Bank Of Japan Joins The Pack

Good Morning Everyone!

Dogecoin (CRYPTO: DOGE) is now worth more than Coinbase (NASDAQ:COIN)(largest U.S crypto exchange) and Silvergate (NYSE:SI) (largest U.S crypto bank) combined.

Probably nothing.

Prices as of 4 pm EST, 12/19/22; % YTD

MARKET UPDATE

Yesterday tax loss selling continued into year-end

Month to date

-

S&P 500 down 6.4%

-

Nasdaq down 8.0%

-

TSX down 6.1%

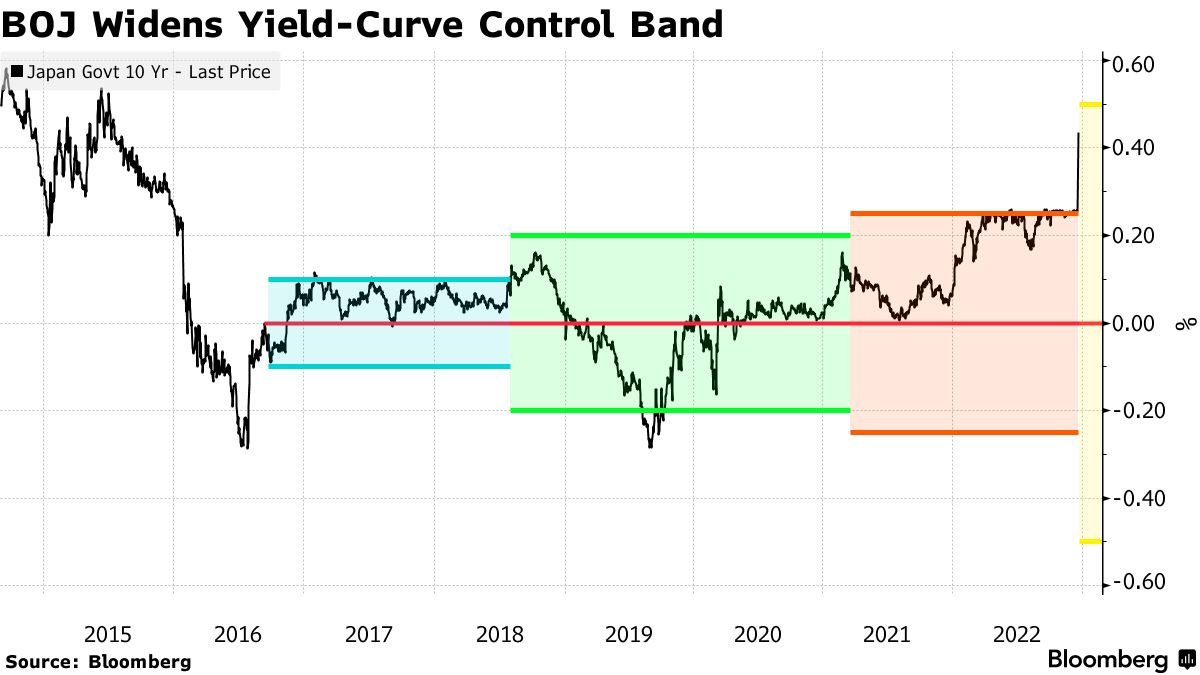

Japan

-

Japan has kept interest rates below zero this year

-

Where they have been since 2016

-

Even as other major Central Banks have raised rates

If Japan does not move off their negative rate policy

-

Inflation is rising

-

Yen is falling

So, over-night, the Bank of Japan is shifting its Yield Curve Control (YCC) stance

-

Will raise its upper yield limit on 10 year JGBs from 0.25% to 0.5%

-

This will open the door for a rate hike in 2023

-

Yen is +3%

-

Nikkei is down 2.5%

-

Japan 10 year yield went up by 15bps to now yield 41 bps

Japan’s impact on U.S. Treasuries

-

10 year up 6 bps

-

2 year up 1 bps

-

Steepening the 2-10 yield curve by 5bps

-

This is the 3rd day in a row that the US 2-10 yield curve has steepened

Crude 76

-

Volume is light because it’s the last trade date for the January futures contract

-

Investors will look at the February contract

-

Near term demand picture is not clear

-

Global supply remains limited by OPEC+ discipline

Amazon (NASDAQ:AMZN)

-

AWS awarded 5 year, $723 million U.S. Navy contract

Apple (NASDAQ:AAPL)

-

Set to begin producing MacBooks in Vietnam by mid-2023

-

Pulled out of negotiations for the NFL Sunday ticket package

-

Amazon and Google (NASDAQ:GOOGL) still bidding

Earnings

-

General Mills k(NYSE:GIS)

CRYPTO UPDATE

We made it on front page of Coindesk…

CZ will probably block me now. pic.twitter.com/fuZZesU7Tb

— Genevieve Roch-Decter, CFA (@GRDecter) December 19, 2022

BlockFi looks to restart some withdrawals

-

Seeking court order green-lighting customer withdrawals

-

Also aims to clear up incorrectly reflected transactions

-

Court hearing Jan 9, 2023

Weekly digital asset fund flows

-

Outflows from investment products picked up last week, totaling $30 million

-

Bitcoin (CRYPTO: BTC) outflows of $17.5 million

-

Ethereum (CRYPTO: ETH) outflows of $9.1 million (5th consecutive week outflows)

-

Much higher trading volumes vs prev week