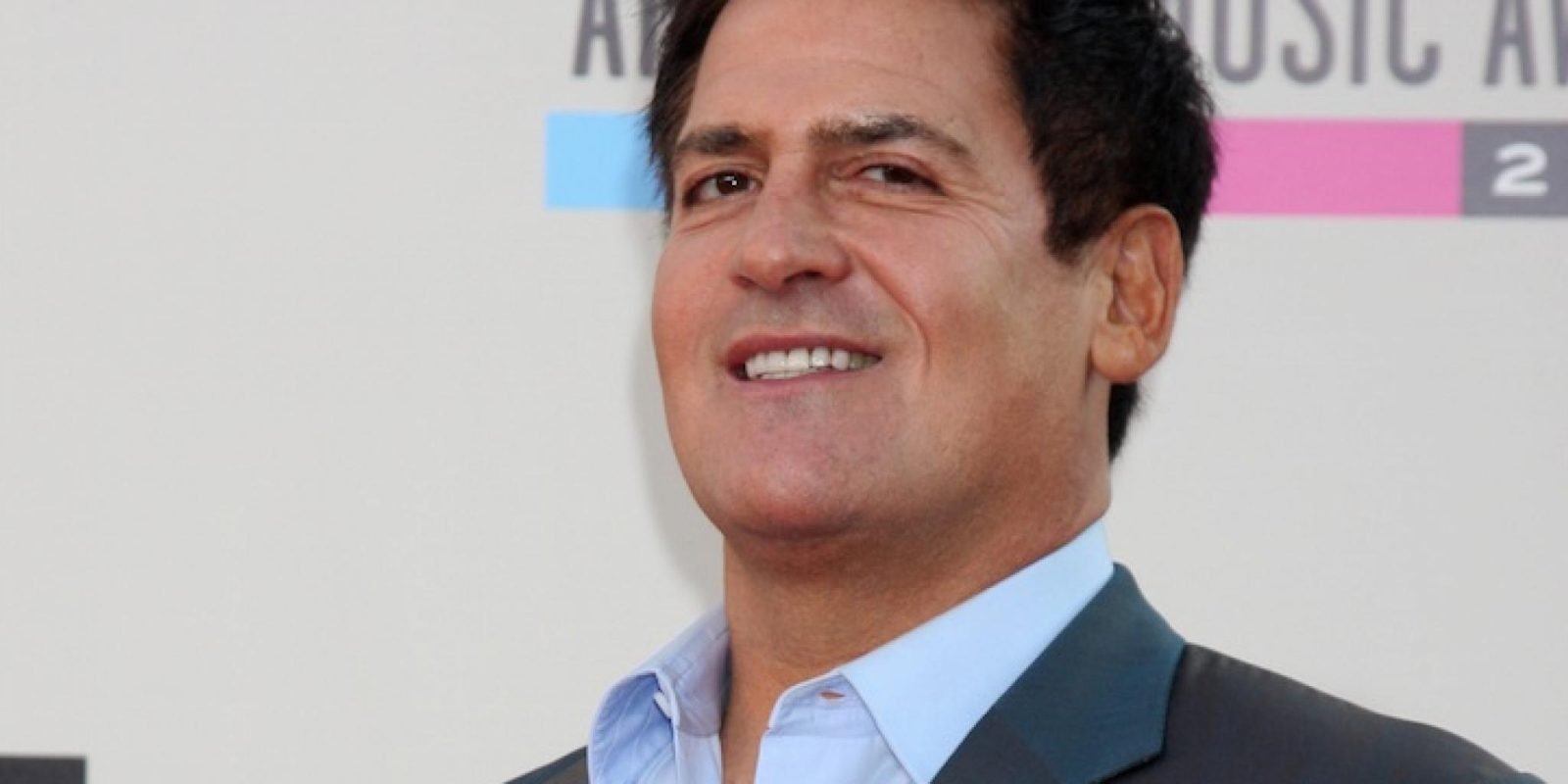

Mark Cuban Predicts Wash Trade Scandal Will Hit Centralized Crypto Exchanges Next

Billionaire and cryptocurrency investor Mark Cuban has predicted that the next scandal to hit the crypto industry will be related to wash trades on centralized exchanges.

There are "tens of millions of dollars in trades and liquidity for tokens that have very little utilization," Cuban told TheStreet. He does not "see how they can be that liquid."

A wash trade is a form of illegal practice that involves creating fake interest in a financial product in order to profit from it.

Also read: Cryptocurrencies Like Bitcoin And Ethereum Can't Shake The Risk Asset Tag: What's Holding Them Back

This type of "pump-and-dump" scheme is prevalent in the cryptocurrency industry and involves a trader buying and selling the same tokens to create artificial trading volumes.

The trader then promotes positive sentiment about the token on social media, leading other traders to believe it is in high demand and increasing its price. The trader can then sell their position at the peak of demand.

The National Bureau of Economic Research (NBER) reported that approximately 70% of transactions on unregulated cryptocurrency exchanges are wash trades, Meanwhile.

The study analyzed data from 29 unregulated exchanges and found that wash trading was more prevalent on exchanges with lower liquidity and higher spreads, suggesting that it may be used to artificially boost the attractiveness of these exchanges.

The study, titled "Crypto Wash Trading," emphasizes the need for increased regulation and oversight in the cryptocurrency industry, stating that "without proper regulation and with vertical integration not seen in other markets, crypto exchanges may potentially engage in market manipulation or even outright frauds."

Next: Meta Bets Go Bust As Digital NFT Land Prices Plummet: Are Investors Wasting Money?