.

-

In aggregate, reported earnings have topped estimates by 8.8%.

Fact Set

What we’re watching today:

-

Bank of America (NYSE:BAC)

-

Novartis (NYSE:NOV)

-

Morgan Stanley (NYSE:MS)

-

Lockheed Martin (NYSE:LMT)

-

Prologis (NYSE:PLD)

-

Goldman Sachs (NYSE:GS)

-

Charles Schwab (NYSE:SCHW)

-

PNC Financial (NYSE:PNW)

-

Bank of NY Melon (NYSE:BK)

-

Omnicom (NYSE:OMC)

-

JB Hunt (NASDAQ:JBHT)

-

Synchrony (NYSE:SYF)

-

Interactive Brokers (NYSE:IBKR)

-

Pinnacle Financial (NASDAQ:PNFP)

-

Western Alliance (NYSE:WAL)

Top Headlines

-

Euro AI battle: France and the UK are competing to establish themselves as the leading country for AI in Europe.

-

Survey says: BofA’s Global Fund Managers survey reveals increasing optimism about a soft landing.

-

Diversification rules: Large US investment funds are being restricted from purchasing more shares in popular tech stocks.

-

Telecom slump: AT&T shares fell to their lowest closing price in 30 years following a WSJ investigation.

-

Ridesharing: Shares of Uber dropped following a court victory for its drivers.

-

Ford EVs: Ford reduced the price of its base model F-150 Lightning by 17% to ramp up competition.

-

Twitter writedown: Cathie Wood’s ARK wrote down its Twitter stake by 47%.

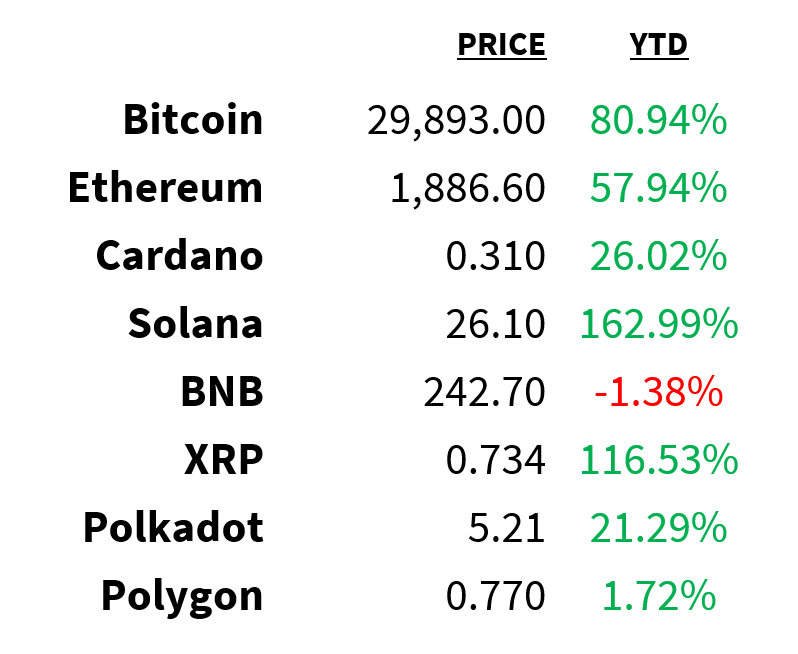

Crypto

Prices as of 4 pm EST, 7/17/23

-

Steady inflows: A $742 million, inflows into crypto products last month hit their highest level since 2021.

-

Addresses surge: The number of unique addresses on the Bitcoin network has topped 500k for the first time since May 2021.

-

COIN goes to DC: Coinbase (NASDAQ:COIN) CEO Brian Armstrong will meet with House Democrats tomorrow to discuss legislation and regulation.

-

Reddit tokens: Reddit’s MOON and BRICK tokens surged after the company explicitly allowed for trading of its Community Points.

-

Crypto liquidation: Celsius’ $160 million liquidation has begun with a $63 million transfer to FalconX.

Deals

-

Finish line: The $69 billion Microsoft/Activision deal is unlikely to close by its deadline (today).

-

Space investments: Private investment in space companies is showing signs of stabilization after years of steady declines.

-

Space unicorn: Rocket startup Firefly is close to announcing the closure of an oversubscribed capital raise.

-

Mining M&A: Glencore has agreed to acquire the remaining 18% stake in PolyMet Mining for ~$73 million.

-

BTC mining SPAC: Bitcoin mining company Bitdeer has become one of the world’s largest crypto miners just 3 months after its SPAC merger.