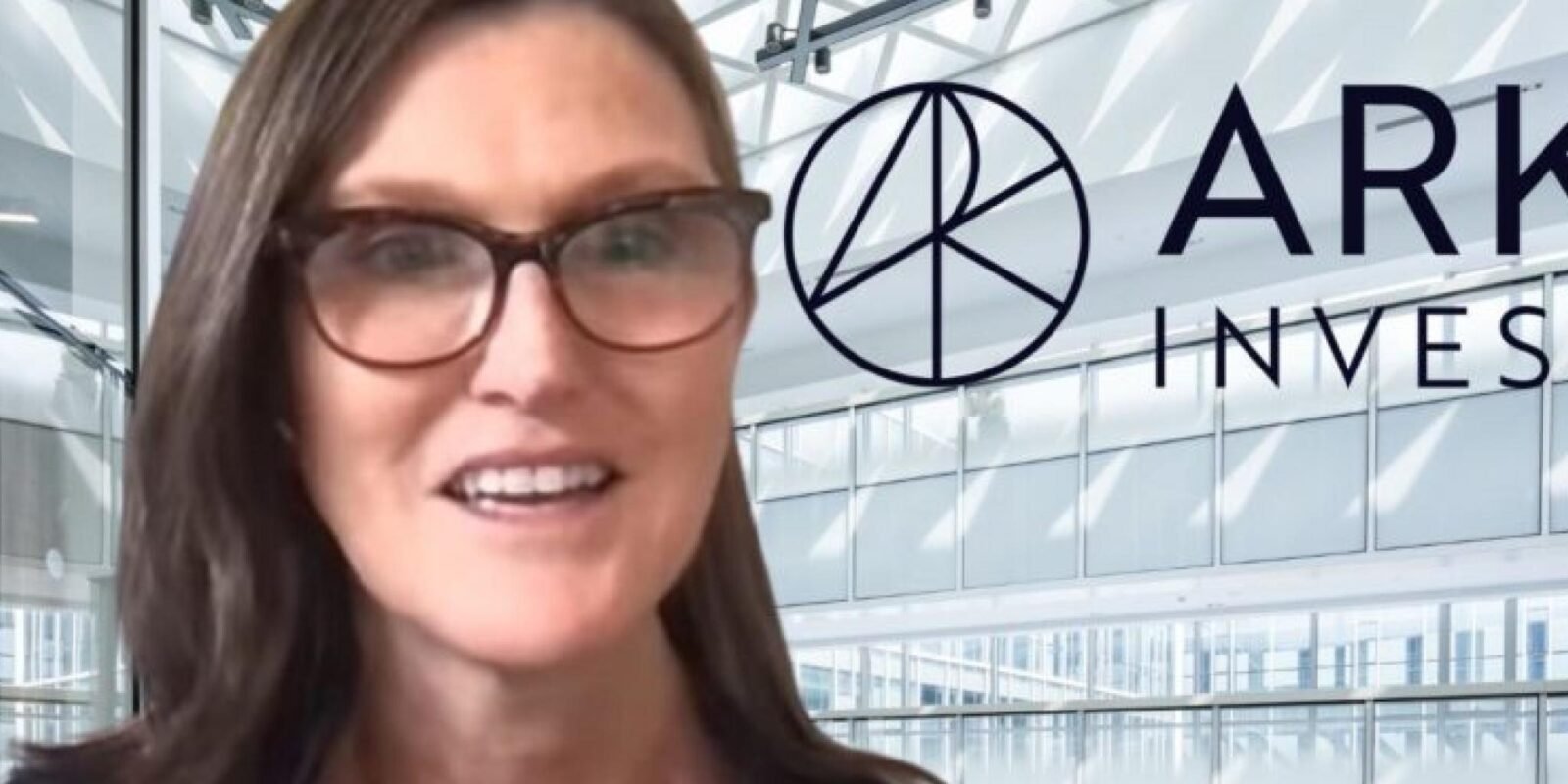

Cathie Wood’s Ark Dumps $12.8M Worth Of Grayscale Bitcoin Trust Amid Crypto Rally Losing Wind In Sails

On Monday, Cathie Wood-led Ark Invest made a significant move by selling over $12.8 million worth of Grayscale Bitcoin Trust (OTC:GBTC) shares, amidst fluctuating cryptocurrency prices. This decision comes at a time when the crypto market, including Bitcoin (CRYPTO: BTC) and Ethereum (CRYPTO: ETH), is experiencing mixed sentiments.

The GBTC Trade

Ark sold 395,945 GBTC units through ARK Next Generation Internet ETF (NYSE:ARKW). The transaction was valued at $12.85 million. The Grayscale Bitcoin Trust closed 8.59% lower at $32.46 on Monday.

Ark Invest’s decision to offload a substantial portion of GBTC shares aligns with the recent market trends in cryptocurrencies. According to Benzinga’s coverage, the crypto market is currently navigating through a phase of uncertainty, with analysts pointing to the $39K level as a critical juncture for Bitcoin.

The Coinbase Trade

Also on Monday, Ark sold a total of 13,634 Coinbase shares through ARK Innovation ETF (NYSE:ARKK), Ark Fintech Innovation ETF (NYSE:ARKF), and ARKW. These transactions were valued at $1.8 million. Coinbase shares closed 5.87% lower at $138.02 for the day.

This month, Ark Invest also adjusted its position in Coinbase Global Inc (NASDAQ:COIN), selling shares amidst a backdrop where Bitcoin crossed the $44K mark. This decision, as detailed in Benzinga’s report, reflects the fund’s ongoing strategy in the crypto space.

Other Trades:

- Significant investments were made in CRISPR Therapeutics AG (NASDAQ:CRSP), with Ark purchasing 33,097 shares through ARKG and 151,909 shares through ARKK, indicating a strong belief in the biotech sector.

- Another notable buy was in Adaptive Biotechnologies (NASDAQ:ADPT), with 142,975 shares added through ARKG, showcasing Ark’s interest in cutting-edge medical technologies.

Ark’s recent trades, particularly in GBTC and COIN, highlight the fund’s responsive strategy to market changes and its commitment to staying ahead in the dynamic investment landscape. As the crypto and tech sectors continue to evolve, Ark Invest’s moves are closely watched by investors seeking insights into emerging trends.

Photo courtesy Benzinga YouTube and Unsplash

Engineered by Benzinga Neuro, Edited by

Shivdeep Dhaliwal

The GPT-4-based Benzinga Neuro content generation system exploits the extensive Benzinga Ecosystem, including native data, APIs, and more to create comprehensive and timely stories for you.

Learn more.