Bitcoin, Ethereum, Dogecoin Enter Cooling Period Following Game-Changing ETF Approval: A Look At The Price Action

Bitcoin (CRYPTO: BTC) was dropping almost 5% lower during Friday’s 24-hour trading session after rising up toward $50,000 on Thursday –the first trading day for 11 spot Bitcoin ETFs approved by the Security and Exchange Commission the day prior.

The SEC’s approval of the spot Bitcoin ETFs provides traditional finance with access to direct Bitcoin exposure. Previously, investors wanting regulated crypto exposure were limited to crypto-related stocks, primarily concentrated in the mining and trading of cryptocurrencies.

The first spot Bitcoin ETF to be approved by the federal agency was the Grayscale Spot Bitcoin ETF (NYSE:GBTC), which began trading at 4 a.m. EST on Thursday. Not only the first spot Bitcoin ETF to be approved, GBTC has the longest track record as the inaugural publicly traded Bitcoin fund in operation after being created in 2013 and is the world’s largest Bitcoin ETF.

Read Next: SEC Twitter Hacked: Fake Bitcoin ETF Approval Tweet Creates Market Mayhem

GBTC is also highly liquid, offering traders and investors a high level of flexibility to manage their trades, with an average 20-day trading volume of about 15,000 shares.

While the approval of the spot Bitcoin ETFs caused Bitcoin and Ethereum (CRYPTO: ETH to run higher into the event, Dogecoin (CRYPTO: DOGE) has lagged the apex-cryptos, trading in a downtrend since Dec. 11.

Whether or not Bitcoin continues higher on a historic run or the SEC’s approval creates a long-term sell-the-news event remains to be seen but new institutional and retail investors with access to the crypto through Grayscale’s ETF, or one of its rivals, maybe watching for cues on Bitcoin’s chart as the news settles in.

Want direct analysis? Find me in the BZ Pro lounge! Click here for a free trial.

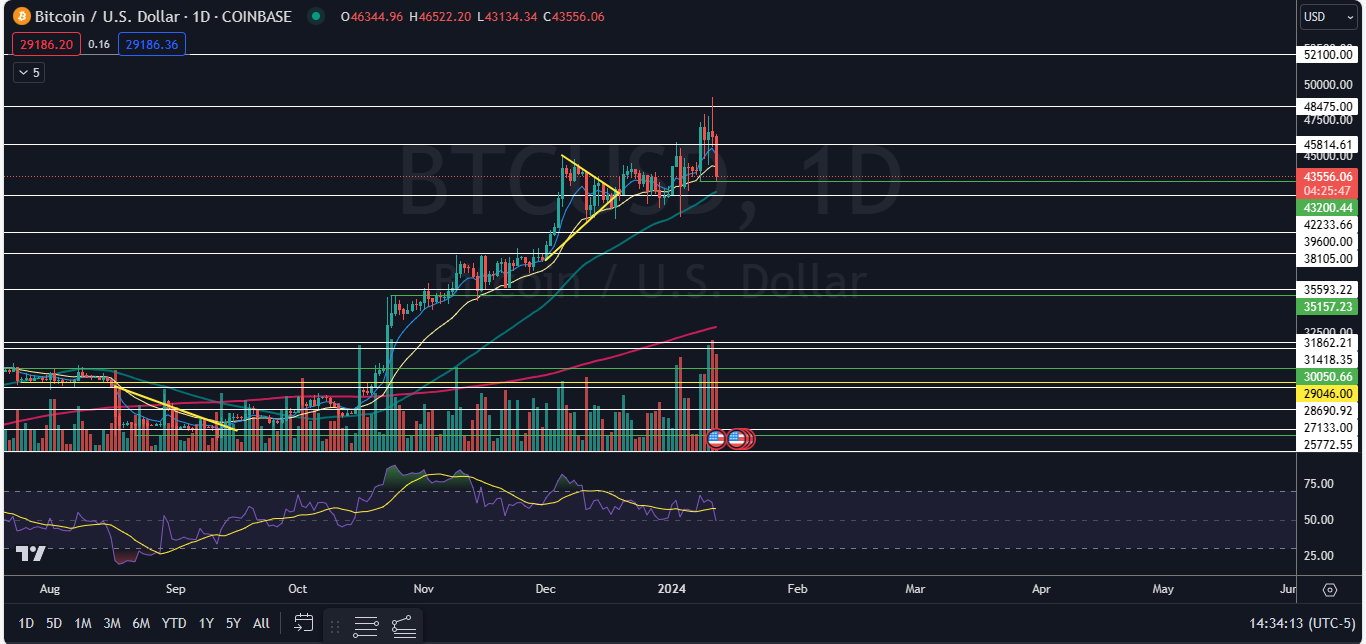

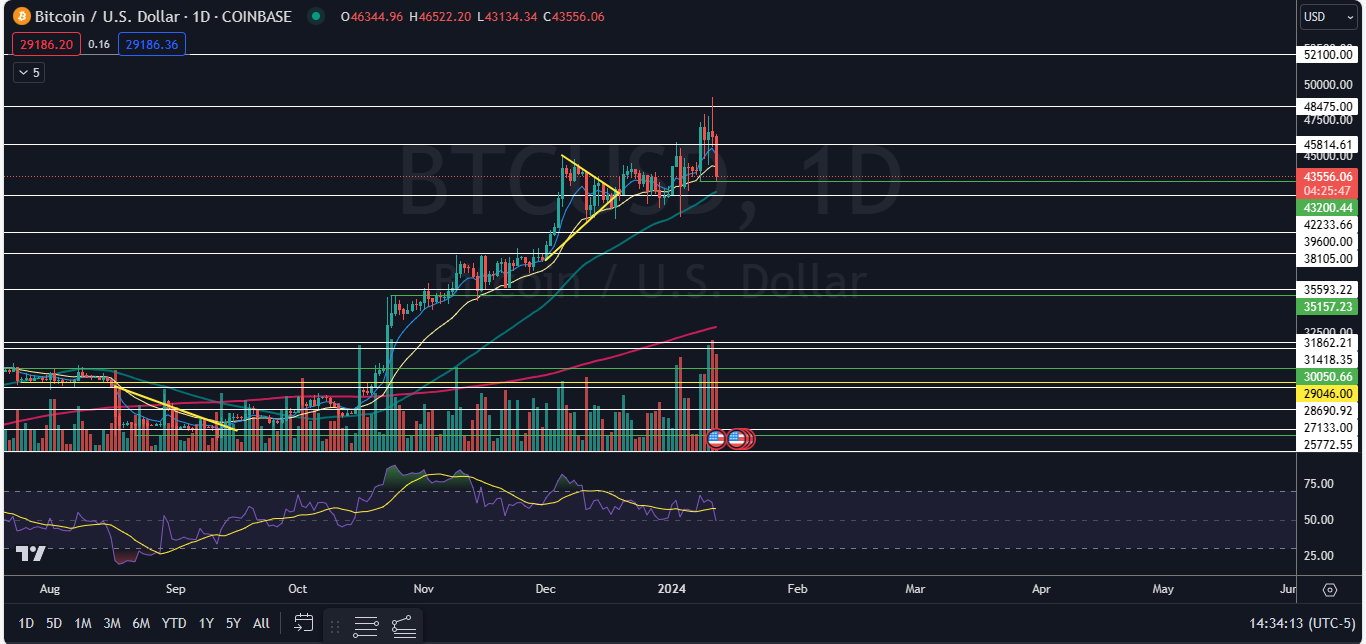

The Bitcoin Chart: When Bitcoin fell to its low-of-day Friday, the crypto bounced up slightly from the $43,130 mark, which caused Bitcoin to print a possible double bottom pattern at that level when paired with the low formed on Monday. If Bitcoin holds above that area, it would be bullish for continuation higher but if Bitcoin falls under that level on the weekend, the current uptrend will be negated and a downtrend could be on the horizon.

- A golden cross formed on Bitcoin’s chart on Oct. 11 and the 50-day simple moving average (SMA) has been guiding the crypto higher since that date. On Jan. 3, Bitcoin tested the 50-day SMA as support and bounced up off that area, if Bitcoin forms a lower low over the weekend, the 50-day SMA may once again act as support.

- Bullish traders want to see Bitcoin hold above $43,100 and begin to trade sideways on decreasing volume to indicate consolidation is taking place and then for big bullish volume to come in and drive Bitcoin to a new 52-week high.

- Bearish traders want to see big bearish volume come in and break Bitcoin down under the 50-day SMA, which could accelerate downside pressure.

- Bitcoin has resistance above at $45,814 and at $48,475 and support below at $42,233 and at $39,600.

- Ethereum’s relative strength index (RSI) reached about 72% on Thursday, which indicated a retracement was likely on the horizon. When a stock’s or crypto’s RSI reaches or exceeds the 70% mark, it becomes overbought, which can be a sell signal for short-term technical traders.

- On Friday, Ethereum was working to print a doji candlestick, which could indicate the local top has occurred and a retracement is in the cards. If Ethereum falls over the next few trading days, bullish traders want to see the crypto rebound from a descending trend line, which Ethereum broke up from on Wednesday. Bearish traders want to see Ethereum fall under that area, which could negate the crypto’s current uptrend.

- Ethereum has resistance above at $2,717 and at $2,950 and support below at $2,461 and at $2,317.

- If Dogecoin falls under the $0.074 mark over the next few trading days, the crypto is likely to find at least temporary support at $0.073, which aligns with the 200-day SMA. If the crypto receives bullish momentum and rises above the most recent lower high, the downtrend will be negated and Dogecoin is likely to regain the 50-day SMA.

- Dogecoin has resistance above at $0.083 and at 9 cents and support below at $0.075 and at the 7-cent mark.