Why Cold Crypto Wallets Trending Again — Are They The Best Way To Store Cryptocurrencies?

Even though 2021 was the best year for digital assets such as cryptocurrencies and non-fungible tokens (NFTs), 2022 has been a washout in comparison and has seen cryptocurrency prices fall to pre-COVID-19 levels, wiping out trillions of dollars worth of investor wealth in the process.

Making the ongoing crypto winter worse has been a series of bankruptcies and closures of crypto lending firms such as Celsius Network and hedge funds like 3AC, brought on by an unprecedented liquidity crisis that has affected the crypto community at large.

Last month’s FTX saga has presumably spooked even fervent crypto fans, as the world’s second-largest cryptocurrency exchange withered away due to liquidity concerns brought about by alleged financial misappropriation.

As a result, the fate of an estimated one million creditors and $1 billion in investor assets hangs in balance, with hopes of these funds being returned diminishing by the day.

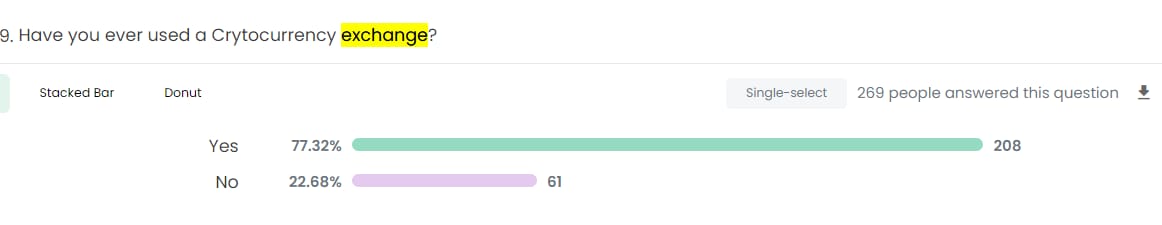

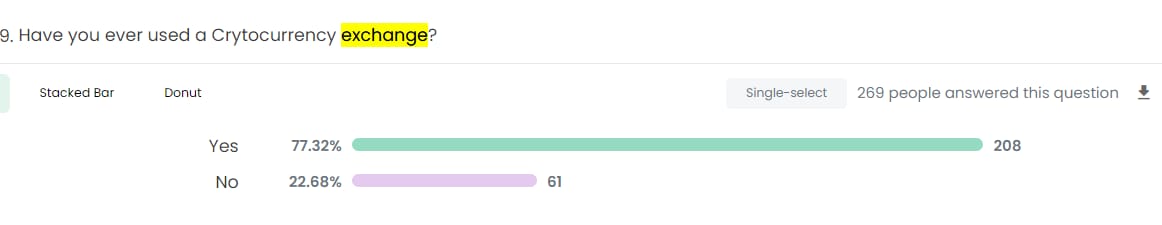

Interestingly, a recent survey conducted by Benzinga alluded to the fact that a little more than three-fourths of all crypto investors in the U.S. have used the services of a cryptocurrency exchange at least once.

With most cryptocurrency exchanges concentrating power and control in the hands of their founders, a growing number of crypto investors are bypassing cryptocurrency exchanges altogether due to trust concerns and preferring peer-to-peer (P2P) transactions when buying or selling cryptocurrencies.

Of the 1,000 crypto users who took Benzinga’s survey, 22.68% of the respondents who answered all questions deny having used a cryptocurrency exchange, highlighting a trend that doesn’t seem to be waning anytime soon.

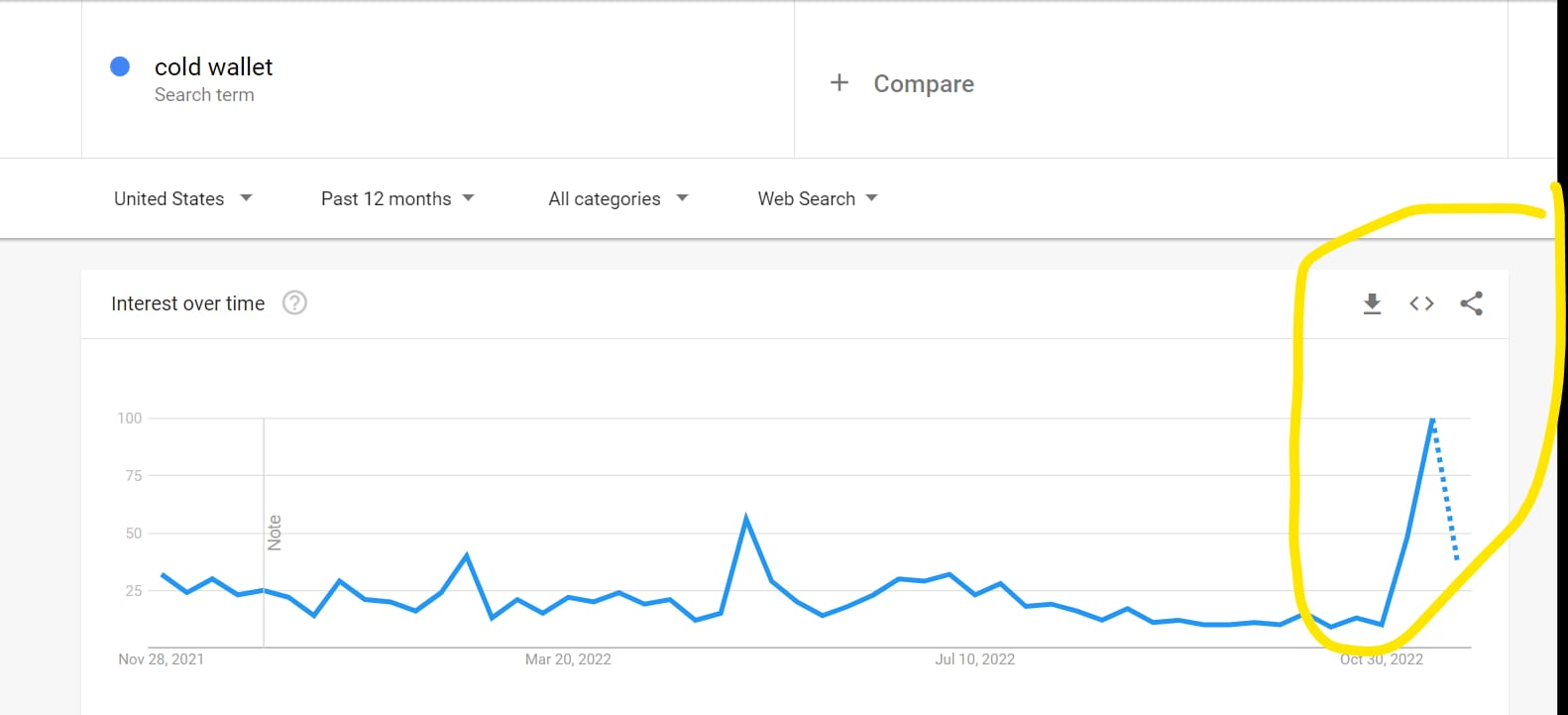

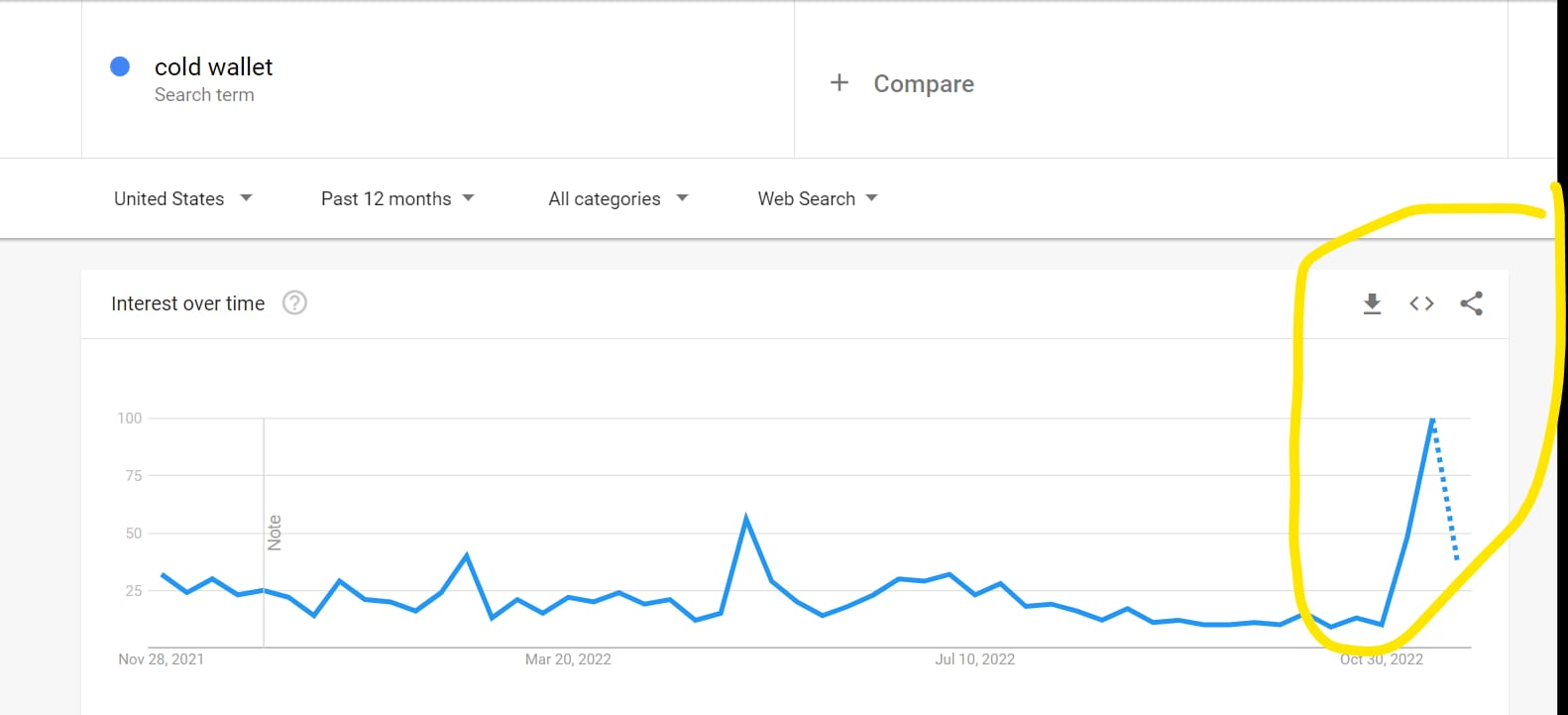

This is corroborated by "cold wallet" or hardware crypto wallet manufacturers such as Ledger and Trezor, with the former recording its best-ever weekly sales at a time when FTX was tethering on the edge of bankruptcy, which it has since declared.

Also Read: Crypto Winter Chills Kraken, 30% Of Staff Gets Cut After 'Quick Scale Up'

While both manufacturers have been tight-lipped about exact sales volumes, their hardware wallets are consistently featured among the best and most secure crypto wallets available on the market today.

In fact, by virtue of storing each user’s private crypto keys on a device instead of online, these "cold wallets" are possibly the best self-custody solutions that offer investors the highest level of security from online attacks and thefts orchestrated by bad actors.

A long-time proponent of cryptocurrencies, Musk believes people ought to get out of cryptocurrency exchanges in order to secure their crypto holdings for the long term.

This sentiment is supported by the latest Google Trends data that has shown a nearly six-fold spike in interest for the term "cold wallet" in the aftermath of the FTX crisis.

Taking into account the renewed calls for shifting to hardware wallets and adding them up with Benzinga’s survey results, it is only fair to conclude that non-custodial wallet solutions will reign supreme over less secure "hot wallets" in the near term.

Read Next: BNB Chain Creators Can Now List Their NFTs On OpenSea

Photo: Anton Gvozdikov via Shutterstock