World’s Largest Hedge Fund Founder Ray Dalio Says Cash Is ‘In Jeopardy’ but Sees an Unexpected Solution

Inflation has been a massive issue for nearly every major country for the past year or so.

Consumers and corporations alike have felt the pain, with the previous four quarters of earnings proving to be relatively lackluster. While inflation is slowly declining, it has caused the debt of the U.S. and other countries to soar.

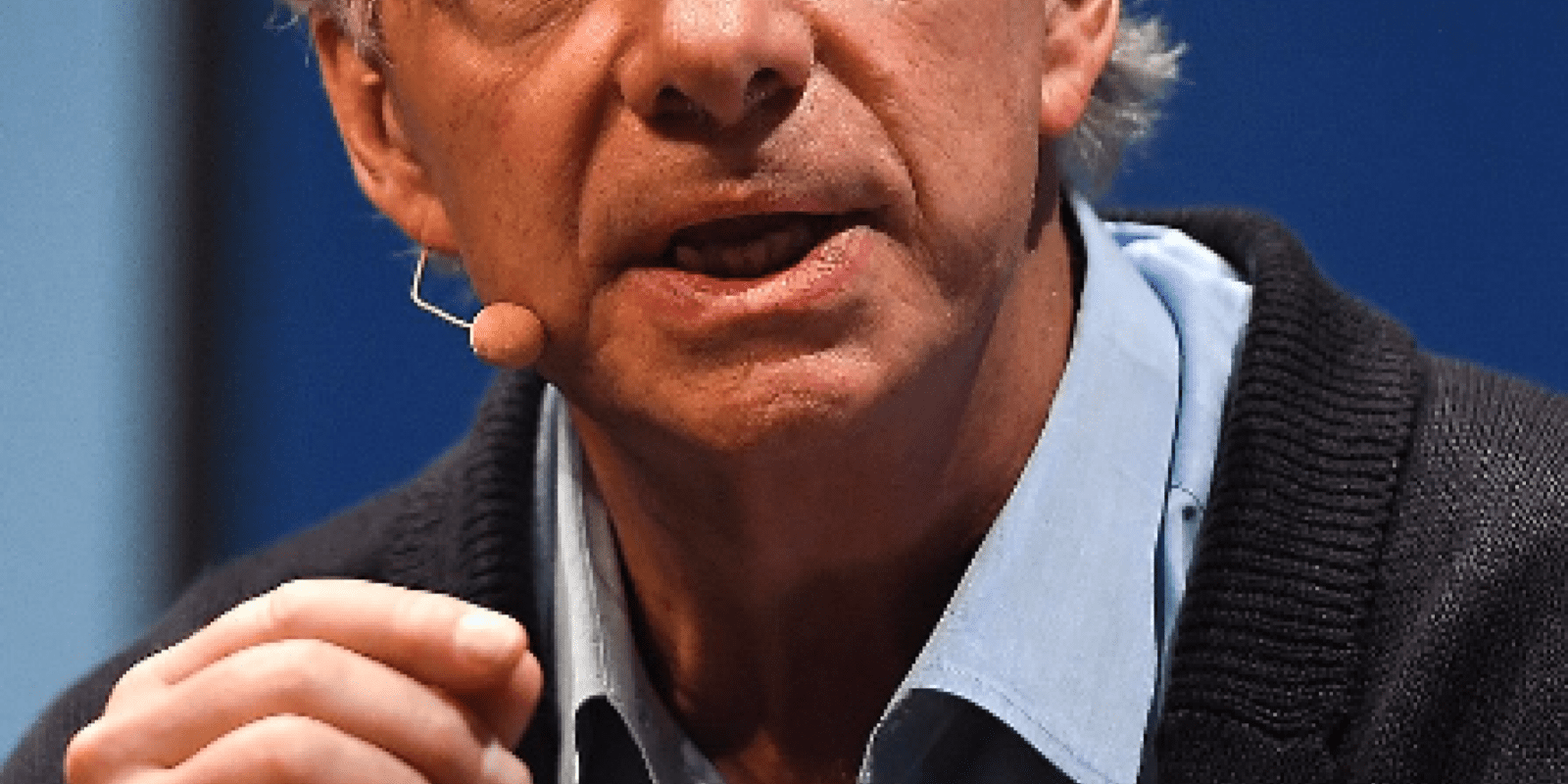

Between strong inflation and the massive debt burden, the founder of the world’s largest hedge fund is sounding the alarm. Bridgewater Associates Founder Ray Dalio has grown his investing empire into one of the largest hedge funds in the world.

In a recent interview with CNBC, Dalio said, “Money as we know it is in jeopardy [because] we are printing too much, and it’s not just the United States.”

Dalio ruled out Bitcoin as a solution because he says it’s proved to be too volatile, doesn’t relate to anything, and many industries are more interesting than crypto.

To stay updated with top startup investments, sign up for Benzinga’s Startup Investing & Equity Crowdfunding Newsletter

While Bitcoin isn’t the answer, a digital currency could be. “I think that what would … be best is an inflation-linked coin,” said Dalio, noting that the closest thing on the market to his vision is an inflation-linked index bond in the form of a currency.

This is in stark contrast to the recent narrative around digital currencies and crypto. The sentiment around crypto and other digital currencies is likely at an all-time low because of the recent collapses of FTX, Celsius Network LLC, BlockFi and several others. But Bitcoin is up as much as 50% since its November lows meaning there might be some opportunity there for investors as sentiment rebounds — even if it doesn’t function as currency.

Some startups could benefit from this rebound in sentiment, including Gameflip. Gameflip is a startup with over $140 million in volume for its non-fungible token (NFT) and gaming assets marketplace that could benefit from a rebound in crypto-based assets even as it continues to be rooted in the broader recession-resistant gaming market. Gameflip is raising on StartEngine, which means anyone can invest for a limited time.

The broader stock market also provides options. Bridgewater’s two largest holdings are Proctor & Gamble Co. and Johnson & Johnson, which account for about 8% of its total portfolio. Dalio noted that he sees biotech and other industries as “more interesting than Bitcoin.”

See more on startup investing from Benzinga.