2022: The Year That Bitcoin Came Of Age And Fiat Showed Its Ugly Side; The Case For A Monetary Escape Hatch

If you’ve been ambivalent on bitcoin until now, then 2022 might just be the year that persuades you of its merits – and that’s despite the onset of crypto winter, and headline-grabbing price declines of over 50% (at the time of writing, at least). As Bitcoin Analyst for one of the world’s largest hardware wallet manufacturers, I’m used to and welcome skepticism. Skepticism is far more healthy than blind acceptance or rejection – it is right that people do their own research when it comes to truly understanding the merits or otherwise of bitcoin (CRYPTO: BTC).

As a popular adage among bitcoiners goes, “to understand bitcoin, you have to understand fiat first” – fiat being the colloquial term for state-issued currencies. This year has been very eye-opening in this regard, as fiat currencies worldwide have shown their ugly side. It’s the recent events, rather than any new development of the admittedly conservative bitcoin, that have prompted many people to reappraise their position on bitcoin.

Rampant Money Printing

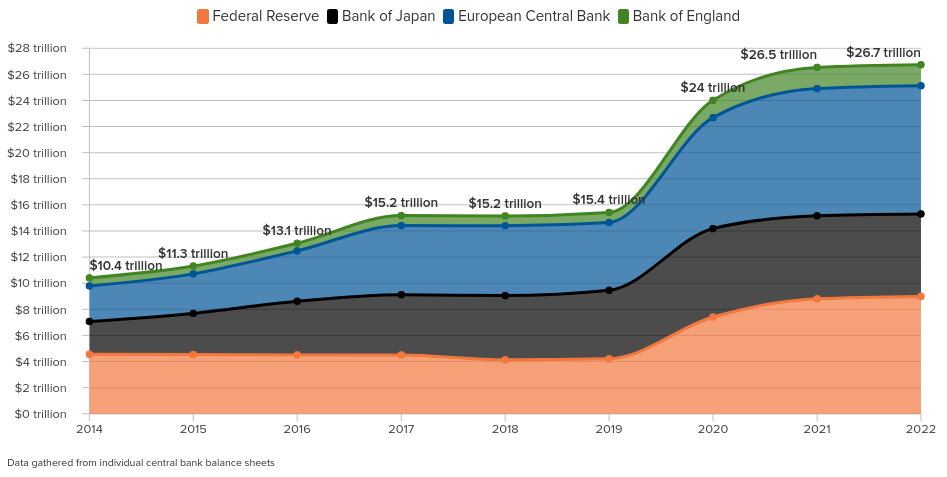

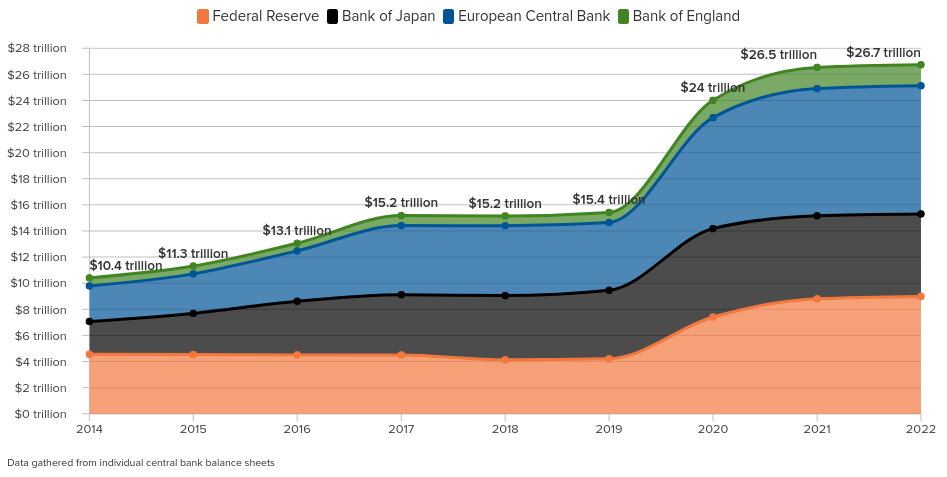

2022 has continued to witness the impact of pandemic-related central bank money printing. In response to the pandemic, four of the world’s major central banks (US Federal Reserve, Bank of Japan, European Central Bank, and the Bank of England) have printed over USD $11 Trillion, which represents an increase in their cumulative balance sheet of around 73%. Such activities are impossible with the fixed total supply of 21 million bitcoin – you simply cannot create money out of thin air with bitcoin.

Balance sheets of major central banks. Source: Global QE Tracker at Atlanticcouncil.org.

Understandably, money printing has led to inflationary pressures in the global economy and interest rates have been rising as a counter-inflationary measure, and that was before inflation spiked as a direct result of Russia’s war in Ukraine. The Eurozone and UK are experiencing inflation levels not seen for decades, which is having an existential impact on individual economies. But generational high inflation in Europe is nothing compared to hyper-inflation in markets like Argentina, Turkey, or Sri Lanka, countries that at the time of writing are experiencing rates of 70-80% inflation.

In many countries, people are experiencing a heady combination of record mortgage payments, skyrocketing energy bills, high debt burdens, and are now faced with a likely severe recession. Understandably, this is making people question the viability of the current monetary order – which is essentially a repeat of 1970s stagflation, but with multiples of debt levels.

Critics may point out that bitcoin has lost 70% of its value since its recent all time high (ATH), making it unsuitable as an inflation hedge. But such critics usually forget to mention two important factors: first, that bitcoin has survived through several similar slumps before, and always emerged stronger. Second, that fiat currencies that undergo severe inflation or devaluation rarely make a comeback. Fiat is volatile only to the downside, whereas bitcoin has an upside as well. Moreover, bitcoiners often recommend a level-headed approach to buying bitcoin in the form of adopting a dollar cost averaging (DCA) strategy, which prevents individuals from getting all the exposure at an ATH. Including bitcoin through a DCA approach to one’s savings plan may prove to be the best inflation hedge in the long term, after all.

Managed Money Invites Mismanagement

Unforced errors of poor governance are another factor in bitcoin’s favour, with the extremely short-lived Prime Minister Truss’s premiership in the UK as a prime example. A poorly received and unfunded tax slashing agenda spooked markets, with the value of the British pound sinking to historic lows against the US Dollar, increasing the cost of government borrowing and residential mortgage rates in the meantime. Truss’s six-week premiership will end up costing British citizens for years to come regardless of the fact that she was forced to resign from office in record time.

For all the talk of monetary policies being independent of current governments, we can see the very opposite taking place, when actions of the head of government affect the strength of a fiat currency, and central bank governors regularly take into account current fiscal policy (such as the recent near-implosion of UK gilts, prevented only by Bank of England stepping in and buying the distressed bonds with – surprise, surprise – newly printed money).

Weaponized Finance

Sanctions imposed on Russia as a result of its war in Ukraine have been well-documented. I expect there is little sympathy for Russian oligarchs deemed supporters of Putin who have found themselves on sanctions lists with assets frozen – from crypto to super-yachts and everything in between. But less reported are the domestic freezes where Russian war objectors have found their assets frozen, and the impact of international sanctions on Russians in exile, who found themselves unable to use their cards and banking services.

In Canada in February, the Canadian Government threatened to freeze corporate and personal bank accounts of truckers who were part of a long-running “Freedom Convoy” protest against COVID vaccination mandates. Regardless of your position on sanctions or vaccinations, the weaponization of finance in this way opened up consideration of the need for a global and neutral payment system.

But it’s not just governments that have been threatening confiscation of personal funds. PayPal recently found itself illuminated uncomfortably (and particularly by the powerful Bitcoin Twitter’ movement) when it threatened to fine users $2,500 for using its services to promote “misinformation”. It claims this information was released incorrectly, but regardless, arbitrary confiscation of your funds isn’t possible with bitcoin stored in self-custodied wallet.

Bitcoin, The Escape Hatch

So let me recap: from sky-high inflation, to asset freezes, to the UK Government’s spectacular implosion of the pound, to the fallout of international sanctions, all set against the lingering impact of considerable central bank money printing, events of 2022 have, in my opinion, been an inadvertent advert for the benefits of bitcoin. Bitcoin cannot be printed at will, has no leader, is supranational and available to all. The price may currently be lagging behind these fundamentals, but then again, bitcoin has shown a tendency to spring back from its grave many times before.

Not everyone will agree of course, and that’s fine, but I sleep more easily at night knowing that at least with bitcoin people do have a secure and entirely neutral monetary system to which they can escape at any time.

Author works as Bitcoin Analyst at Trezor.