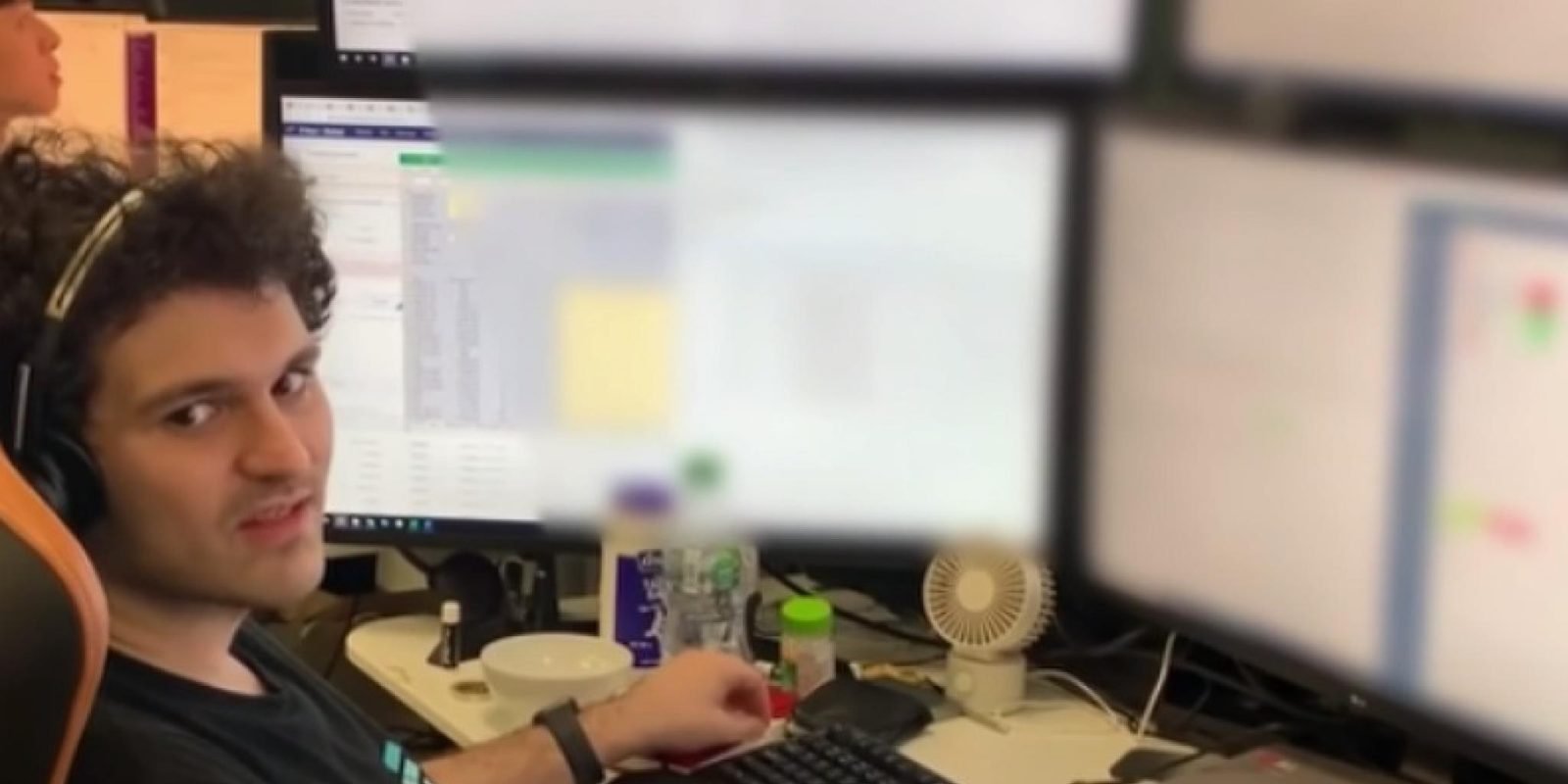

FTX Founder Bankman-Fried Allegedly Borrowed Funds To Purchase Robinhood Stake

Former FTX CEO Sam Bankman-Fried borrowed hundreds of millions of dollars from Alameda Research to purchase a stake in Robinhood Markets, according to court records.

In an affidavit delivered to a Caribbean court before his detention, Bankman-Fried stated that he and FTX co-founder Gary Wang jointly borrowed $546 million from Alameda via promissory notes in April and May.

This money was used to fund a shell company called Emergent Fidelity Technologies, which acquired a 7.6% share in Robinhood in May.

Also Read: 'How To Survive In Prison' – Pharma Bro Martin Shkreli Offers Tips To Bankman-Fried

The dispute over the ownership of the 56 million Robinhood shares, which are valued at over $440 million, involves three parties: FTX Group, BlockFi, and Bankman-Fried.

In a court statement, cryptocurrency lender BlockFi claimed that it was entitled to the shares due to a deal signed by Bankman-Fried in early November.

Both FTX and BlockFi have filed for bankruptcy.

According to a filing on Tuesday, Alameda Research — whose funds were used to initially purchase the shares — pledged the shares as security against a loan taken out by the company.

A sudden liquidity crisis led to FTX's bankruptcy last month.

The operator of the cryptocurrency exchange allegedly used customer funds to support risky bets made by its sister trading firm, Alameda Research, which led to the company's collapse.

Next: Nexo Makes Final Pitch To Vauld – 'This Deal Isn't Over, Advisor Misrepresented Us'